General Motors has confirmed it will end development of its next-generation hydrogen fuel cell systems, marking a major strategic shift away from hydrogen-powered vehicles. The company said it will redirect resources toward battery-electric technologies, citing higher market demand and the slow rollout of hydrogen fueling infrastructure in the U.S.

The decision effectively pauses GM’s HYDROTEC initiative, which had been aimed at developing new fuel cell systems for future passenger and commercial vehicles. Plans for a $55 million hydrogen research and development facility in Detroit have also been canceled.

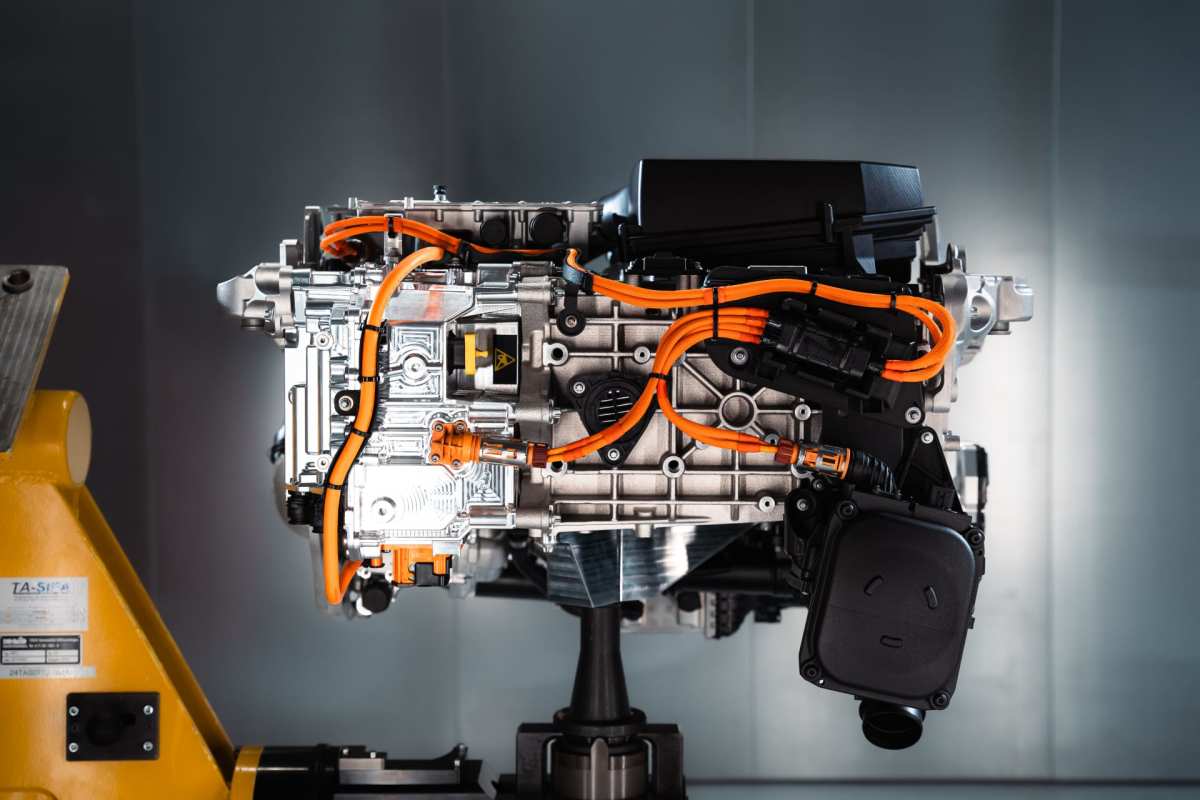

GM said in a statement that hydrogen remains “a promising technology in select sectors,” but that immediate investments will now prioritize areas “with proven market traction.” The automaker will continue producing existing hydrogen fuel cells for stationary and industrial uses through Fuel Cell System Manufacturing LLC, its joint venture with Honda.

A Retreat From Hydrogen Mobility

This move places GM on a different trajectory from other major automakers still pushing hydrogen development. Toyota continues to see fuel cells as the key to decarbonizing heavy transport, and BMW outline similar ambitions. Both brands argue that hydrogen refueling times and energy density make it ideal for trucks and long-distance vehicles.

GM’s decision reflects the opposite calculation, that the economics, infrastructure, and policy incentives currently favor battery-electric vehicles. Hydrogen stations remain limited, with fewer than 70 public refueling sites nationwide. By contrast, EV charging networks have expanded rapidly thanks to federal funding and private partnerships.

Industry Context and Competitive Landscape

Automakers’ approaches to hydrogen are diverging sharply. BMW, for example, expects its first hydrogen-powered production cars to arrive by 2028. The company is banking on Toyota-sourced technology to deliver faster refueling and long-range capability, a bet GM has now effectively abandoned.

Meanwhile, GM’s exit from next-generation hydrogen research mirrors similar retrenchments across the industry. Stellantis ended its hydrogen program earlier this year, while Honda’s focus has shifted to smaller, modular fuel cell systems rather than full-vehicle applications.

Why It Matters

GM’s withdrawal underscores a growing divide between automakers pursuing hydrogen as a long-term solution and those concentrating on the electric transition already underway. By reallocating resources toward EVs, GM aims to strengthen its Ultium battery platform and cut costs after several tough quarters marked by supply issues and margin pressures.

For hydrogen advocates, however, GM’s move is a setback. Without major automakers driving development, fuel cell momentum in North America could slow dramatically.

Still, the company insists it hasn’t closed the door entirely. Its ongoing partnership with Honda will continue supporting limited hydrogen production for commercial and stationary uses, a quieter, more pragmatic application of the technology it once saw as transformative.