Want more housing market stories from Lance Lambert’s ResiClub in your inbox? Subscribe to the ResiClub newsletter.

This week, Zillow economists published their updated 12-month forecast, projecting that U.S. home prices—as measured by the Zillow Home Value Index—will fall by 1.0% between June 2025 and June 2026. For calendar year 2025, they forecast U.S. home prices, as measured by the Zillow Home Value Index, will fall -2.0%.

Heading into 2025, Zillow’s 12-month forecast for U.S. home prices was +2.6%. However, many housing markets across the country softened faster than expected, prompting Zillow to issue several downward revisions. While Zillow has since stopped cutting its outlook, it is still kind of bearish. At least over the short-term.

Why did Zillow downgrade its forecast for national home prices so many times this year?

“The rise in [active] listings is fueling softer [home] price growth, as greater supply provides more options and more bargaining power for buyers,” Zillow economists wrote in March. “Potential buyers are opting to remain renters for longer as affordability challenges suppress demand for home purchases.”

Essentially, Zillow believes that strained housing affordability—driven by U.S. home prices soaring over 40% during the Pandemic Housing Boom and mortgage rates jumping from 3% to 6% in 2022—is putting upward pressure on active inventory growth and short-term downward pressure on home price growth.

“Sellers have been motivated to join the market through the first half of the year, but buyer demand hasn’t kept up. With housing inventory accumulating, Zillow forecasts home values will decline by 2.0% in [calendar year] 2025,” wrote Zillow economists on Wednesday. “Slightly lower mortgage rates toward the end of the year could further aid affordability, but significant improvements appear unlikely. Still, home shoppers have some advantages–plenty of options have given them more bargaining power than in any summer in at least seven years.”

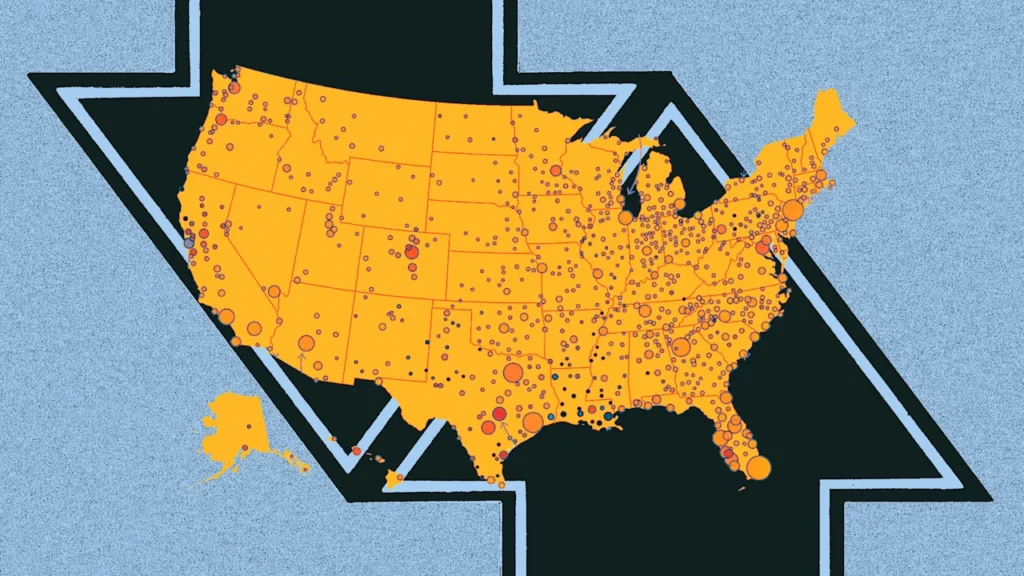

According to Zillow’s home price model, the listing site also believes that weakening and softening housing markets across the Sun Belt will weigh on nationally aggregated home prices this year.

Among the 300 largest U.S. metro area housing markets, Zillow expects the strongest home price appreciation between June 2025 and June 2026 to occur in these 10 areas:

- Atlantic City, NJ → 2.9%

- Kingston, NY → 2.2%

- Knoxville, TN → 2.0%

- Torrington, CT → 1.9%

- Rockford, IL → 1.7%

- Concord, NH → 1.7%

- Pottsville, PA → 1.7%

- Fayetteville, AR → 1.6%

- Norwich, CT → 1.6%

- East Stroudsburg, PA → 1.5%

Among the 300 largest U.S. metro area housing markets, Zillow expects the weakest home price appreciation between April 2025 and April 2026 to occur in these 10 areas:

- Houma, LA → -9.6

- Lake Charles, LA → -9.5%

- Alexandria, LA → -8.0%

- New Orleans, LA → -7.2%

- Lafayette, LA → -7.0%

- Shreveport, LA → -6.9%

- Beaumont, TX → -6.5%

- San Francisco, CA → -6.1%

- Austin, TX → -5.1%

- Corpus Christi, TX → -5.0

Below is what the current year-over-year rate of home price growth looks like for single-family and condo home prices. The Sun Belt, in particular Southwest Florida, is currently the epicenter of housing market weakness right now.