President Trump has signed an executive order reducing tariffs on Japanese auto imports from 27.5% down to 15%, implementing the deal negotiated in July. The order takes effect seven days after publication and applies retroactively to August 7. The White House calls it a win for U.S. consumers, but industry voices suggest the reality is more complicated.

Copyright 2015 Brandon Turkus / AOL

Relief for Japan, Pressure on Europe

For Japanese automakers, the order is a lifeline. Toyota, Honda, and Nissan had all warned of tariff pain eating into profits, with Toyota alone seeing operating income shaved by billions. Prime Minister Shigeru Ishiba hailed the move as the start of a “golden era” in U.S.–Japan relations.

But the same cannot be said for Europe. Mercedes-Benz recently revealed Trump’s tariffs have already cost the company $420 million, and with no deal yet in place between Washington and Brussels, European automakers remain exposed. The contrast between Japan’s relief and Europe’s ongoing strain underscores how selective tariff deals can reshape global competition.

U.S. Automakers Cautious on Benefits

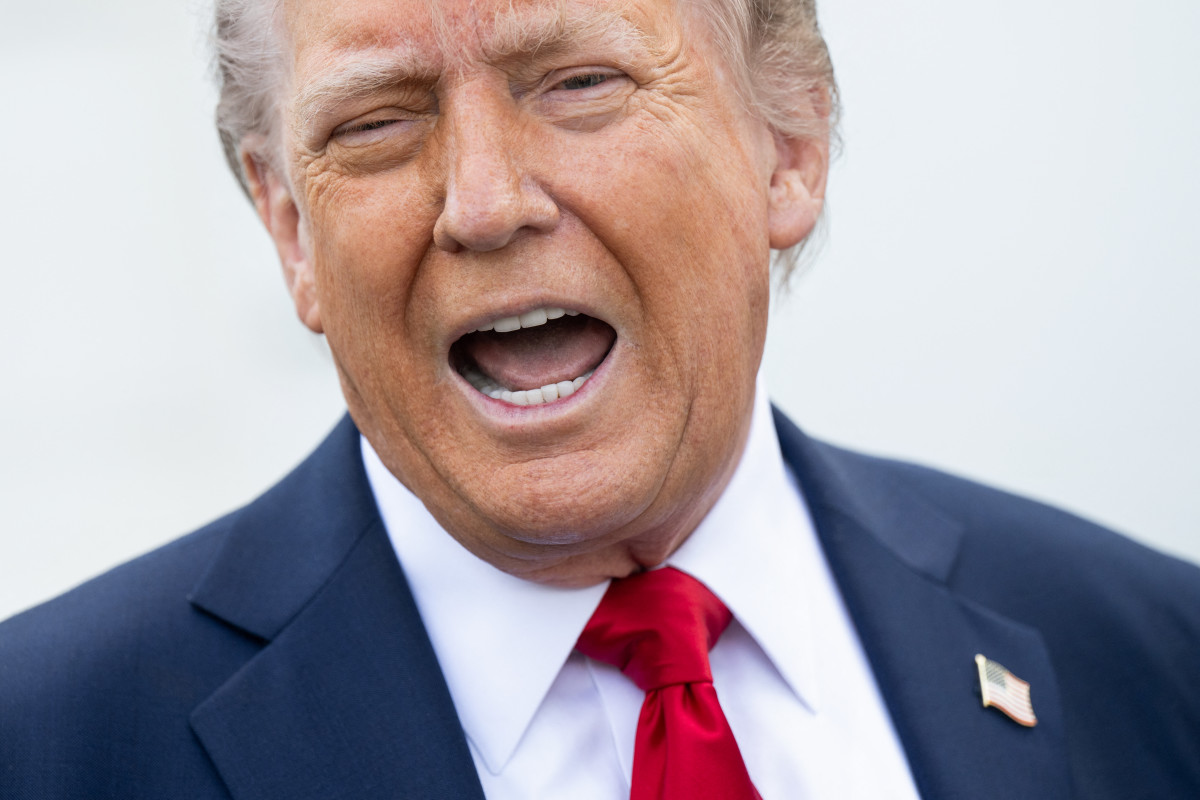

Trump framed the order as a boost for American exports too, telling reporters that Japan would soon be importing Ford pickups. But Ford quickly pushed back, making clear that Tokyo hasn’t agreed to buy F-150s. The public disagreement highlights the uncertainty around promises that Japan will “take our cars” when Ford strongly disagrees with that characterization.

Domestic automakers also worry that lower tariffs may help Japanese brands undercut U.S. products in price-sensitive segments. Ford CEO Jim Farley has warned that even modest changes could widen the gap between U.S. and Japanese offerings.

SAUL LOEB/AFP via Getty Images

Politics at the Center

The timing of the order is politically significant. It comes as Trump courts voters in key agricultural states, touting Japan’s pledge to import more U.S. rice, corn, and soybeans as part of the deal. The agreement also includes $550 billion in Japanese investment across chips, energy, and defense.

But politics in the auto world are volatile. Just last month, Tesla’s owner base was rattled when brand loyalty cratered after Elon Musk’s endorsement of Trump. Trump’s close ties to the industry cut both ways, as he is energizing some consumers while alienating others.

My Final Word

Trump’s order cutting Japanese auto tariffs gives Tokyo breathing room, bolsters U.S. farmers, and arms the White House with a headline victory. But for European automakers facing a $420 million squeeze, for Ford disputing claims about F-150 exports, and for an industry already grappling with political crosswinds, the fallout is far from simple.

Cheaper Japanese imports may be coming—but the ripple effects across markets and politics are just beginning.