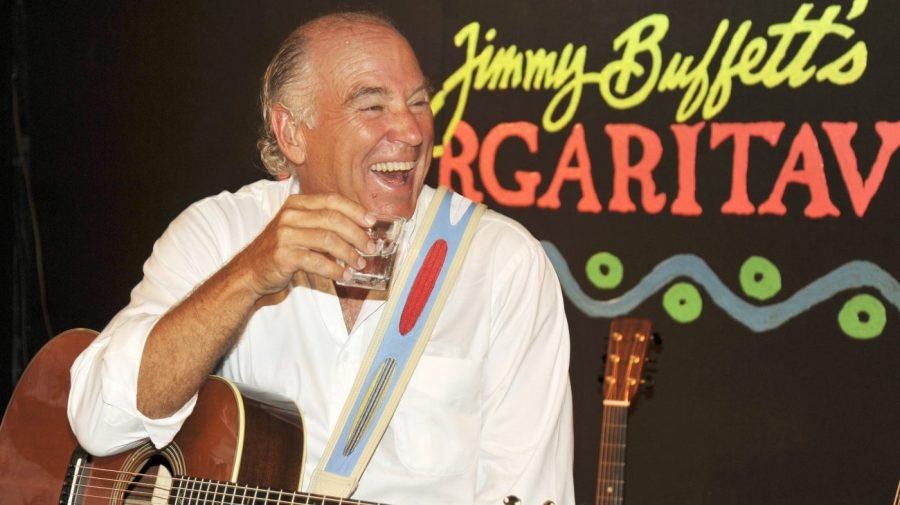

(NewsNation) — Jimmy Buffett’s multi-million dollar estate is now included in two opposing lawsuits, according to reports.

Buffett’s widow, Jane Buffett, and his financial adviser, Richard Mozenter, are arguing over who has control of the singer’s trust. Jane Buffett claims in her lawsuit that the trust is worth $275 million. Her suit was reportedly filed a day after Mozenter’s, on June 3, in Los Angeles civil court. Mozenter’s was filed in the Palm Beach County Circuit Court.

The duo is accusing one another of mismanaging the trust and is asking a judge in each jurisdiction to remove the other as co-trustee, according to records. Barron’s reported that his trust includes a 20 percent stake in Buffett’s Margaritaville Holdings, which was founded by the Buffett family. It reportedly owns and operates hotels, cruise ships, casinos, and more.

Buffett’s will was written over 30 years ago and amended twice — once in 2017 and once in 2023. According to legal filings, the trust was created “for the wife’s sole benefit of her lifetime.” The assets in the trust also reportedly include:

- $34.5 million in real property

- $15 million in equity from Strange Bird Inc.

- $2 million in musical equipment

- $5 million in vehicles

- $12 million in various investments

Jimmy Buffett concerned about wife’s ability to ‘manage assets’: Lawsuit

Mozenter’s lawsuit claims that Buffett, who built the Margaritaville brand, established the trust with Mozenter as the independent trustee because he was concerned about “Jane’s ability to manage and control his assets.”

Jane Buffett was allegedly “very angry” about the structure of the trust, according to the lawsuit, and “has repeatedly acted in a hostile manner and has been completely uncooperative with Rick in his attempts to administer the Trust.”

The lawsuit said that, since Buffett died in 2023, Jane Buffett “has only acted on behalf of herself as a beneficiary and not as a co-trustee.” She has reportedly refused to work with Mozenter on financial analysis, tax returns and more.

Montezer said that Jane Buffett even tried to remove the couple’s eldest daughter from the trust, despite Jimmy Buffett wanting all three children to remain as beneficiaries. Their children — Savannah, Delaney and Cameron — should receive any of the singer’s remaining assets left after Jane Buffett dies.

Jimmy Buffett’s widow says co-trustee has been ‘plainly deficient’

In Jane Buffett’s lawsuit, however, she claimed that Mozenter has been “plainly deficient” in his role as co-trustee. She said that Mozenter and the attorney for the trustees, Jeffrey Smith, have been hostile toward her and worked against her best interests.

Buffett was married to Jimmy Buffett for 46 years, but said she hasn’t been able to get detailed financial information from the trust since his death. This includes the money she is supposed to receive as her income. In the meantime, Mozenter and his firm have allegedly paid themselves $1.7 million in the past year in fees.

When Buffett was given reports in April 2024, the lawsuit said, “This was not the work product Mrs. Buffett expected to receive from a handsomely paid professional accountant after months of delay.” Buffett was told her income should be about $2 million, but the lawsuit claims that is “a remarkably poor return for a Trust with an estimated $275 million in assets.”

Buffett’s attorney, Matthew Porpora, reportedly said, “It is alarming and upsetting that Rick Mozenter… has taken it upon himself to direct funds intended for Jane to instead cover… legal fees in a brazen and baseless attempt to have her removed from the very trust that was established to protect her. Mr. Mozenter is replaceable — Jane isn’t.”

Marital trusts allow someone to pass along a portion of their estate to a beneficiary of their choosing so that assets aren’t taxed when they die. These trusts will help a spouse during the rest of their life, and, when they die, the estate tax will be due, according to the managing director of wealth strategy at U.S. Bank’s Ascent Private Capital Management, Justin Flach.

These assets will become governed by “very specific rules around how it’s used for that surviving spouse,” Flach said. However, if a trust qualifies for a deduction, the surviving spouse should get all income from the trust and can demand “that the assets of the trust be productive to produce that income.”

It is unclear what will happen with these lawsuits next.