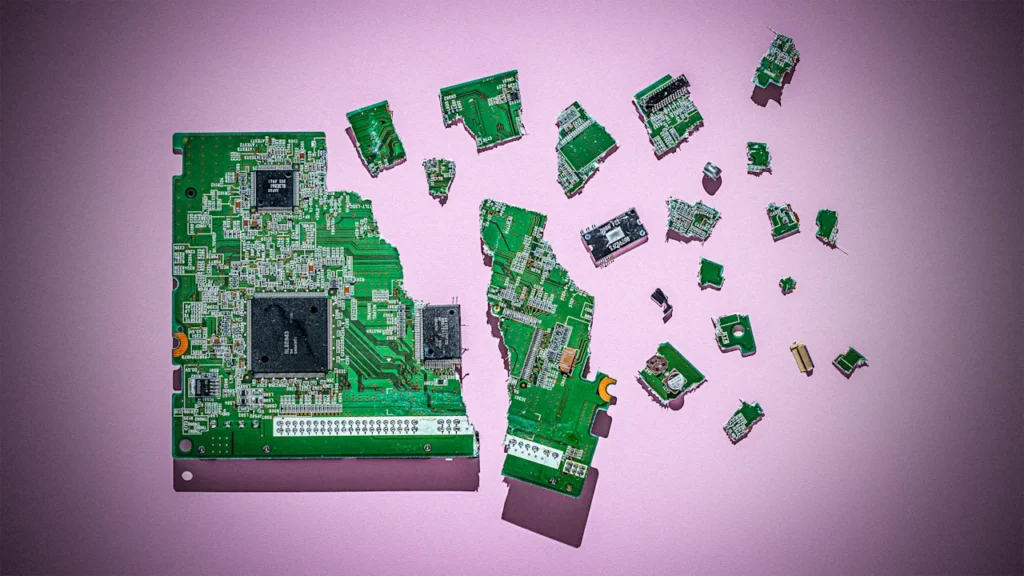

Two of the tech industry’s AI hardware companies are seeing their share prices drop after they reported their most recent quarterly earnings after the closing bell yesterday.

The stock prices of Super Micro Computer, Inc. (Nasdaq: SMCI) and Advanced Micro Devices, Inc. (Nasdaq: AMD) are down significantly over investor fears that artificial intelligence-related growth is lagging expectations. Here’s what you need to know.

Supermicro misses expectations

Shares in Super Micro Computer (aka Supermicro) are trading sharply lower in premarket as of the time of this writing. Currently, SMCI shares are down more than 16.2% to $47.95. The reason for this dramatic stock price drop has everything to do with the company’s just-announced Q4 2025 results.

The server maker announced Q4 net sales of $5.8 billion, which was up significantly from the $4.6 billion it posted in Q3. Net income for the quarter was $195 million, which was also up from Q3, when the company posted $109 million in net income. Finally, its Q4 earnings per share (EPS) were 41 cents, up from 31 cents in Q3.

So if Supermicro’s results were up over the last quarter, why is the stock falling?

It’s a combination of expectations and sales that fall short of past quarters. While Supermicro posted net income of $195 million—around $86 million more than the previous quarter—that was down from its $297 million in net income during the same quarter a year earlier.

As noted by CNBC, the year-over-year Q4 net income decline is partially attributable to Supermicro’s costs from President Trump’s tariffs. However, costs aren’t the only thing bugging Super Micro Computer investors. The company’s results also didn’t meet investor expectations.

LSEG consensus estimates for the quarter were an EPS of 44 cents, three cents short of what Supermicro delivered. Investors also expected revenue of $5.89 billion—more than the $5.76 billion that Supermicro reported.

As Reuters notes, many attribute the company’s lower-than-estimated revenue to Supermicro losing out on AI server sales to its bigger competitors, including Dell and HP.

Finally, Super Micro Computer also disappointed investors by forecasting full-year fiscal 2026 net sales to total at least $33 billion. Previously, the company had said it expected net sales of around $40 billion in 2026.

All this has led to growth fears: While the AI revolution may mean high demand for servers that are needed for artificial intelligence, Supermicro isn’t benefiting from that demand as much as hoped.

AMD missed expectations, too

AI chipmaker AMD is also facing stock price declines this morning—though not as severe as Super Micro’s.

The company posted its Q2 2025 results after the bell yesterday, and since then its shares are down nearly 7% to $162.16 in premarket trading as of the time of this writing.

AMD posted a Q2 revenue of $7.7 billion and net income of $781 million. Its earnings per share (EPS) for the quarter was 48 cents.

However, as with Supermicro, AMD’s EPS was below expectations. As noted by CNBC, the LSEG consensus was that AMD would report an EPS of 49 cents.

The company also suffered hundreds of millions in lost sales after the Trump administration banned sales of its MI308 chips to China. However, this ban may soon be reversed.

As Reuters notes, AMD did post a 14% revenue rise in its important data center unit, yet this sum of $3.2 billion was also slightly below expectations, suggesting investors fear that AMD isn’t benefiting to the maximum degree that it can from the AI chip boom.

Stock price history and future challenges

Before today’s premarket decline for Supermicro and AMD, shares in both companies have had a good run in 2025.

As of yesterday’s close of market, AMD shares had risen 44% in 2025. SMCI shares surged 87% in the same period.

Looking back over the past 12 months, AMD shares were up nearly 30% as of yesterday’s close.

SMCI shares were down nearly 6% for the same period. However, the company had been plagued last year and earlier this year by an accounting crisis that had risked its delisting from the Nasdaq. It eventually filed delinquent forms with the Securities and Exchange Commission (SEC) in February.