Is Gold a Good Investment? Learn the Advantages and Disadvantages of Investing in Gold

With recent high inflation, investors are wondering if gold is a good investment. This article answers questions related to investing in physical gold, gold coins, gold ETFs and gold mining companies. You’ll learn whether gold is a good inflation hedge, if gold coins are a good investment, which is better physical gold or stocks, and finally the pros and cons of investing in physical gold. You’ll also find out ways to invest in gold.

This article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link.

Quick Summary

Bottom Line: Gold serves as portfolio insurance and a diversification tool but significantly underperforms stocks over long periods. Best suited for conservative investors seeking stability rather than growth.

50-Year Gold vs. Stock Market Return Stats:

- S&P 500 annual return Nov. 1975-Nov. 2025: 11.93% (dividends reinvested)

- Gold annual return since Nov. 1975-Nov. 2025: 6.93%

Data source: dqydj.com

Best For: Investors who want to diversify beyond stocks and bonds, those concerned about currency devaluation, or anyone seeking a “store of value” asset.

What is Gold Investing?

Gold has been considered a valuable commodity for thousands of years and continues its allure today. Investing in gold is simply buying and selling gold. You could buy physical gold bars with an app, or purchase gold through exchange traded funds (ETFs) or stocks in gold mining companies.

Unlike stocks or bonds, gold doesn’t generate income through dividends or interest. Instead, its value comes from universal agreement that gold is valuable—a characteristic that makes it a “store of value” asset. This consensus among individuals, institutions, and governments, along with its limited supply, is why gold can appreciate despite offering no yield.

Opinions abound concerning whether to invest in gold, or not. Similar to other financial assets, the price of gold goes up and down.

The End of the Gold Standard

Gold’s importance changed in the U.S. in 1971, when President Nixon ceased the convertibility of gold into U.S. dollars, effectively terminating the gold standard. The decoupling of the dollar with gold, removed gold’s inherent mechanism to control inflation.

Following the halting of gold standard, gold prices soared during the 1970’s and 80’s and then traded flat for the next 20 years. While gold hasn’t been a perfect inflation hedge and delivers lower returns than equities, its diversification benefits support including a small gold allocation in a balanced portfolio.

Pros and Cons of Investing in Gold

Advantages of Gold Investing

- Diversification Benefits Gold typically has a low correlation with stocks and bonds, meaning it often moves independently of traditional assets. This can reduce overall portfolio volatility.

- Store of Value Gold maintains purchasing power over extremely long time horizons and is universally recognized as valuable across all cultures and economic systems.

- Historical Trustworthiness With thousands of years as a valued commodity, gold has demonstrated remarkable staying power and is likely to remain valuable far into the future.

- Crisis Hedge During periods of economic uncertainty, geopolitical instability, or currency devaluation, gold often performs well as investors seek safe-haven assets.

Disadvantages of Gold Investing

- No Income Generation Unlike stocks (dividends) or bonds (interest), gold produces zero cash flow. You profit only if the price appreciates.

- Storage and Insurance Costs Physical gold requires secure storage and insurance, adding ongoing expenses that erode returns over time.

- Underperformance vs. Stocks Historical data shows gold trails stock market returns over long periods.

- High Volatility Without Commensurate Returns Gold experiences stock-like volatility but delivers bond-like returns, creating an unfavorable risk-reward profile.

- Unfavorable Tax Treatment Net capital gains from selling collectibles (such as gold) are taxed at a maximum 28% rate, higher than the capital gains rate on stocks and bonds.1

How to Invest in Gold?

Gold investing has been around for centuries. Today, there are a preponderance of methods for investing in gold. You could buy the actual metal in the form of bars or coins, buy stock in gold-mining companies or invest via other market derivatives like gold futures.

1. Physical Gold (Coins and Bars)

You can buy physical gold through a gold app like Vaulted. They will store the gold for you for low fees, or you can take possession of the physical gold. You’ll also find many dealers, individuals or online platforms that sell gold.

Gold coins are available at the US Mint or a dealer.

