The best lazy investing portfolio is the set up in line with your risk tolerance and rebalanced regularly. In investing there’s no one right way to invest or manage your portfolio. In fact there are hundreds of approaches, from momentum, buy and hold, tactical, technical and more.

Active portfolio managers, each have their own ideas about how to get the highest returns for their strategies. Hedge funds, clamor for alpha from creative investment strategies. Finally, the market timers attempt to outsmart the indexes and strive to invest at the bottom and sell at the top.

In most cases, your best lazy portfolio will outperform all the other approaches. If you don’t believe me, then check out Mark Hulbert, William Bernstein, and scores of other well regarded investors and researchers.

Hey, even Warren Buffett, one of the greatest investors of all time, believes in a lazy portfolio.

This article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link.

My Lazy Portfolio Story

For several decades I was an investment portfolio manager. During that time I researched individual stocks and bought and sold them for my company and our family investment portfolio. I read everything available, from Graham, Buffett, Bernstein, Lynch, William O’Neil and more. I subscribed to the American Association of Individual Investors (AAII), Morningstar, the Wall Street Journal and Value Line, all the top research sites of the time. My individual investing strategy was simple, dig into corporate and economic trends, compare valuation, debt, profitability ratios with their historical averages. choose companies trading below or at fair market value, with growth drivers. Buying and selling individual stocks was challenging and profitable.

I was successful and content with my methods and returns.

Once I entered the in the Penn State MBA program, I learned about lazy investing or passive investing studies and research.

On the first day of my investing portfolio management class the professor asked who could beat the market averages. Of course, my hand shot up. After all, most years, my stock picking, beat the S&P 500.

Then, while digging into the investing research, I found out that – over the long term – individual stock pickers rarely beat investing in a portfolio of diversified index funds. And even the stellar portfolio managers, rarely continued to beat the market over the long term. And, today, more so than ever, stock pickers are competing with sophisticated computerized algorithms that are smarter than most individual investors.

My investing methodology was upended.

At that point, I transitioned from a stock picker to a lazy investing approach. Although to this day, I still hold a few individual stocks, the majority of our portfolio is invested in our best lazy portfolio of index funds.

What is a Lazy Portfolio?

A lazy portfolio is a “set and forget” passive investment strategy using low-cost index ETFs and mutual fund allocated by risk tolerance. This approach consistently beats active fund managers because most investors and investment managers fail to outperform major market indexes long-term.

Lazy Portfolio vs Active Investing

Passive investing (lazy portfolios) tracks popular indexes with minimal buying and selling. Active investing involves frequent trading to beat market returns. Vanguard research confirms passive index investing typically outperforms actively-managed funds due to lower fees and consistent market exposure. Even investors who beat the market one year rarely sustain that outperformance.

Lazy Portfolio Research

Vanguard has extensive research that demonstrates the outperformance of a Vanguard lazy portfolio over most actively-managed investment funds.

Studies have shown that even if an investor or actively managed fund beats the market one year, they’re unlikely to repeat that out-performance over the long term.

Best Index Funds for Lazy Portfolios

Lazy portfolio index funds track major indexes. Choose from among the available broad and diversified Low-fee ETFs from these categories:

- S&P 500 – 500 largest U.S. public companies

- Russell 3000 – Tracks 3,000 largest U.S. stocks, representing 98% of the stock market

- Nasdaq 100 – Top 100 Nasdaq companies, technology-focused

- Bloomberg U.S. Aggregate Bond Index – Broad diversified bond market exposure

- FTSE All-World ex-US – Top international index spanning the most important global companies.

For those seeking greater diversification, you’ll additional indexes to copy such as mid- and small-cap US funds, European and Asian global funds or style index funds such as value and growth. There are hundreds of indexes that include portions of the US and global stock and bond markets.

How to Build A Lazy Portfolio

- Choose low-fee ETFs or index mutual funds matching your risk profile.

- Allocate between stocks and bonds based on financial goals.

- Rebalance annually to maintain target allocations and keep costs low.

How Does Portfolio Rebalancing Work?

Portfolio rebalancing maintains your preferred asset allocation percentages. If your target is 70% stocks/30% bonds but market movements shift it to 65% stocks/35% bonds, sell 5% bonds and buy 5% stocks to restore original allocation.

Why Choose a Lazy Portfolio?

- Low management fees maximize investment returns.

- Market-matching performance over time.

- Minimal maintenance required.

- Time-tested wealth-building strategy.

What is the Lazy Portfolio Performance?

One of the most common investing questions about a strategy is, “What is the investment performance?”

That question typically describes the portfolio performance of returns during the past year.

So, if your portfolio was worth $10,000 at the beginning of the year, and at the end, its value was $11,000, your portfolio performance or return was 10.0%.

The best lazy portfolio returns will replicate the returns of the underlying investment funds during the year.

