2025 was a year defined by U.S. EV pushback

Looking back, 2025 was a year where EVs took a back seat in America, as the Trump Administration systematically dismantled electric vehicle policies and reversed years of progress toward clean transportation. On his first day in office, President Trump paused billions in federal EV charging infrastructure funding and revoked Biden’s target for EVs to comprise half of new vehicle sales by 2030. The administration eliminated the $7,500 tax credit for new EVs and $4,000 credit for used ones, incentives that had driven consumer adoption.

In December, Transportation Secretary Sean Duffy announced an initiative that would roll back fuel economy standards to levels easily achievable with gasoline-powered vehicles. Over the summer, EPA Administrator Lee Zeldin proposed rescinding the 2009 endangerment finding, the scientific determination that greenhouse gases threaten public health, a move that the U.S. Energy Information Administration (EIA) found would increase gas prices.

Though EV sales surged in September as buyers rushed to claim expiring tax credits, they plummeted in October when the incentives ended. Yet beneath the volatility, a new survey finds that consumer interest in EVs in the U.S. may not be entirely on the back burner after all.

Deloitte

Deloitte: U.S. EV interest increased, but still remains at single digits

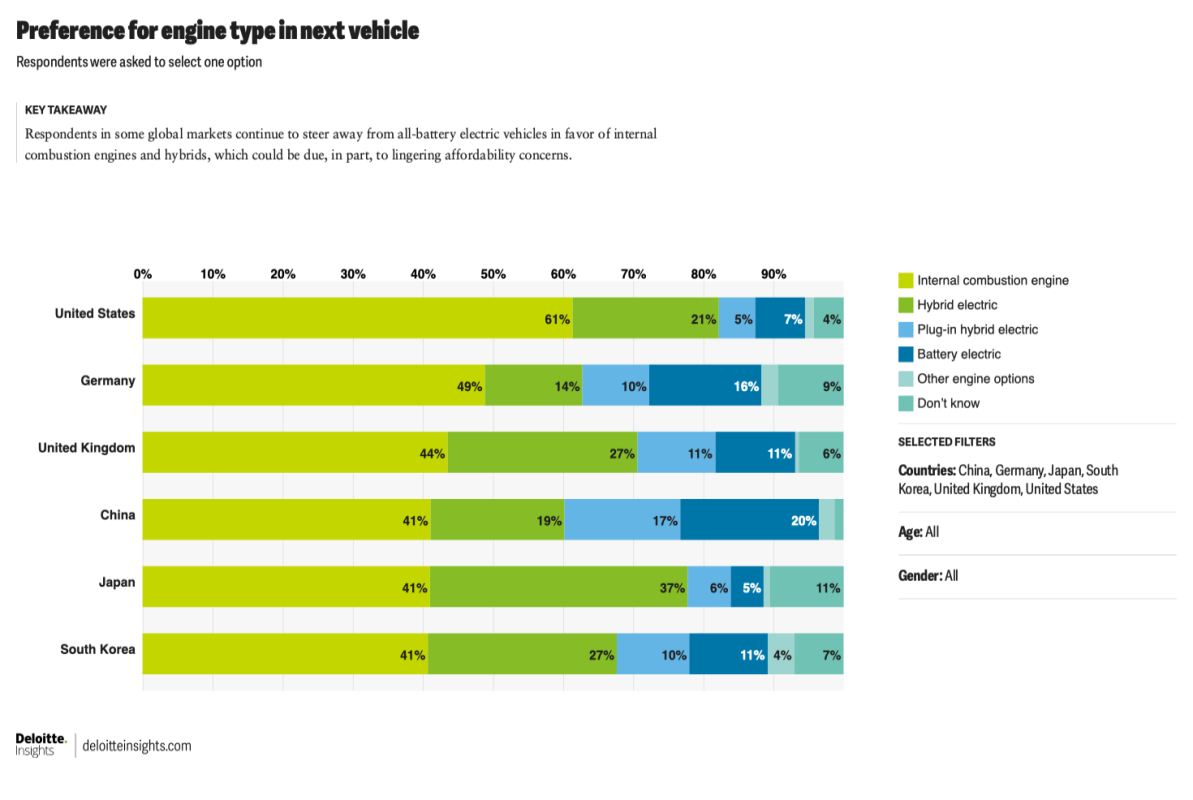

According to new data from Deloitte and its 2026 Global Automotive Consumer Study, U.S. consumer interest in EVs has increased, though it remains at single digits. Just 7% of U.S. car buyers told the accounting firm and management consulting specialists that they plan on buying an electric vehicle for their next car, a steady year-over-year increase from the 5% figure it collected in the 2025 edition of the same survey.

At the same time, the first choice of American buyers is cars powered by conventional gas-or diesel-powered internal combustion engines (ICE), with 61% responding. Trailing behind, 21% of American buyers said that they want a hybrid, while just 5% said that they want to buy a plug-in hybrid.

Notably, Deloitte’s data shows that Americans aren’t the most stubborn against the electric plug. Just 5% of Japanese car buyers said that they are interested in buying an EV for their next vehicle; however, they show a near-equal interest in traditional ICE-powered cars and hybrids. About 41% of Japanese buyers are interested in a traditional ICE-powered car, while 37% say they’ll consider a hybrid like the Toyota Prius.

David Paul Morris/Bloomberg via Getty Images

Deloitte: U.S. buyers value quality and pricing over brand loyalty

Despite the overwhelming preference for powertrain choice favoring gas cars, another tenet that Deloitte observed about U.S. car buyers was that they don’t particularly feel loyal or committed to a single automotive brand and are willing to enter into a relationship with another.

They found that just 45% of U.S. car buyers said that their vehicle was from the same brand as their last one, and 53% of U.S. buyers surveyed said that they plan on choosing a model from a different automotive brand for their next car. In contrast, Deloitte found that the Japanese are the most brand loyal, with 51% reporting that they stuck with the same brand as their last car, and 41% said that they intend on switching to another brand for their next car.

Influencing this move is the American consumer’s fixation on the core product attributes of a particular car brand. The firm found that the most important factors that drive U.S. consumers’ choice of car brand are quality (58%), vehicle performance like fuel economy or electric range (51%), and price (46%). In addition, just 36% of American consumers indicated that they preferred American cars, while 46% said they didn’t care where a car came from, as long as it met their needs.

Final thoughts

In a statement, Deloitte’s vice chair and U.S. auto sector leader, Lisa Walker, noted that its data shows that the U.S. auto sector is “entering a critical phase defined by tightening affordability, evolving expectations around value, and a growing emphasis on longer-term ownership experiences,” adding that dealership experiences contribute to these sentiments.

As affordability, value, and “bang for your buck” become the top priority for automakers and consumers alike going into 2026, it should not be surprising to see buyers defect from their established alliances and loyalties to particular brands, as MSRPs and deals become the new meta.