2. Gold ETFs and Mutual Funds

You can buy a gold ETF or mutual fund. The SPDR Gold Shares (GLD) ETF is a low-cost efficient way to access the gold market. Other gold funds include Invesco DB Gold Fund (DGL) and the Franklin Gold and Precious Metals Fund (FKRCX). The Sprott Physical Gold Trust (PHYS) is a closed end gold fund where unitholders have the ability to redeem their units for physical gold. The Fidelity Select Gold Portfolio (FSAGX) mutual fund spans precious metals and mining activities.

3. Gold Mining Stocks

An alternative to physical bold is to buy a publicly traded gold mining company stock or fund. You can buy an ETF like VanEck Gold Miners ETF (GDX) which strives to match the price and yield of the NYSE Arca Gold Miners Index (GDMNTR).

Individual gold mining stocks include Barrick Gold (GOLD) and Equinox Gold Corp. (EQX).

4. Gold Futures and Options

Contracts to buy or sell gold at predetermined future prices are best suited for sophisticated investors. It’s best to learn more about futures trading before embarking on this method of buying gold.

Are Gold Coins a Good Investment? Coins vs. Bars

If you’re torn between investing in gold coins or bars, check out this comparison.

Purity and Authenticity

- Gold Coins: Typically minted in 22-karat (91.67%) or 24-karat (99.9%) purity. Examples include American Gold Eagle (22k) and American Gold Buffalo (24k). Coins are produced by sovereign mints, offering guaranteed authenticity backed by government certification.

- Gold Bars: Almost always 24-karat and close to 100% pure. While bars can carry certifications, they lack the inherent government-backed authenticity of coins, making verification more critical when purchasing.

Storage and Security

- Coins: Standard sizes make storage straightforward, but their condition significantly impacts value. Investors must protect coins from damage, adding complexity to storage.

- Bars: Easier to store and less sensitive to minor blemishes. However, large bars can pose challenges due to uneven sizing and concentration of value in a single piece.

Liquidity

- Coins: Highly liquid due to government certification, recognizable designs, and added numismatic appeal. Easier to resell, though they often carry higher upfront costs.

- Bars: Less liquid because buyers require weight verification and authenticity checks. Typically held long-term for their melt value rather than traded frequently. Although the Vaulted App provides liquidity for gold bar investors.

Premiums

- Coins: Higher premiums over spot price due to rarity, condition, and popularity. Dealers charge extra for their ease of resale and collectible value.

- Bars: Lower premiums since value is tied solely to gold content. They are generally more affordable and reflect spot prices closely, making them cost-effective for bulk stacking.

Investment Strategy

- Choose Coins if you prioritize liquidity, frequent trading, or enjoy collecting pieces with historical or aesthetic value.

- Choose Bars if your goal is to accumulate maximum gold weight at the lowest cost and you’re comfortable with long-term storage (unless using an app).

Neither option is universally better; the choice depends on your investment objectives. Coins offer authenticity and liquidity, while bars provide cost efficiency and simplicity. For diversification, consider a mix of both. If you lack the money to buy a complete bar of gold, you can buy fractional shares of gold bars with an app.

Gold Prices vs Inflation Prices – 1970 to 2025

Sources: Gold Prices – Macrotrends, Inflation Rates – US Inflation Calculator

Is Gold a Good Inflation Hedge?

With inflation a frequent concern, investors are turning to gold investing. Gold is often considered to be a hedge against inflation. The chart above tracks the nominal price of gold (gold line) per ounce in U.S. dollars, and the red line tracks the annual percentage change in the consumer price index (CPI),

The data shows these insights comparing gold prices vs inflation rates:

- 1970s Surge: Both inflation and gold prices spiked during the 1970s oil crisis and stagflation era.

- 1980 Peak: Gold hit a high in 1980, mirroring peak inflation.

- 1990’s: Inflation peaked in 1990, with no commensurate increase in gold prices. Throughout the decade. gold remained stable while inflation was more volatile. The 1990’s showed a low correlation between gold prices and inflation.

- 2000s–2020s: Gold prices rose sharply post-2008 and again during the COVID-19 era, while inflation remained relatively low until 2021–2022. In 2010, inflation sank and gold prices rose. another inverse correlation.

- 2022–2025: Inflation peaked again in 2022 (~8%) and began to normalize, while gold prices continued climbing, reaching over $3,000/oz in 2025.

