Want more housing market stories from Lance Lambert’s ResiClub in your inbox? Subscribe to the ResiClub newsletter.

On Tuesday, D.R. Horton—America’s most valuable and largest homebuilder, with a $46 billion market capitalization and ranked No. 123 on the Fortune 500—reported its third-quarter earnings for the three months ending June 30.

While D.R. Horton’s earnings didn’t wow investors, the fact that there wasn’t an accelerated softening beyond what homebuilders—including D.R. Horton—had already reported earlier this year was enough for some Wall Street investors to buy back into homebuilder stocks.

For today’s piece, we’re going to take a closer look at D.R. Horton’s earnings and the commentary its executives provided during Tuesday’s earnings call.

Incentive spending is helping D.R. Horton’s home sales hold steady

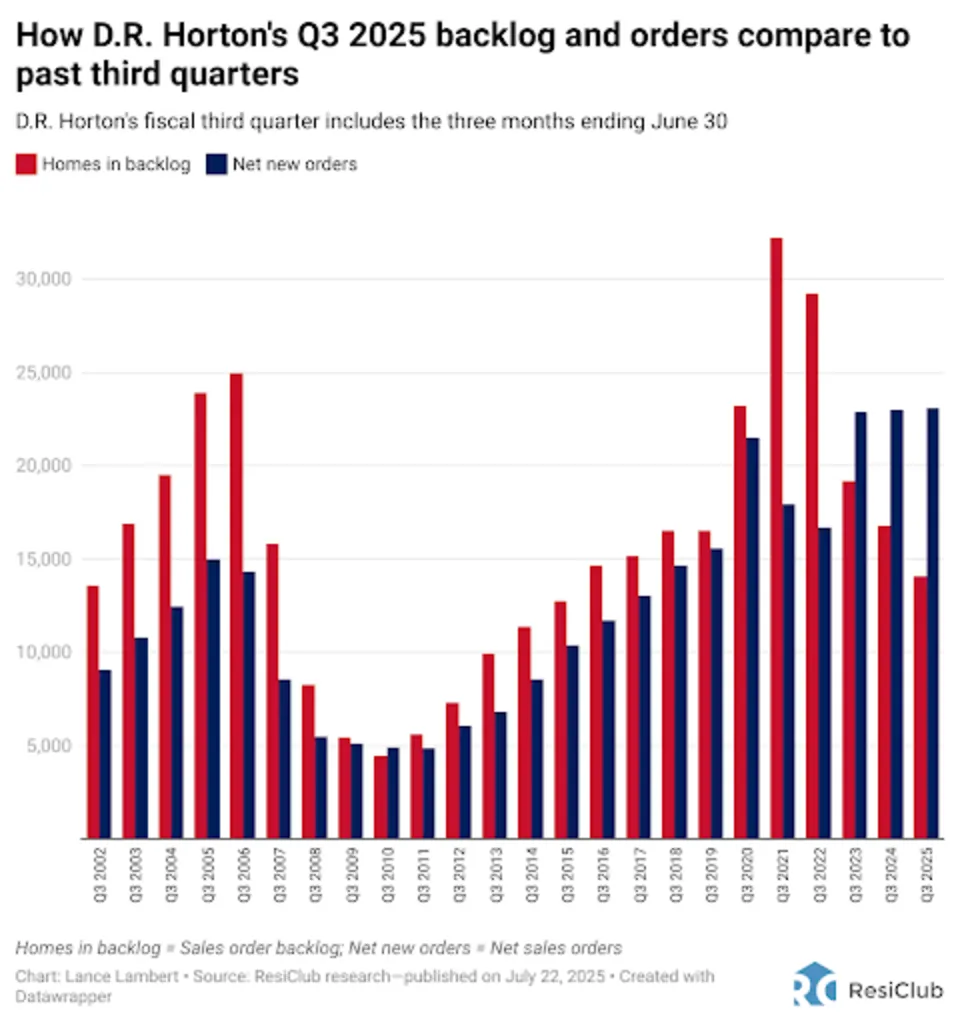

D.R. Horton’s net new orders, by its fiscal Q3 (the three months ending June 30th):

