The risks of long-term EV ownership apparently don’t have some customers worried

It’s an oft-repeated mantra that EVs are a “lease, don’t buy” proposition, but it seems like not everyone’s subscribed to the same newsletter. In fact, new data published by Experian in its quarterly auto finance report shows the opposite holds true for vehicles arguably the most ubiquitous in the EV space: Tesla. Perhaps even more shockingly, the brand isn’t completely alone.

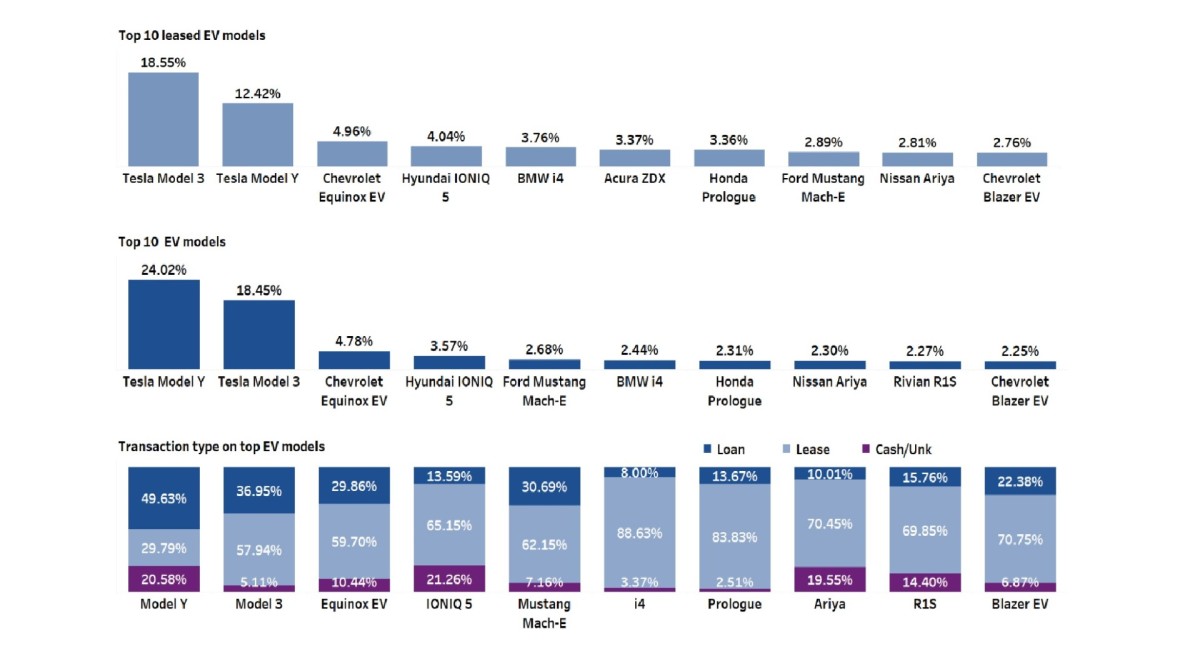

Tesla Model Y

While most top EV models enjoy a healthy lease-to-loan ratio — and we’ll get to that in a minute — American brands specifically seem to attract buyers committed to the long haul. The data shows that a whopping 70% of Tesla Model Y shoppers chose to finance or pay cash for their vehicle in Q2 2025, leaving just under 30% leasing. The Model 3 had a similarly high 42% of customers opting to finance or pay cash. If we look back to Q1, we see that these numbers are an increase from last quarter’s Model Y figures, meaning significantly more customers chose to pay cash. Furthermore, in Q1, we saw the Tesla Cybertruck defy all odds with 73.92% of customers paying cash or financing in lieu of leasing.

