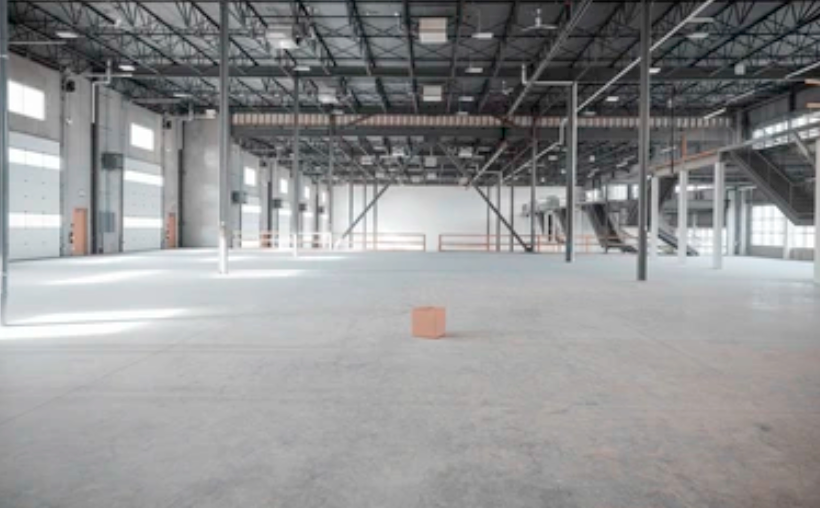

Stockbridge has picked up a 7-building portfolio consisting of 775,000 square feet of warehouse assets. Cushman & Wakefield arranged the disposition of the Greater Valwood Industrial Portfolio in the Dallas-Fort Worth area on behalf of the seller. The firm also served as the exclusive advisor to the buyer, Stockbridge, in securing an acquisition loan provided by Lincoln Financial Group. The properties were in the Valwood/North Stemmons and Metropolitan Addison submarkets.

The portfolio is 100% leased to 14 tenants with an average tenure of 9 years.

Cushman & Wakefield’s Jim Carpenter, Jud Clements, Robby Rieke, Emily Brandt and Trevor Berry represented the seller. John Alascio, TJ Sullivan and Jason Blankfein of Cushman & Wakefield’s Equity, Debt & Structured Finance group advised the borrower.

Stockbridge says its offerings include open and closed-end funds featuring diversified and single-sector focuses, as well as joint ventures for large-scale capital deployment within specific sectors. Stockbridge has approximately $35 billion of assets under management spanning all major real estate property types and certain specialty property types, with an emphasis on residential and industrial space throughout the United States.

The post Stockbridge Acquires 775K-SF FW Industrial Portfolio appeared first on Connect CRE.