Getty Images; Tyler Le/BI

You know the saying: Keep your friends close, and your trillion-dollar AI enemies closer.

The artificial intelligence explosion has sparked an intensity of competition in Silicon Valley not seen since the smartphone boom, as tech companies spend billions of dollars to sprint ahead with the most advanced models, access to the most compute power, and the best researchers.

The AI race has also brought some of these rivals closer together than ever. In some cases, uncomfortably close.

Just look at what’s happened in the last few weeks. OpenAI signed a $300 billion deal to access Oracle’s compute power — despite being majority-backed by Oracle rival Microsoft — while Meta signed a $10 billion deal for Google Cloud, per a person familiar. Microsoft, meanwhile, announced that it’s giving its customers access to Anthropic’s AI models, which run on Amazon and Google’s cloud services. For all we fixate on the AI “war,” right now there’s also a lot of AI lovemaking, as many of these companies need each other more than ever.

“The stakes are so high that you’re seeing behavior that in the past wouldn’t happen,” said Gil Luria, managing director at investment firm D.A. Davidson. “It’s a big chess match of: how can I progress on my stuff, but also not miss the boat if someone else is winning?”

But how close is too close? Not only do these AI deals largely run on debt, they’re also forming complex — and consequential — dependencies between companies. In late September, Nvidia announced a $100 billion investment in OpenAI, which in turn said it will build out at least 10 gigawatts of AI datacenters with Nvidia chips, an alliance that has raised the specter of vendor financing and memories of Cisco extending loans in the 90s so companies could purchase its telecoms equipment. Spoiler alert: that didn’t end well.

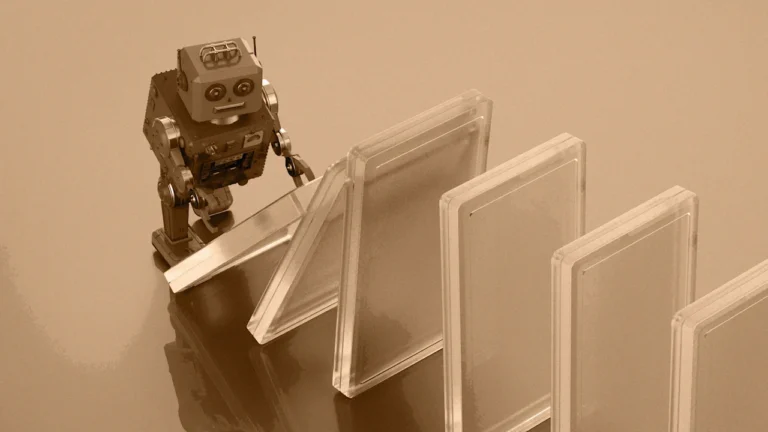

In the knotty game of AI Twister, what happens when any one giant leg slips?

In some ways, Silicon Valley’s rise to dominance has been built on enemies getting into bed with each other.

Google, for one, just got dragged through a federal court by the Justice Department because of its long-held deal with Apple — a direct competitor — to be the default search engine on the iPhone. In return, Apple gets a huge revenue stream for doing very little work. (In 2022, Google paid Apple a whopping $20 billion, per the DOJ.) The rise of the cloud giants also created an intricate web of dependencies, as smaller rivals began renting the compute powers from the titans they were trying to take down. Amazon offers Apple TV+ on Prime Video. Netflix runs on Amazon’s cloud servers. Apple relies on Samsung components for its phones that compete with Samsung’s.

Think of it like David and Goliath, if the giant was helping David design and build slingshots.

Now the AI boom and spurred a new generation of relationships born out of necessity, while deepening existing ones.

At Goldman Sachs’ Communacopia + Technology conference in San Francisco in September, both OpenAI and Meta’s CFOs talked about how their companies are leaning on Google Cloud. Apple has even trained its AI on Google’s Tensor Processing Units, Business Insider previously reported. But Google Cloud customers also want Nvidia’s GPUs, so Google rents and offers Nvidia’s competing chips to its customers via Google Cloud. Meta has struggled to catch up, with its Llama models falling short to the point Meta employees themselves are using competing AI models for their work.

Many of the deals are simply pragmatic, as several tech companies were caught off guard by the suddenness of the AI boom, and needed to lean on competitors and form less usual relationships to keep up.

“People recognize it’s hard to build large language models, and not only hard, it’s really expensive,” says Rishi Jaluria, analyst at RBC. “So how do you benefit from that without taking the financial burden on your balance sheet?”

Some companies may have also been haunted by the specter of the dotcom bubble. “We saw what happened when people missed the internet. Sears could have been Amazon. Blackberry could have dominated enterprise mobile,” says Jaluria. “Everyone looks at that and nobody wants to miss this race.”

These entanglements carry longer-term strategic risks that some of these companies might have once tried to avoid. OpenAI is giving big business to cloud providers such as Google and Microsoft right now, but in doing so it’s also learning how to build out its own data centers that might one day threaten business for the cloud giants.

Think of it like David and Goliath, if the giant was helping David design and build slingshots.

