Plant-based cheesemaker Stockeld Dreamery has ceased operations as it became clear that it “simply didn’t have the momentum to justify raising more capital.”

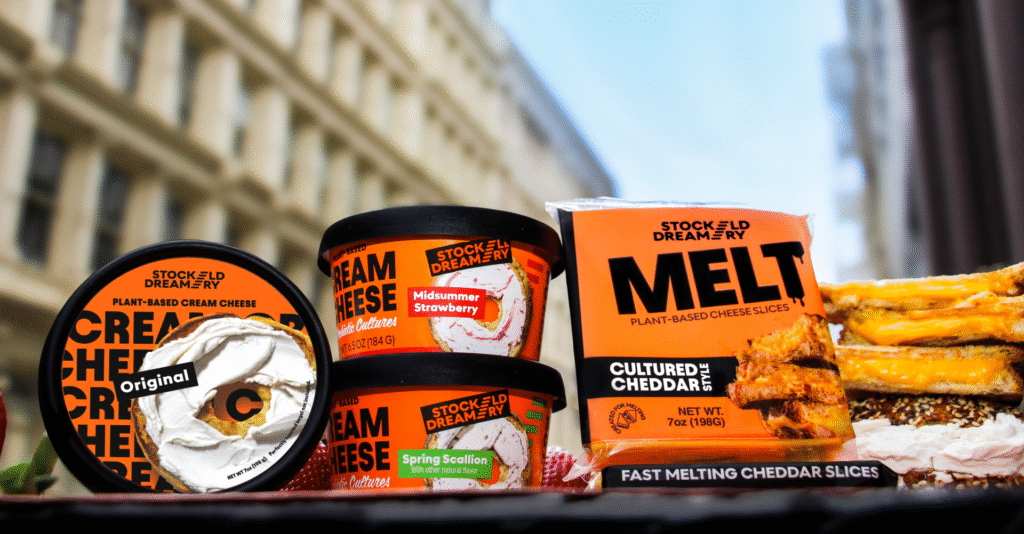

Founded by Anja Leissner and Sorosh Tavakoli in 2019 and backed by $20 million+ in capital from investors including Astanor Ventures and Northzone, Stockeld sought to differentiate itself in the category with cultured legume products and bold packaging designs.

The startup, which has products in 500+ locations in the New York area spanning bagel chains, burger joints and retailers, has recently picked up new accounts, including a listing at 17 Whole Foods stores in NYC scheduled to come online next March and a deal with Fresh Direct.

But the path to profitability was paved with too many roadblocks, Tavakoli tells AgFunderNews.

While vegans and consumers with dairy allergies and intolerances are still looking for non-dairy cheese, he says, the hoped-for surge in interest from flexitarians—something the entire alt protein segment has been relying on—has failed to materialize.

Put more bluntly, he says, the elephant in the room now facing all players in the sector is that the underlying consumer demand to shift away from animal products is just not there, at least not yet.

While plant-based milk has garnered a sizable market share in the US and many other markets, he says, that doesn’t mean you can assume the same penetration rates are inevitable in other categories such as meat and cheese, which present far greater technical challenges, and are beloved by consumers in a way that dairy milk is not.

The elephant in the alt-protein room

There are plenty of decent spreadable non-dairy cheese products on the market, says Tavakoli, while compelling alternatives to mozzarella or cheddar are coming with new tech. But right now, the basic consumer proposition for vegan cheese is not wildly appealing.

In short, the best argument that even the most exciting brands in this space can make to flexitarians is that they are making something that’s more expensive, and at best, just as good, as a product consumers already buy and enjoy, he observes.

Which is a “pretty terrible argument” for switching to something else, he points out.

With plant-based cheese, unlike say, alternatives to processed deli meats, you can’t even make much of a health argument, he adds. “Cheese isn’t a health food.”

According to SPINS data shared with AgFunderNews, US retail sales of refrigerated plant-based cheese are going backwards:

- Total refrigerated plant-based cheese: -8.5% to $220.3 million

- Shredded and grated cheese: -4.1% to $107.8 million

- Sliced and snacks: -13% to $78.9 million

- Spreads: -1.7% to $9.7 million

- Other (blocks, etc): -14.5% to $24 million

Source: SPINS, US retail, 52 weeks to Sept 7, 2025

‘Retailers are cutting back space’

As the data above show, the plant-based cheese category is shrinking in US retail, says Tavakoli, and retailers are cutting back selections.

“You can’t blame investors [for not backing alt-cheese startups] and retailers for cutting back selections. They are just responding to consumers and realigning shelf space to reflect whatever people want to buy.

“Neat Burger [a plant-based burger chain] had a restaurant in NYC. It closed down [in 2023] and was replaced by another burger chain that doesn’t even offer any vegetarian options, never mind vegan options, which tells you something [about consumer demand].”

He adds: “Retailers have supported us because they felt like maybe these guys can achieve something different, given that we have a fermented product and our packaging really stands out, yet it wasn’t enough, even though we get great feedback. We’re kind of selling on par with the top sellers, but we’re not out-selling them, and I think that’s kind of ultimately, what made us decide [to throw in the towel] rather than dragging things out.

“Our hypothesis was always that nobody’s going to pick up these products because of climate or animal welfare, and cheese is not a health food. So essentially, it comes down to cultural acceptance, which is why we worked with outlets that are known for having integrity, serving delicious food, and being really cool, being an authority within their space, from Apollo Bagels and Essa Bagel to Gotham Burger. But it wasn’t enough.”

The path to profitability

As for unit economics, he says, “You look at your business and ask what scale do we need to reach to become profitable? And every year we had to envision a smaller company. We needed about $6 million of revenue to become profitable with a very small team and that was looking to be four years away, so it was a case of, we need to raise additional capital, take other people’s money, work for another four years, and still be a subscale business.”

Like many players in the alt-protein space struggling to make the numbers add up in a declining market, Stockeld started looking at opportunities to join forces with other firms to cut overheads, but nothing ultimately worked out, and the decision was made to “close in a responsible way,” he says.

“Our entire team stayed on to support the wind down, selling equipment, closing offices and labs, and selling through our remaining inventory. We’ll gradually be taken off menus and shelves in the next few months. We’re having a few conversations about a new home for our IP and would welcome others who might be interested.”

The future for alt dairy

Looking ahead, he says, the economics of alternative proteins may become much more compelling as tech improves and the true cost of animal agriculture comes into view. But in the meantime, alt meat and dairy brands have to provide a more compelling consumer proposition.

It’s a lesson that startups producing real dairy proteins in microbes (via precision fermentation) or plants (molecular farming) are now clearly taking on board with moves into higher-value products such as lactoferrin (Alpine Bio, Vivici, All G, DeNovo/EFFV, Eclipse, Helaina) or functional (Verley) or nutritional add-ons (Eden Brew) that enable them to access higher-value markets, he notes.

“We knew success would demand something extraordinary and we came close, but as the market fell, it just got so much harder than we ever expected.”

Further reading:

From record Series A to market reset: Where TiNDLE Foods—and plant-based meat—go next

The post Plant-based cheese startup Stockeld Dreamery shutters as flexitarian dream fizzles appeared first on AgFunderNews.