- Q3 2018 —> 14,650

- Q3 2019 —> 15,588

- Q3 2020 —> 21,519

- Q3 2021 —> 17,952

- Q3 2022 —> 16,693

- Q3 2023 —> 22,879

- Q3 2024 —> 23,001

- Q3 2025 —> 23,071

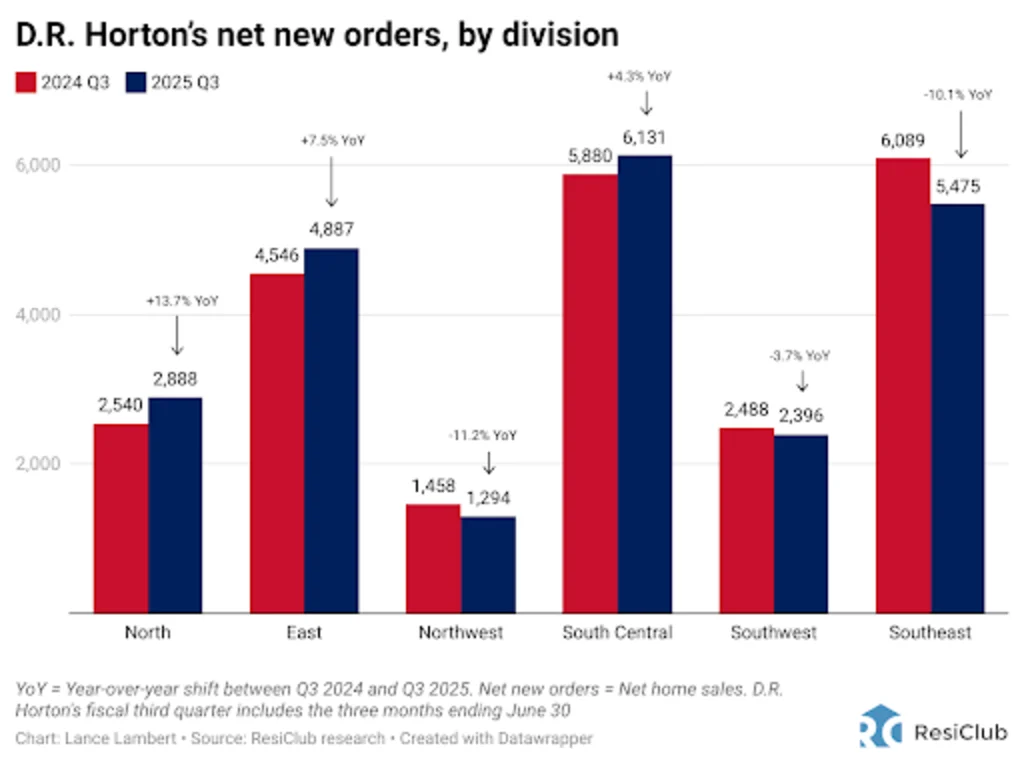

D.R. Horton continues to see weakness in Florida

While D.R. Horton’s national net orders were pretty much flat year-over-year, there was a -10.1% year-over-year drop in its Southeast division. That division includes Florida—which D.R. Horton once again acknowledged remains on the softer/weaker side.

“There’s been a lot of a change [weakening] in the dynamic in the Florida markets. And perhaps most so there. Other markets continue to be consistent performers where there’s been limited inventory and limited development of lots. And housing production continues to see strong demand in those markets,” D.R. Horton chief operating officer Michael Murray said during their earnings call on July 22, 2025.

- North (13% of D.R. Horton’s Q3 2025 net new orders): Delaware, Illinois, Indiana, Iowa, Kansas, Kentucky, Maryland, Minnesota, Missouri, Nebraska, New Jersey, Ohio, Pennsylvania, Virginia, West Virginia, and Wisconsin

