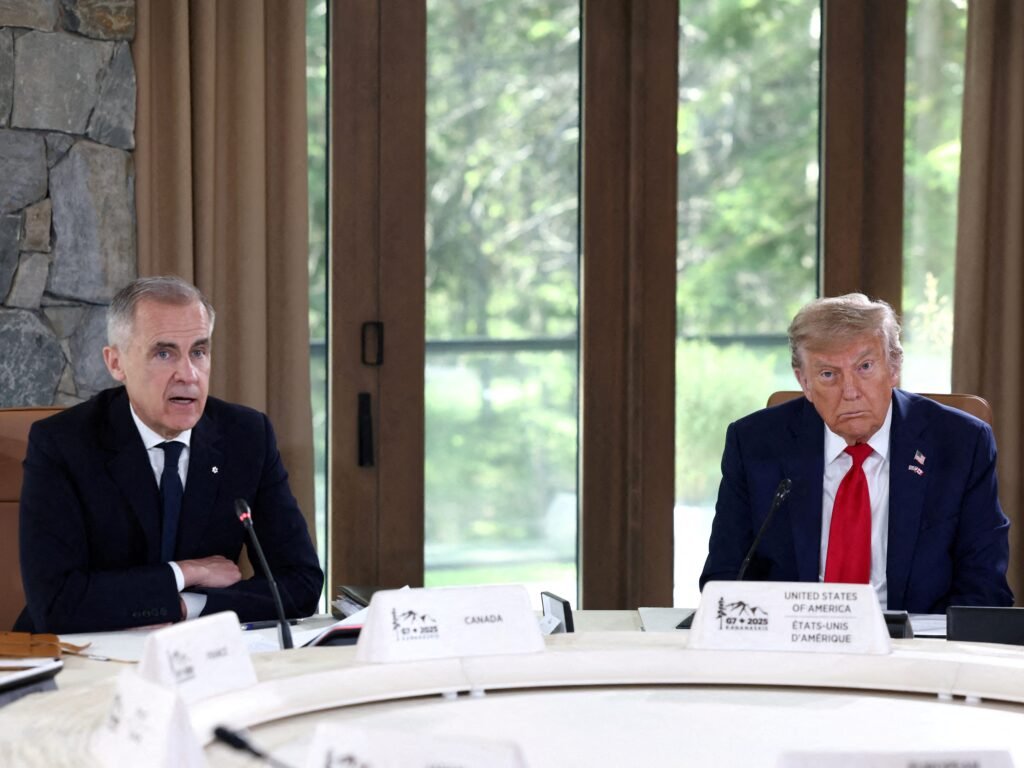

Kevin Lamarque/REUTERS

- Canada scrapped a digital services tax after a trade threat from President Donald Trump.

- The tax would have cost US tech firms billions each year and $3 billion in retroactive payments.

- Similar digital taxes also exist in France and the UK, aimed at large digital companies.

US tech giants came close to paying billions to Canada under a new tax law.

Had Canada not halted a digital services tax enacted in 2024 that applies retroactively to 2022, US tech giants would have needed to pay Canada approximately $3 billion upfront on Monday, on top of a 3% levy on all revenue earned from digital services linked to Canadian users going forward.

The Computer & Communications Industry Association estimated that Canada’s tax measure would lead to annual losses of between $900 million and $2.3 billion for US firms and could result in up to 3,000 job losses in the country.

In a separate estimate by Canada’s Parliamentary Budget Officer in 2023, the DST would generate CA$7.2 billion in revenue for the government over five years, which is about $5.29 billion at the current exchange rate.

The digital services tax, which is a tax on companies that earn revenue in Canada through social media advertisements and other online services, was halted on Sunday after President Donald Trump announced on his social media on Friday that the US would be “terminating ALL discussions on Trade with Canada” over the measure.

Canadian Minister of Finance and National Revenue François-Philippe Champagne will introduce legislation to officially rescind the tax.

US Treasury Secretary Scott Bessent also discussed launching a Section 301 investigation on Canada’s tax measure on CNBC on Friday.

“Today’s announcement will support a resumption of negotiations toward the July 21, 2025, timeline set out at this month’s G7 Leaders’ Summit in Kananaskis,” wrote Mark Carney, Canada’s Prime Minister, in a statement posted by Canada’s Department of Finance.

The tax measure would have applied to tech companies with worldwide annual revenues greater than 750 million euros ($885 million) and Canadian digital services revenue greater than $20 million a year. Services subject to the tax include advertising, social media, and marketplaces, and large tech companies in the US, like Meta, Amazon, and Apple, would primarily be affected.

Canada is the US’s second-largest trading partner and the top buyer of US exports. According to the Census Bureau, the northern neighbour bought $349.4 billion in US exports in 2024 and exported $412.7 billion worth of goods across the border. Canada has been spared from some of Trump’s highest tariffs, but still faces a 50% duty on steel and aluminum.

Canada is not the first or the only country to propose a digital services tax. Both France and the UK have similar measures aimed at taxing revenue generated by large multinational digital companies.

The White House has restarted trade talks with Canada following the scrapped tax policy.

Carney’s office, the White House, Meta, and Apple did not immediately respond to requests for comments.