Want more housing market stories from Lance Lambert’s ResiClub in your inbox? Subscribe to the ResiClub newsletter.

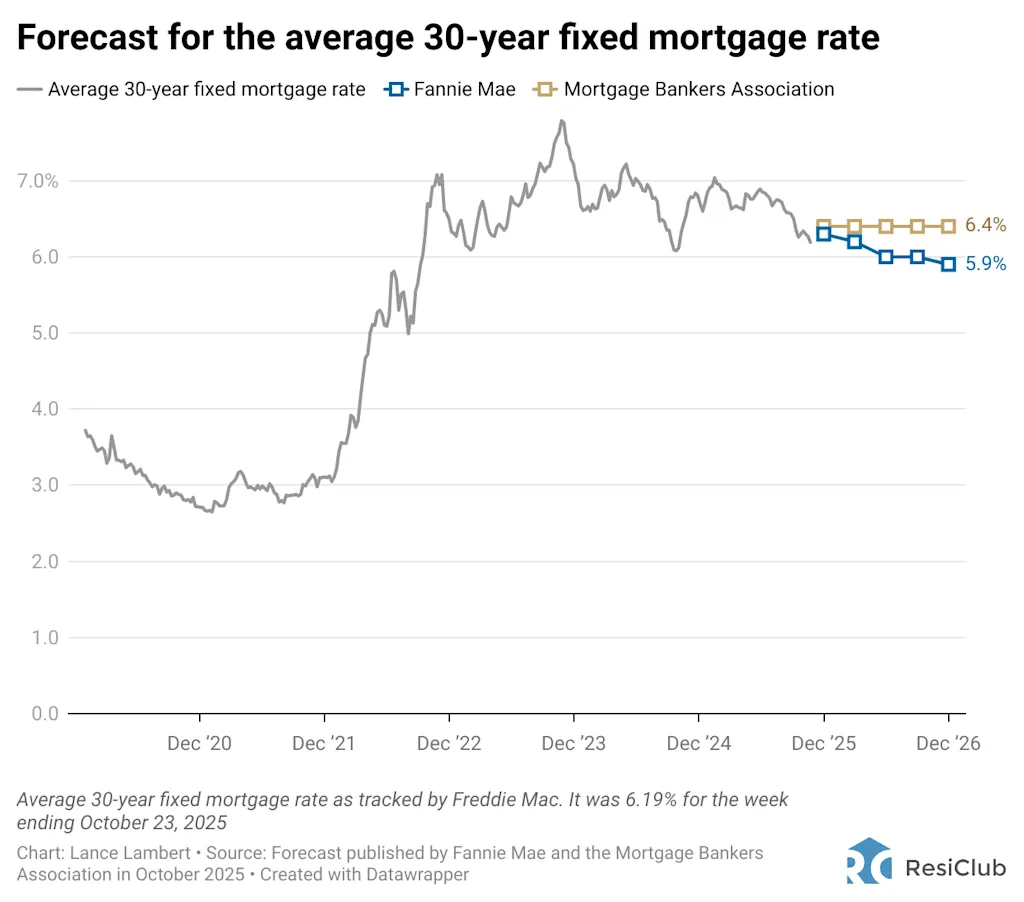

The average 30-year fixed mortgage rate sits at 6.19%, down from 6.54% a year ago. While that decline represents some welcome relief for homebuyers, economists at Fannie Mae and the Mortgage Bankers Association (MBA) believe most of the short-term mortgage rate relief is already behind us.

Both Fannie Mae and the MBA released 2026 forecasts this month showing not much change from here. Fannie Mae expects the average 30-year fixed mortgage rate will fall to 5.9% by the fourth quarter of 2026—a decline of just 0.3 percentage points from today’s levels.

The MBA’s forecast is even more conservative, calling for an average 6.4% rate by late 2026, which would actually mark a slight uptick.

Their shared view underscores a growing consensus among economists: The easy phase of mortgage rate relief has passed, unless something material changes in the economy.

Both organizations do anticipate a mild shift in the broader economy/labor market. The U.S. unemployment rate, currently 4.3%, is expected to soften a tad, with Fannie Mae projecting 4.4% by the end of 2026 and the MBA expecting 4.6%. While that would mark further labor market softening, it’d hardly be a full-blown break in the labor market.

Let’s say they’re wrong and mortgage rates fall more than expected. What happens?

- There’s a potential wildcard—an economic slowdown. If joblessness were to climb faster than anticipated or if the economy were to meaningfully deteriorate, that could put additional downward pressure on both Treasury yields and mortgage rates. In that scenario, mortgage rates could dip more than the baseline forecasts suggest.

- The “mortgage spread” represents the difference between the 10-year Treasury yield and the average 30-year fixed mortgage rate. Last week, the spread stood at 218 basis points. If the spread—which widened when mortgage rates spiked in 2022—continues to compress/normalize toward its long-term average since 1972 (176 basis points), it could help push mortgage rates lower, even if Treasury yields hold steady.

One last thing: Mortgage rate forecasts should always be taken with a grain of salt, at least to some degree. Predicting long-term yields depends on accurately anticipating inflation, Federal Reserve policy, and the broader trajectory of the U.S. and global economies—all of which are notoriously hard to get right.

Over just the past five years, forecasters have been caught off guard by a pandemic, a historic inflation spike, and one of the fastest rate-hiking cycles in modern history. The lesson? Even the best models can’t account for every shock. Mortgage rate forecasts are useful guideposts but not guarantees.