It can go the other way, too. But these may be tomorrow’s problems. Right now, analysts say that it’s in Nvidia’s best interest to have as many players out there as possible, and OpenAI’s best interest is to secure as much compute as it can while it’s available. As for giants like Google and Meta, everyone is sitting at the poker table and not wanting to be the only one that doesn’t go all-in.

Johannes Neudecker/picture alliance via Getty Images

“When you hear about any of these big participants talking about this right now, like Mark Zuckerberg or Sundar Pichai, the type of language they use is: the risk of underinvesting is bigger than the risk of overinvesting,” says Luria.

We’re also seeing AI drag in both new players and old incumbents who want a piece of the pie. “Just the fact Oracle is going atomic on this thing is a huge deal,” says Patrick Moorhead, chief analyst at Moor Insights & Strategy. “Ten years ago, I would have said: no way, they’re a software company.”

Sometimes — surprise — sleeping with the enemy gets messy.

Nvidia’s $100 billion investment in OpenAI includes plans to build out at least 10 gigawatts of AI data centers. That will require OpenAI purchasing millions of GPUs from … Nvidia. (OpenAI is also reportedly working on its own in-house chips that would eventually compete with Nvidia’s. “We do not require companies we invest in to use NVIDIA technology,” an Nvidia spokesperson said when asked for comment). The deal was announced just days after OpenAI also signed a deal with Oracle to access $300 billion of the cloud company’s compute power over five years.

Right now, almost everything appears to be riding on Sam Altman.

Oracle is also currently buying billions of chips from Nvidia. Is this tale not tangled enough for you? In October, OpenAI also announced a deal to buy six gigawatts worth of GPUs from Nvidia chip rival AMD. In short, Nvidia is helping to prop up one of its biggest rivals.

You can see why there’s been a lot of talk round-tripping, which has been a particular phenomenon of the cloud wars.

Here’s how it often works. Company A invests in Company B, which in turn pays Company A for services such as cloud infrastructure. Company A makes some of its investment back, and is also able to show that demand for its services has grown.

An example of this was Amazon investing $4 billion in Anthropic, which in turn selected Amazon Web Services as its “cloud provider of choice.” Here’s where things get extra sticky though: Google is also an investor in Anthropic, meaning its investment is also tied to the performance of one of its biggest rivals.

Investors tend to not love these arrangements because they allow companies to juice their numbers and blur the difference between revenue that is organic and that is circulated back. Take an even more egregious example: Nvidia is selling its chips to smaller cloud providers in which it also invests, and then reportedly renting them back. So the startup gets to report an increase in revenue from its cloud business, which in turn boosts Nvidia’s stake in the business.

Cue the Christian Bale in “The Big Short” concerned face.

But it’s important to differentiate the “healthy” and “unhealthy” behavior, says Luria, who points to Nvidia-backed cloud company Coreweave as “the most glaring example of bad behavior.” The company, which offers customers access to Nvidia’s GPUs, has an ever-expanding contract with OpenAI, which uses Coreweave’s cloud infrastructure. After Coreweave’s IPO earlier this year fizzled, Nvidia inked a $6.3 billion agreement to buy back any unsold cloud capacity from Coreweave.

“Nvidia seeded Coreweave to create competition,” he says. Then, “they signed up as a customer.” Coreweave having a cost of capital of 10% on a 5% return on its assets was “self-evidently value destructive,” he says. “It’s like taking a margin loan from your broker to buy treasuries,” he adds.

“Nvidia is an important partner to CoreWeave to be sure,” a CoreWeave spokesperson said in an emailed statement. “However, we do not receive any preferential treatment. We compete for supply like every other customer.”

Luria says the demand for AI was “very real” and he doesn’t believe it’s going away. “There’s not going to be a moment where we say oh this AI stuff is nonsense like we did about the metaverse.”

So if there is a bubble to burst at all, perhaps it will simply be one that hurts the “unhealthy” players. To take a Keynesian perspective on the current AI economy, if the ultimate customer demand is there — and right now, everyone seems to agree it is — then big players like Nvidia and Oracle priming the pump to stimulate the wider AI economy isn’t necessarily a bad thing.

“This is just how the economy works,” says Juluria. “We’re just seeing it in a very exaggerated way.”

The fact some AI companies are generating revenue from the technology is one reason some analysts are hopeful Silicon Valley’s big tangled love-in will pay off.

“By no means am I saying there is no risk,” Moorhead tells Business Insider. “But the downstream impact of AI for companies that are doing it right is very positive.”

Speaking to CNBC last week, Nvidia CEO Jensen Huang said his and other companies were building “a brand-new industry called AI infrastructure.”

But the demand will ultimately need to be there to stop this intricately woven infrastructure from collapsing inward – to the tune of $1 trillion and counting. Right now, almost everything appears to be riding on Sam Altman, who has placed OpenAI squarely in the middle of this tangled web of deals and strange bedfellows.

“Sama has the power to crash the global economy for a decade or take us all to the promised land,” wrote Bernstein analyst Stacy Rasgon in a note this month. “And right now we don’t know which is in the cards.”

Hugh Langley is a senior correspondent at Business Insider where he writes about Google, tech, and wealth.