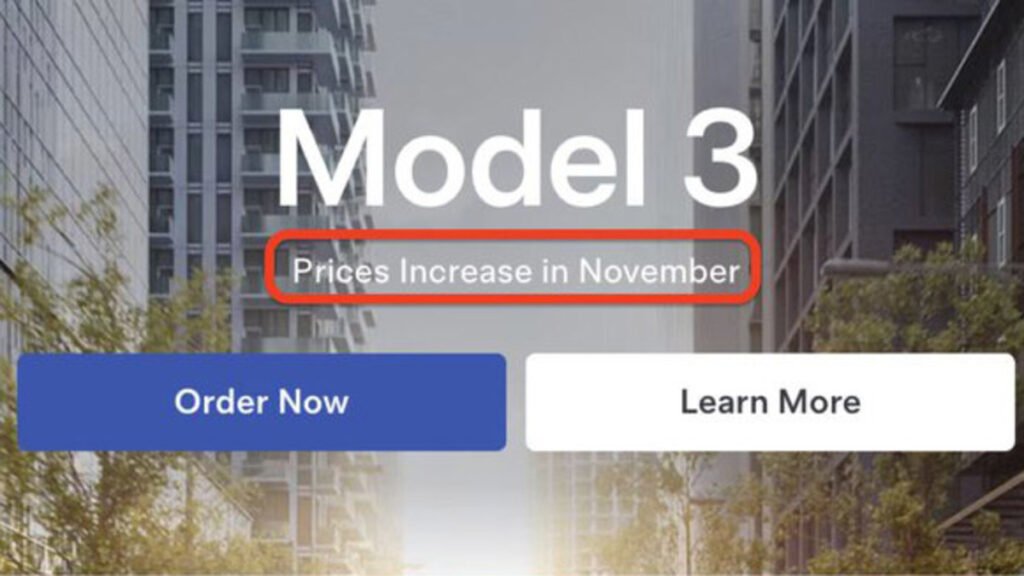

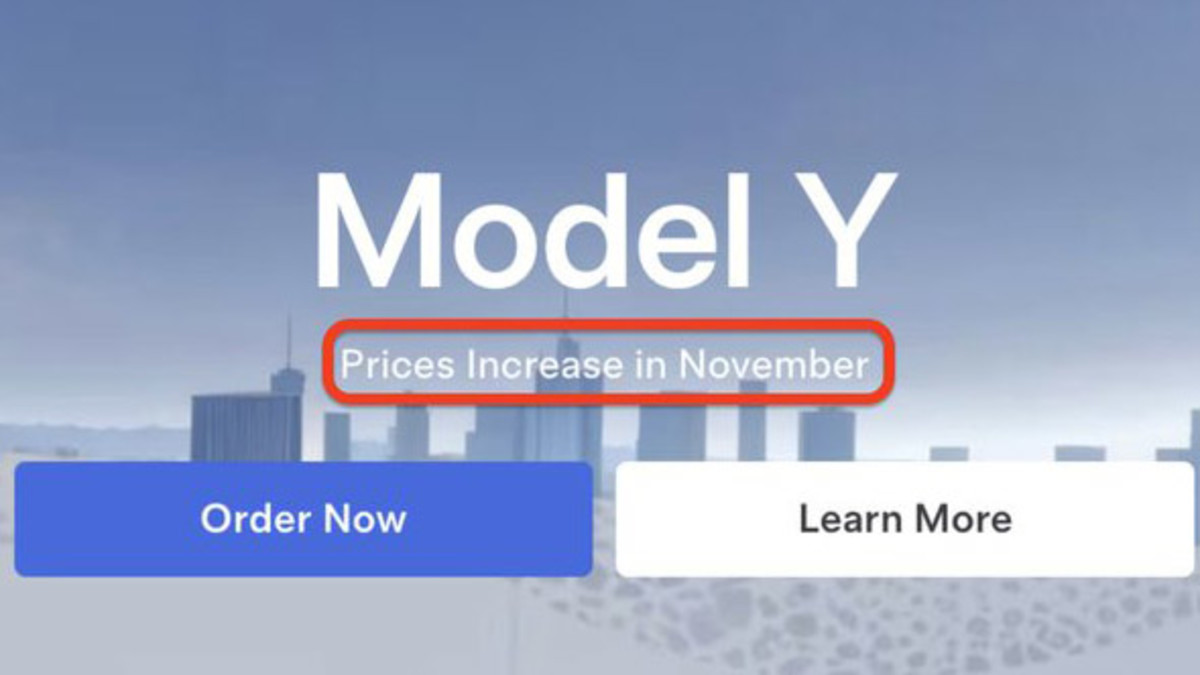

Tesla’s website provides a vague message if you go to look at a Model 3 or a Model Y: “Price Increases in November.” The website does not provide other information, and no information was given in the form of a press release. Tesla also does not have a PR department to contact for comment, which means buyers and media alike are left in the dark with a somewhat ominous message.

Tesla Plans November Price Hike

Nowhere on its website does Tesla specify why or by how much prices will be increasing. For now, it seems the increases apply solely to the Model 3 and Y, both of which just received new “Standard” trims that are significantly cheaper than existing base models.

A quick look through Tesla’s website reveals one possibility: Tesla may be ending its $6,500 Tesla lease credit. The company announced the lease credit following the suspension of federal tax credits by the Trump Administration on September 30. The automaker’s configurator states: “Monthly lease payment already includes the $6,500 Tesla lease credit, which is subject to change or end at any time.” Tesla may have been asked to end the credit, resulting in price increases. Ford and GM bowed to Republican lawmakers when they attempted to offer an incentive to EV buyers following the suspension of federal incentives. Then, the trio of Republican senators, which included Ted Cruz, was quick to put out a press release touting their bullying. Perhaps we’ll be clued in by another press release.

Local Incentives Are Still In Place

Tesla

Tesla has briefly cut prices ahead of the increase, with some qualified lease payments falling by $100, depending on local incentives and taxes. It’s worth noting that the brand’s configurator can be misleading, including items like local incentives for EV lease purchases, but omitting local taxes and fees, so that the lease deal may vary depending on location. It’s unlikely Tesla will further clarify before prices rise in just a few weeks.

At a guess, Tesla will raise prices for its priciest models, leaving Standard pricing alone for the moment. The automaker’s largely US-based production will insulate it from tariffs, but the company’s margins will no doubt take a hit due to the expiration of federal incentives.