Gold prices appreciated during certain periods with little or no correlation with increased inflation. There is little data to suggest that inflation consistently drives gold prices. in fact, during some periods there is an inverse relationship between gold and inflation with low inflation and rising gold prices. Geopolitical and other factors might contribute to rising gold prices, regardless of inflation levels.

A weak correlation doesn’t imply no correlation between gold prices and inflation. Yet, there may be better inflation hedges than gold. A study by Bloomberg, World Gold Council from 1998 to December 2020, found that real estate and the 10-year TIPs were more consistent hedges against inflation with gold clocking in at third place.

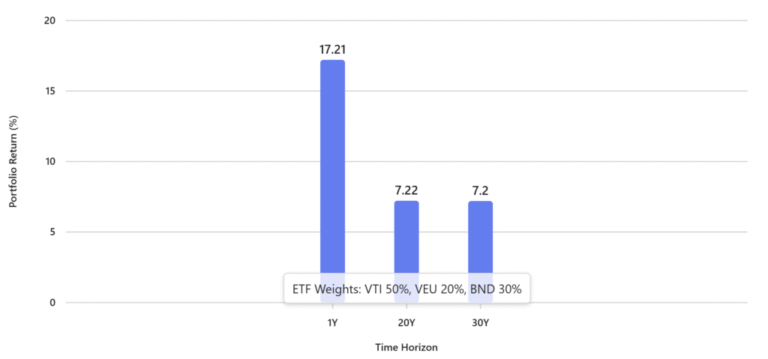

Gold vs Stock Market Returns – 50 Year

11/1975 to 11/2025

**** pardon our dust – we’re updating this article ************

Should I Buy Physical Gold or Stocks?

Physical gold should be seen as a safety net – a preservation of value – more so than an outright investment. Most stocks, in contrast, are investments. When comparing growth of the S&P 500 with that of gold prices, the stock market prevails during most historical periods.

Gold vs Stock Investing Comparison

| Factor | Physical Gold | Stocks |

| Income | None | Dividends (typically 1-3% annually) |

| Growth Potential | Limited to price appreciation | Earnings growth + multiple expansion |

| Liquidity | Moderate (dealers, premiums) | High (instant trading) |

| Taxes | 28% collectibles rate | 15-20% long-term capital gains |

| Volatility | High | High |

| Correlation | Low with stocks | 1.0 with itself |

The S&P 500 returned 11.93% annually during the last 50 years (as of November 2025), with dividends reinvested. In contrast, gold delivered 6.93% annualized returns during that same time.

As for buying physical gold or gold stocks, keep in mind that physical gold often sells at a premium. That might make gold stocks a cheaper option. In addition, buying and selling gold stocks or funds is an easier and faster process than is buying and storing physical gold.

If your time horizon is short – i.e., you want to invest in gold for under a decade – you are likely to find funds or even future contracts more convenient than beginning a gold coin/bar collection. In the end, though, no one says you cannot do both. You can hold physical gold for worst-case scenarios, own a gold ETF in your portfolio for diversification, and buy gold stocks for investment.

For long term investors, seeking capital appreciation, the stock market has delivered greater returns than gold investing.

Does Gold Lose Value?

Gold’s value is influenced by supply, demand and investor sentiment. Gold is a shiny valuable metal and has been considered important for a long time. Likely, gold will only lose value if investors lose faith in the metal, a phenomenon that is unlikely to occur anytime soon.

Gold’s limited supply adds a price floor and enables price growth when demand grows.

If you were to value gold objectively, such as via its use in electrical and jewelry manufacturing, the metal is highly overpriced. This keeps value investors, such as Warren Buffett, away from gold. But this does not mean gold is losing value over time.

Rather, gold’s benefit lies in its so-called “store of value.” It is not only a faith-based commodity with a long track record, but it is rare. It cannot be artificially manufactured, and it does not decay over time. If you buy a gold coin now, you will have the same amount of gold relative to the total amount of gold in circulation decades from today, as there is a finite supply of gold.

That said, the price of gold can go up and down, and there have been long periods of time, like 1980 to 2000 and 2010 to 2020, when gold’s price has remained flat.

Is There a Downside to Investing in Gold?