Tesla buyers aren’t the only ones eschewing leasing, either. Nearly 38% of Ford Mustang Mach-E shoppers opted to pay in full or finance their car. That’s a small decrease from Q1 2025, when around 40% of customers chose the same. Last quarter, we also saw F-150 Lightning cash and financing account for around 55% of all purchases. Chevy’s Equinox EV stood out in Q2, too, with around 40% of customers choosing to pay cash or finance it.

Leasing numbers for BMW, Rivian, Honda, and other EVs were much more predictable

Among the best-selling EVs for the quarter, there were some predictable finds. Rivian R1S lease take rates sat at 69.85%, and over 70% of Nissan Ariya customers — which represented 2.3% of all EV customers in Q2 2025 — chose to lease. Outliers on the higher end include the Honda Prologue, where 84% of customers chose to lease, and the BMW i4, where a whopping 89% of customers opted for short-term ownership. Notably, Experian’s Q1 data also revealed that 88% of VW ID.4 buyers chose to lease.

Experian

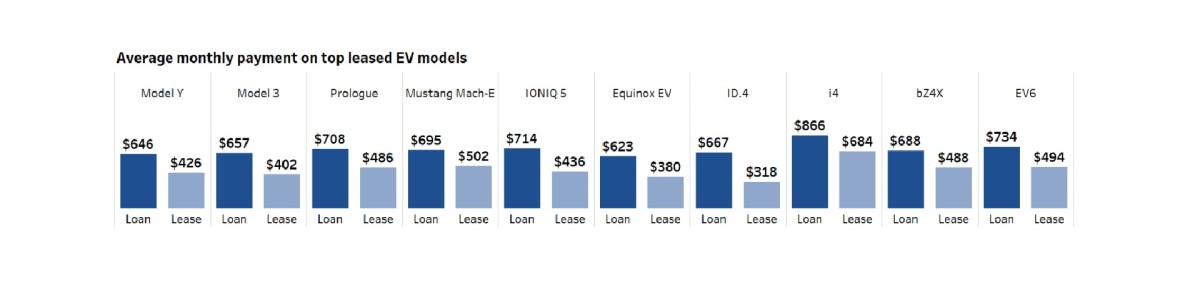

Of course, there are a few good reasons for customers to take the lease path instead of financing or paying cash for an EV. For one, all new cars depreciate, and EVs are certainly no exception. Due to the developing technology, the inevitability of expensive battery replacements, and fluctuating new car prices, EVs are even more heavily impacted than internal combustion vehicles by depreciation. EVs are still generally on the pricier side, too, which makes leasing more affordable in the short term. Data points to a $175 difference between leasing and financing an EV in Q2 2025, with leasing being cheaper across all EVs, which is identical to Q1 2025. Some outliers? The Tesla Model 3 was $255 cheaper per month when leased. The Honda Prologue was $282 cheaper.

Experian

Final thoughts

It’s worth noting that, despite financing and cash being the purchase option of choice for many of these Tesla shoppers, the Model Y and Model 3 dominated all others when looking at the top 10 most-leased EV models. The Model 3 and Model Y together accounted for over 30% of all EV leases in Q2 2025. Respectively, they held the number one and number three spots across all leased vehicles, gas, electric, or otherwise. This figure, perhaps more than anything else, illustrates the sheer volume of EVs that Tesla sells compared to rivals.

As far as extrapolating anything from the data? Well, Tesla’s lease take rates have always trailed other OEMs, as initially, lease buyouts were not allowed. Furthermore, the Model Y and Model 3 are still fairly fresh, having both received significant updates in the last year. It tracks that customers might expect value to hold better on these models over time, and paying cash or financing means a little more flexibility if they decide to ditch the car. Meanwhile, over at Ford, some Lightning models enjoy a $10,000 incentive only on financed trucks. Frankly, the Mach-E and Equinox EV take rates have no easy explanation, but they’re also slightly closer to industry norms. Possibilities are endless, but ultimately, it does seem like legacy brand shoppers are either not comfortable with leasing or prefer the flexibility of financing/outright purchases.