The U.S. Chamber of Commerce is taking the lead in helping congressional Republican sell President Trump’s One Big, Beautiful Bill Act to a skeptical public after this year’s bruising battle over deep Medicaid cuts tarnished the public image of President Trump’s signature legislative accomplishment.

The U.S. Chamber, one of the nation’s pre-eminent business groups, plans to hold 100 round-table discussions about the trillions of dollars in assorted tax cuts and tax incentives in the law, which Republicans hope will spur economic growth for years to come.

Republican strategists want to avoid the mistakes made during Trump’s first term, when strategists now believe they didn’t do enough to sell Trump’s landmark 2017 Tax Cuts and Jobs Act before the 2018 midterm election.

The GOP paid the political price during Trump’s first midterms when Democrats picked up 41 House seats and captured control of the lower chamber.

Some early polling shows that Americans have a largely negative view of the law after Democrats spent months highlighting cuts to Medicaid and the Supplemental Nutrition Assistance Program (SNAP), cuts that led some Republicans such as Sens. Thom Tillis (R-N.C.) and Susan Collins (R-Maine) to vote against it.

Tillis, after announcing his opposition to the bill, decided not to run for a third Senate term and Collins faces a tough re-election race next year.

A KFF Health Tracking Poll of 1,283 U.S. adults conducted last month found that 46 percent of the public thinks the new law will generally hurt their families while only 26 percent think it will generally help.

And 63 percent of people polled have an unfavorable view of the law while 36 percent have a favorable view.

Tim Monahan, vice president and managing director of government affairs at the U.S. Chamber of Commerce, says a “lesson learned” after 2017 is that Republicans need to continue talking about the benefits of tax cuts after they’ve been enacted — a goal that was not fully accomplished after Trump’s first tax package passed eight years ago.

“One of the most comprehensive tax reform bills in the history of our country got done and people kind of stopped talking about it,” he told The Hill in an interview.

This year, the U.S. Chamber is making sure that senators and House members are fully armed with data to explain to their constituents at town hall meetings and other venues the tax benefits of the bill and how it could help their local businesses and communities directly.

“We had that top-of-mind going into this whole debate and we produced and continue to update all types of economic and industry data specific to congressional districts and, on the Senate side, on the state level,” Monahan said. “We thought it would be helpful to take some of these conversations outside of D.C.”

The group has partnered with state and local chambers of commerce to convene lawmakers and local business owners around the country to talk about popular but overlooked provisions of the law.

The Chamber has already held more than 40 roundtable discussions about the bill’s benefits with members of the Senate and House, and plans to hold a total of 100 such events.

“Those have proven to be very effective and well-received,” he said.

“This bill, we believe, at this point is largely undefined, which presents an opportunity for us to help define how this is perceived. A lot of people are talking about the Medicaid aspects. There’s a lot more than just that in this bill,” he said.

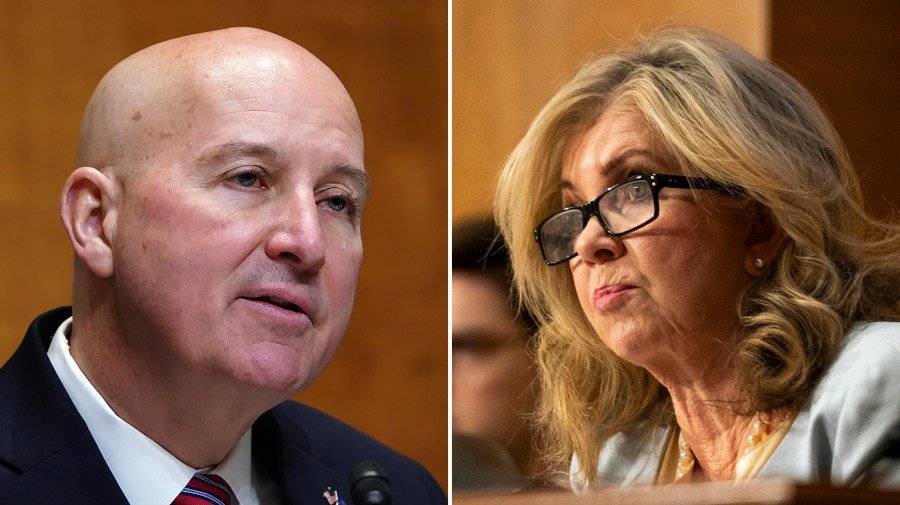

The U.S. Chamber and the Nebraska State Chamber of Commerce hosted Sen. Pete Ricketts (R-Neb.) on Monday for a roundtable discussion in Omaha.

Ricketts in a statement noted that passage of Trump’s tax bill allowed the average Nebraska family to avoid a potential tax hike of $2,443.

Todd Bingham, the president and CEO of the Nebraska Chamber of Commerce said provisions in the bill restoring full research and development expensing and 100-percent bonus depreciation would send a clear signal to businesses in the state to ramp up investments.

These meetings have highlighted other elements include as the enhancement to the employer-provided childcare tax credit, higher limits for Dependent Care Flexible Spending Accounts, and tax-preferred “Trump accounts for children born between 2025 and 2028, to which the government will provide a $1,000 credit.

“Permanency on the tax side provides predictability for businesses,” said Monahan, of the U.S. Chamber. “The 100-percent bonus depreciation for new capital investments, increased interest deductibility limits, immediate [research and development] expensing — in some cases retroactive going a couple years back — and then some of the benefits for child care. Those are some of the key things we’re talking about.”

The Chamber hosted a roundtable with Sen. Marsha Blackburn (R-Tenn.), who announced plans Wednesday to run for governor, in April.

It has also held events with Reps. Don Bacon (R-Neb.); Mike Collins (R-Ga.), who will run for Sen. Jon Ossoff’s (D-Ga.) seat next year; Vince Fong (R-Calif.); Young Kim (R-Calif.); Mike Lawler (R-N.Y.) and David Valadao (R-Calif.), to name a few other participants.

Several of the Republicans on that list face potentially tough re-election races next year.

Republicans are hoping the economic boost provided by Trump’s tax cuts will help offset the headwinds created by the president’s global trade war, which has already begun to bite into earnings at major companies such as Ford Motor, UPS, Whirlpool and Caterpillar.

The purpose of the discussions with Republican lawmakers over the August recess is to counter the Democratic attacks framing the law as a tax windfall for billionaires at the expense of middle- and lower-class Americans who will see their healthcare costs rise because of the failure to extend Affordable Care Act subsidies and provisions to cut nearly $1 trillion in federal Medicaid spending.

Democrats and their union-affiliated allies say they will use the August recess to highlight the cuts to Medicaid and the looming expiration of the Affordable Care Act health insurance subsidies in states and congressional districts around the country.

Arizona Sen. Mark Kelly and former Social Security Commissioner Martin O’Malley held a town hall meeting in Tucson Tuesday to highlight what they say will be the negative impacts of Trump’s bill.

Kelly and O’Malley, a former Biden administration official, say that the Republican-passed laws will throw more than 300,000 Arizonans off their health insurance, increase the cost of care and undermine the future solvency of Social Security and Medicare.

The U.S. Chamber sought to counter that messaging earlier this year by holding a roundtable discussion with Rep. Juan Ciscomani (R-Az.) and Susanne P. Clark, the president and CEO of the Chamber of Southern Arizona.