Gold has a real expected return of zero with no cash flow. Over a long enough time horizon, gold holds its value against inflation, meaning that – on average – the performance of gold relative to nearly any asset, whether it be one with yield or equities, is poor. Gold is often bought as a hedge against inflation, despite the reality that the price of gold is inconsistently impacted by inflation.

Moreover, gold comes with extra expenses. Physical gold sells at a premium and often requires storage costs. Gold is also taxed as a collectable, which is the same as your marginal income tax rate and capped at 28%.

Lastly, gold is volatile. Investors should be rewarded for holding risky, volatile assets, as is the case for stock investing. However, gold doesn’t reward investors for its commensurate risk and the risk/reward profile for investing in gold is poor in contrast with investing in stocks.

That said, adding a small gold allocation to an all stock and bond portfolio might temper the portfolio’s volatility of returns.

Gold vs Cryptocurrency Investing – Which is Better?

Digital currency, spearheaded by the founding of Bitcoin in 2009 is emerging not only as a currency, but also as an investment. The future of cryptocurrency investing is less certain than gold, which has been around for thousands of years. As businesses, and even governments begin to accept digital currency, investors gain confidence in the future of crypto investing.

Whether gold or cryptocurrency investing is better depends upon your investment objectives and risk tolerance.

In 2009, one bitcoin was worth $0.09.

Bitcoin reached a peak of $114,472 on October 26, 2025 and on November 21, 2025 one bitcoin was priced at $84,848.

Gold closed out 2009 at a price of $1104, and is trading in November 2025 at $4096. Clearly, bitcoin had a better run than bitcoin cryptocurrency since 2009.

For investors, with a high risk tolerance, seeking potential returns that surpass the S&P 500, crypto might be a better alternative. If you want a secure store of value, with a long history, then consider gold investing.

How Much Gold Should You Own?

When investing in speculative and alternative assets, we typically recommend a 5% to 10% allocation. That way, if gold prices stagnate for long periods of time you’ll have ballast during a down market, and minimal impact when stocks and bonds are rising.

Final Verdict: Should You Invest in Gold?

Physical gold is a highly concentrated store of wealth. The benefit of gold investing comes from it’s long history as a valuable commodity. Gold also has validity as a portfolio diversifier. Small allocations to gold can smooth out the volatility of a diversified portfolio.

But, gold comes with its own problems, including storage risks (getting lost or stolen), counterfeiting (usually via tungsten) and extra costs (certification, taxes, and premium prices). You can alleviate many of these problems via an online vendor such as Vault. Gold isn’t the best asset fo capital growth and tends to underperform over time

Ultimately, gold is a reasonable alternative for diversifying your portfolio and adding a small ballast against inflation. Think of gold as portfolio insurance, not a growth investment. Just as you maintain home insurance hoping you’ll never need it, hold gold as a safety net while building real wealth through stocks, real estate, and other productive assets.

Before investing in gold, ensure you’ve:

- Understood your investment objectives and risk tolerance

- Maximized tax-advantaged retirement accounts

- Built an adequate emergency fund

- Invested appropriately in stocks for your time horizon

Gold has its place in your investment portfolio—just make sure that place is limited and strategic.

Related

- Vaulted Review-Best Gold Investing App

- Should I Invest In Dividend Stocks?

- Pros And Cons Of Target Date Funds

- How To Benefit From Cyclical Investment Markets

- What Are TIPS Inflation Protected Bonds?

- Are I Bonds A Good Investment?

- M1 vs Wealthfront: Which Is Best?

Sources:

- https://www.gold.org/goldhub/research/beyond-cpi-gold-as-a-strategic-inflation-hedge

- https://www.reuters.com/article/sponsored/beyond-cpi-gold-as-a-strategic-inflation-hedge

- https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2078535

- https://www.nber.org/papers/w18706

- https://www.jmbullion.com/investing-guide/bullion/gold-bars-vs-gold-coins/

- Gold Prices – Macrotrends

- Inflation Rates – US Inflation Calculator

- https://dqydj.com/gold-return-calculator/

- https://www.irs.gov/taxtopics/tc409

Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link. That said, I never recommend anything I don’t believe is valuable.

The post Investing in Physical Gold: Pros, Cons & Complete Guide (2025) appeared first on Barbara Friedberg.