- East (21%): Georgia, North Carolina, South Carolina, and Tennessee

- Northwest (6%): Colorado, Oregon, Utah, and Washington

- South Central (27%): Arkansas, Oklahoma, and Texas

- Southwest (10%): Arizona, California, Hawaii, Nevada, and New Mexico

- Southeast (24%): Alabama, Florida, Louisiana, and Mississippi

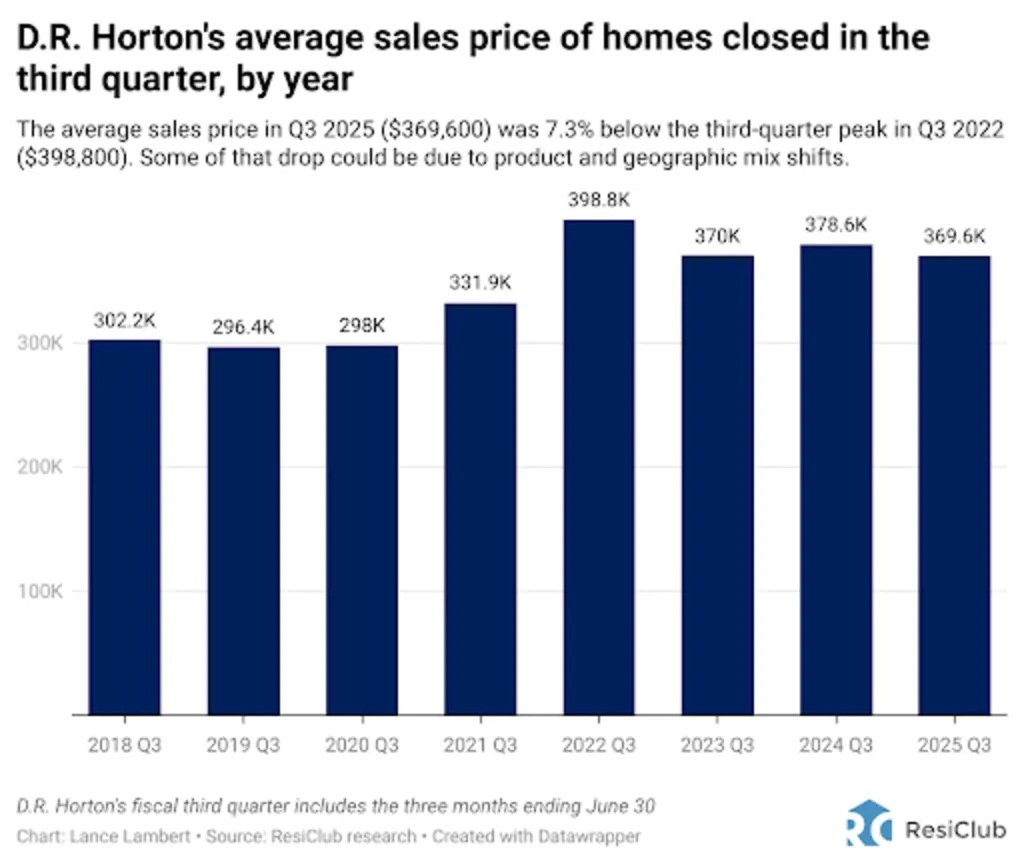

D.R. Horton’s average sales price moves sideways

D.R. Horton’s average sales price in Q3 2025 ($369,600) was -7.3% below the third-quarter peak in Q3 2022 ($398,800).

It’s possible that some of the drop in average sales price is due to shifts in product and geographic mix. Instead of outright price cuts, D.R. Horton has preferred to offer bigger incentives this cycle, such as mortgage rate buydowns.

Regardless, D.R. Horton’s average sales price confirms that upward pricing momentum has stalled in many markets.

D.R. Horton’s incentive spend has caused margin compression

D.R. Horton reported a 21.8% gross margin on homes for Q3 2025. That’s down from 24.0% in Q3 2024; however, it’s unchanged from its Q2 2025 gross margin (21.8%).

The fact that the margin didn’t further compress quarter-over-quarter is why some investors bought the stock back.

However, D.R. Horton acknowledged that, looking ahead, the ongoing housing market softening still points towards a bit higher incentives.

“Our commentary really over the last year has been that incentives have been increasing. That’s been the main driver for the gross margin decline over the last year. Our operators are striving every day to strike the best balance between hitting pace and maintaining margin in each community to maximize returns. And so they’re using all the levers they have with incentives to try to balance that. And so we have seen the pace of incentive cost increases and the pace of margin decline moderate a bit over the last couple of quarters and then this quarter it held flat sequentially [quarter-over-quarter],” Jessica Hansen, head of investor relations at D.R. Horton, said during their earnings call on July 22, 2025.

Hansen added that: “But the trend is still pointing towards a bit higher incentives, and we don’t see significant offsets to that, though we will continue to work on costs on the construction side.”

On Tuesday, D.R. Horton told investors expect Q4 2025 gross margins to come in between 21.0% and 21.5%.

Labor hasn’t been an issue for D.R. Horton yet despite the increased ICE crackdown

“From labor availability, it’s plentiful. We have the labor that we need. Our trades are looking for work. And that’s why you’ve seen sequential and year-over-year reduction in our cycle time. Because we have the support we need to get our homes built. And, you know, given those efficiencies, reductions in stick and brick [costs] over time. Some of that is from design. And efficiency of the product that we’re putting in the field. And some of that is just from the efficiency of our operations,” D.R. Horton CEO Paul Romanowski said during their earnings call on July 22, 2025.

Tariffs haven’t coincided with higher stick-and-brick costs—but lumber tariffs are something to watch

On Tuesday, D.R. Horton told analysts that stick-and-brick costs are down 2% year-over-year and down 1% quarter-over-quarter.

Note: My understanding is that “stick-and-brick costs” include direct construction costs of building a home on-site using traditional wood materials like lumber (“sticks”) and masonry materials like concrete (“bricks”). These costs include both materials (e.g., lumber, drywall) and labor (plumbers, roofers, etc.).

Although the White House hasn’t included Canadian softwood lumber on their broader tariff list, the U.S. government is preparing to more than double the duties on Canadian lumber imports. As a part of its annual review, the U.S. Department of Commerce plans to raise the tariff on Canadian lumber from 14.45% to 34.45%. The U.S. Department of Commerce argues that Canadian lumber is being unfairly subsidized and sold below market value in the U.S.

“It [higher duties on Canadian lumber] will have some potential impact, but we’ve not quantified that. I know it is a significant step up in the tariff rates, I think, going to effect next month. But, you know, we’re buying some percentage of that wood and there’s some substitutionary product that would be available as well. Based on where that pricing ultimately settles,” D.R. Horton chief operating officer Michael Murray said during their earnings call on July 22, 2025.

Homebuilder stocks got a little bounce following D.R. Horton’s earnings

Following the earnings reports from D.R. Horton and PulteGroup on Tuesday, Wall Street gave homebuilder shares a slight bounce. While the move doesn’t return shares to the highs reached around September 2024, it could signal that some on Wall Street believe homebuilder margin compression is losing momentum.