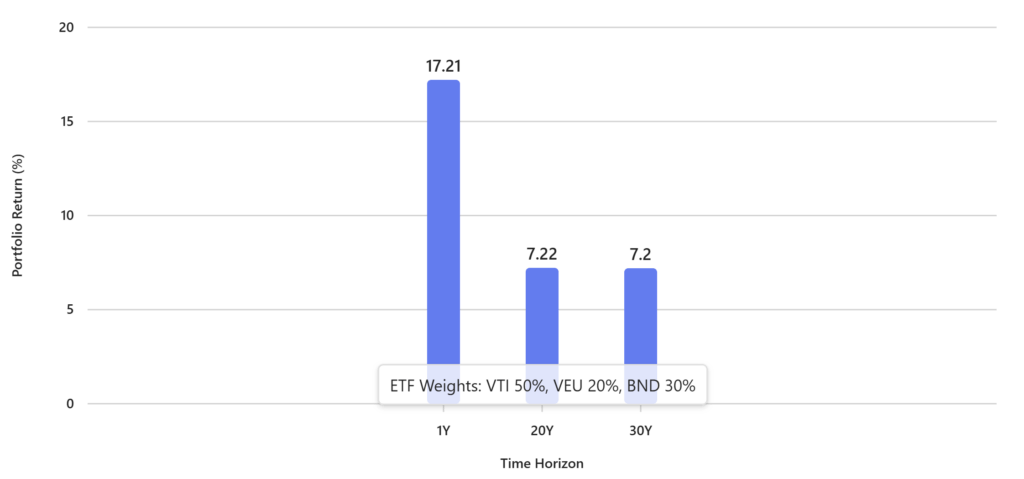

For example, let’s assume that you invested in this three-fund Vanguard lazy portfolio:

| Asset Class | Vanguard Index Fund | Percentage | 1-year return |

| Vanguard Total Stock Market | VTI | 50% | 17.10% |

| Vanguard FTSE All-World ex-US ETF | VEU | 20% | 32.69% |

| Vanguard Total Bond Market ETF | BND | 30% | 7.08% |

| Total Portfolio | 17.21% |

The returns of the portfolio replicate the returns of the funds, in the percentages invested. So, the Vanguard Total Stock Market ETF earned 17.10% during one year. Multiply 17.10% by 50%, since that’s the percentage invested in the lazy portfolio. Add up each annual return multiplied by it’s percentages and you’ve got the total return of the portfolio.

Here’s a chart showing the same Lazy ETF portfolio returns over -1, -20 and -30 years.

Three Fund Lazy ETF Portfolio Returns – Annualized One, 20 and 30 Year Performance

Ultimately, your return will approximate that of the returns of the underlying low fee index funds.

There are many different types of lazy portfolios to construct. The underlying similarity is that they all use low fee index funds. But, which indexes you choose to include, will determine your returns.

For those who want low-cost lazy portfolios, created for you, check out the Wealthfront Robo-Advisor. The platform includes low-cost investment management and a top-notch digital financial advisor.

Backtesting and Performance Analysis

Backtesting means calculating how a specific portfolio might have performed in the past. It’s useful to understand how sectors of the investment markets can vary over time. Although, each asset class will deliver distinct returns during various time periods. The annual returns of U.S. and international stocks and bonds, illustrate how returns vary each year. Notice that stock returns are more volatile than those of bonds.

Backtesting a lazy portfolio will provide insights into the returns and volatility that you might expect in the future.

Stock and Bond Indexes Annual Returns | 2000 – 2025

Data Source: https://pages.stern.nyu.edu/~adamodar/New_Home_Page/datafile/histretSP.html

Our three fund lazy portfolio above, shows that last years performance of over 17% is 10% higher than the average performance of that same portfolio during the prior 20 and 30 year periods. Thus, it’s likely that the average portfolio return of 17.21% will continue in the future.

Examining past returns and volatility of asset classes, gives a view of possible performance in the future. Check out years with greatest drawdowns, to make sure you can stomach potential losses in your portfolio value. By backtesting your proposed lazy portfolio, you can avoid common behavioral finance errors such as believing last years performance will continue into the future, or recency bias. Examine standard deviation, which will show the volatility of asset classes as well as years with greatest drawdown in portfolio value.

Best Lazy Portfolio Ideas

For the laziest investors, this is my favorite:

- 60% All World Stock Index Fund or ETF

- 40% US diversifed Bond Index Fund or ETF

This two-fund lazy portfolio invests in one stock fund which covers the entire worlds stock markets and one bond index mutual funds. Depending upon your risk tolerance, you can choose the percent invested in each fund. The more conservative investors will lean towards higher allocations invested in the bond fund, while the more aggressive investors will boost the stock fund amount.

