Volkswagen’s global profit has fallen 61% for the first nine months of 2025. Earnings after tax slid to about €3.4 billion, even though sales stayed roughly flat. In the third quarter alone, VW posted a €1.3 billion operating loss. Those numbers come straight from Volkswagen’s own interim report for 2025.

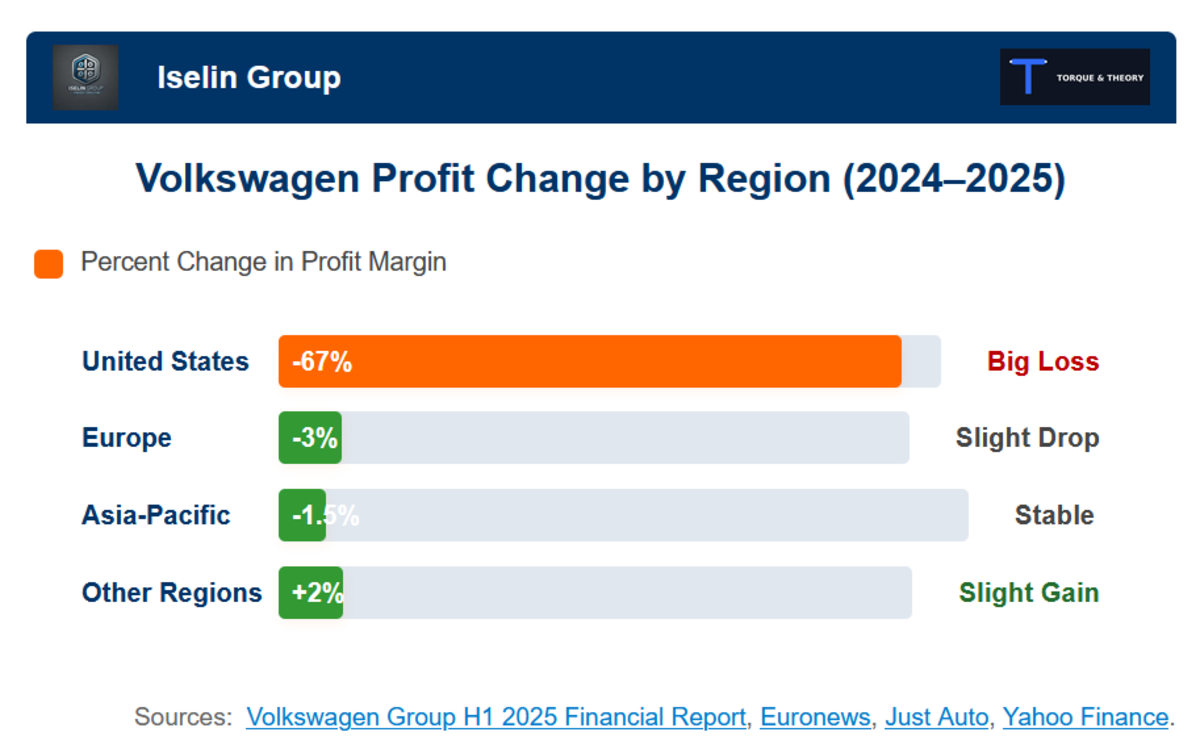

But if you look at the chart below, the picture gets even sharper for VW in the US. Profit margin for Volkswagen in the United States is down 67%, while Europe shows only a small dip, Asia-Pacific is almost flat, and other regions manage a slight gain. VW still moves metal everywhere, but the U.S. is where the wheels came off the earnings wagon.

How 27.5% Tariffs Crushed VW’s U.S. Profits

So what changed? First, Trump’s auto tariffs landed like a sledgehammer. A new 25% tariff on imported cars and parts, stacked on top of the old 2.5% duty, pushed the total hit on many European cars to around 27.5%.

Volkswagen told investors that higher U.S. import tariffs and the fallout from them will knock up to €5 billion off 2025 results when you add the direct charges and lost volume together. That pain is on top of a massive bill from Porsche’s EV strategy reversal, which delivered another multi-billion-euro punch to VW Group earnings.

The key thing for you: the U.S. region is taking a much harder hit than Europe or Asia. German exports to the States already faced a tough road; now they run straight into a tariff wall that hits high-priced German cars the hardest.

Volkswagen

Why You Won’t Find Deals on Audis and VWs Anymore

BMW and Mercedes built huge plants in the U.S. years ago. They can crank out crossovers in South Carolina and Alabama and dodge most of the tariff damage. VW, Audi, and Porsche have some local production, but a lot of the tasty stuff — hot Audis, turbocharged Porsches, high-spec Volkswagens — still rolls in on ships and takes the full hit.

When profit in the U.S. melts away like that, the company has only a few levers to pull. It raises prices, trims incentives, or cuts low-margin trims and niche models. That’s where this story lands in your driveway.

Expect fewer screaming lease deals on that sporty Audi you wanted for its sharp handling and quiet ride comfort. Expect fewer discounts on the family VW crossover you liked for its solid fuel economy. And don’t be shocked if some special-order builds or low-volume EVs quietly disappear from U.S. order guides for a while. Shipping a thin-margin car into a 27.5% tariff hurdle simply doesn’t pencil out.

The Bottom Line: VW Needs Profits More Than Your Business

Volkswagen’s 61% profit crash means the balance of power in the showroom tilts away from you. VW is now chasing profit, not volume, in the U.S. That means less room to haggle, tighter inventory, and slower rollouts of the fun stuff.

If you want a VW, Audi, or Porsche in your garage, watch prices and trims closely. The company’s earnings sheet now rides shotgun on every boat headed for the States, and it cares a lot more about getting those orange bars on that chart back up than about giving you a bargain.