Lazy Portfolios With Vanguard Funds

William Bernstein, former physician turned prolific investing researcher, author and wealth manager recommends this four-fund allocation on the Marketwatch lazy portfolio site:

- 25% Vanguard European Stock Index Fund Investor (VEURX)

- 25% Vanguard Small-Cap Index Fund (NAESX)

- 25% Vanguard 500 Index Fund (Investor class) (VFINX)

- 25% Vanguard Total Bond Market Index Fund (Investor class) (VBMFX)

This equally divided lazy portfolio limits the bond investments to 25% percent of the entire portfolio with the remaining 75% equally divided among a broad US stock market index fund. The stock portion of the portfolio includes a European equity index fund, and a U.S. small capitalization index fund.

Bernstein’s portfolio is capitalizing on the research that smaller stocks might outperform the total U.S. stock market over the long term.

Friedberg Family Lazy Portfolio

Although I occasionally tweak our asset allocation, here is the current iteration. I’m not recommending this lazy portfolio to anyone else, simply showing our current asset allocation. For context, my husband and I are reaching the end of our formal working years and will be transitioning to contract and freelance work. Within a few years we’ll also be claiming Social Security.

Others might prefer a target date fund, or an asset allocation with fewer funds. There’s no perfect asset allocation.

Why This Friedberg Family Best Lazy Portfolio Is Good For Us

We’re aproaching retirement and have reached our ‘number’.

We’re more concerned with capital preservation than appreciation. That’s why we have 34% of our investment assets allocated to the fixed category.

The total stock market category allows us to participate in the U.S. market.

The small cap value allocation capitalizes on the Fama and French research that suggests that over the long term, small cap and value stocks outperform the total stock market indexes.

Despite lagging international equity performance recently, I’ve lived long enough to know that popular investment categories shift, sometimes quite slowly. Since the U.S. is only 42% percent of the global equity market, according to Visual Capitalist, it just makes sense to invest internationally.

Real estate is an important category and may be less correlated with the stock markets. I also have a sentimental attachment to real estate due to my long history of working for a real estate holding company and investing in real estate myself.

I’m not suggesting that any of these portfolios are best for you. But only, that if you want an easy way to invest, you might consider creating your own lazy portfolio of ETFs or mutual funds.

Set Up Your Lazy Portfolio – The Easy Way

If you’re just getting started, you might consider creating your lazy portfolio at M1 Finance. The benefit of investing with that firm is that once you set up your portfolio, M1 will rebalance it for you. And that saves a lot of time!

In fact, we have an account with M1 Finance and like the fact that you can invest in nearly 6,000 stocks and ETFs without a management fee. They also offer pre-made portfolios, so you don’t even need to choose your own funds!

M1 Finance Pre-made Investment Portfolios

For lazy investing, you might consider:

- General Investing

- Plan for Retirement

- Just Stocks & Bonds

General Investing Model Portfolio From M1

The general investing pre-made choices are ideal for your lazy portfolio. Just choose your risk tolerance, from ultra conservative to ultra aggressive and you’re done.

Here are the investments included in the moderately aggressive option:

Notice that this is actually a Vanguard Lazy portfolio, premade to fit the moderately aggressive risk tolerance.

For the lazy investor, who is investing for the long term, this type of investment strategy is an easy way to build wealth for tomorrow.

The dividend yield for this investment mix will vary based upon the combined weighted dividend yield of all of the funds. The average expense ratio of the funds is a rock-bottom 0.05%.

The M1 Finance General Investing portfolio (also called “pie”) is available in several risk levels, with the more conservative owning more bond ETFs and the more aggressive choices weighted towards equity or stock ETFs.

Lazy Portfolio Guide Wrap Up

What is the best lazy portfolio?

There is no single “best lazy portfolio” for every investor. The ideal lazy portfolio strategy is the one you design around your personal risk tolerance, long‑term investing goals, and asset allocation preferences. Because future market returns are unpredictable, no investment allocation can guarantee specific results.

Instead, focus on building a diversified lazy portfolio of index funds or ETFs, rebalance your investments annually, and stay consistent with your plan. Over time, this passive investing approach can help you grow wealth while minimizing stress. By learning core investing concepts—such as asset allocation, rebalancing, and long‑term compounding—you’ll be better equipped to stick with your lazy portfolio strategy and enjoy the benefits of simple, low‑maintenance investing

Related

- Lazy Investors Asset Allocation Guide to Amass $787,355

- Which Are The Best M1 Pies For You? Free Lazy Investment Portfolios

- Investing Lazy Portfolios Drill Down

- Best Personal Investment Strategy – For Women (and Men too)

- How to Choose a Mutual Fund

- What Are Index Funds And Asset Classes Investing?

- Best Asset Allocation Based On Age and Risk Tolerance

Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link. That said, I never recommend anything I don’t believe is valuable.

The post Lazy Portfolio Basics: Easy, Low-Cost Wealth Building appeared first on Barbara Friedberg.