Data shows that pricey vehicles aren’t swaying customers

It’s hardly news that shoppers are paying more than ever for their cars. However, it seems that instead of cutting back, more shoppers than ever are taking on payments that might make financial advisors wince. According to data published by Experian in its Q2 2025 State of the Automotive Finance Market report, drivers are getting even more cozy with the idea of paying $1,000 or more per month. More loans and leases were above the $1,000 mark in Q2 2025 than in the preceding quarter among new and used vehicles.

Experian

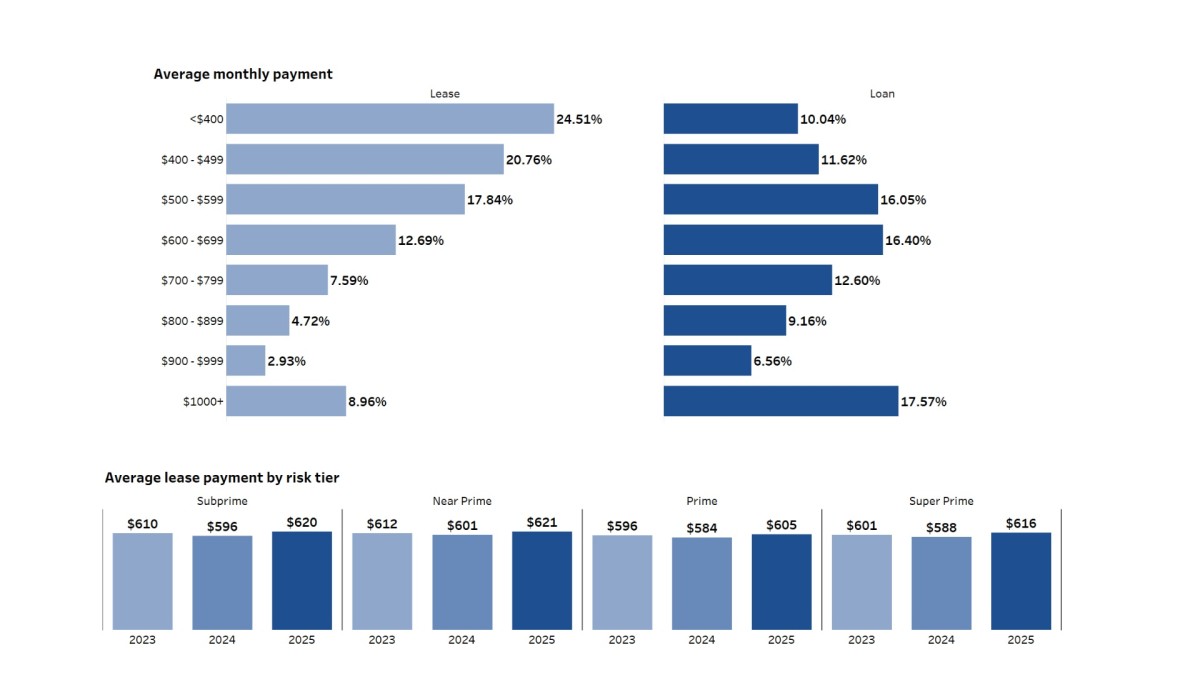

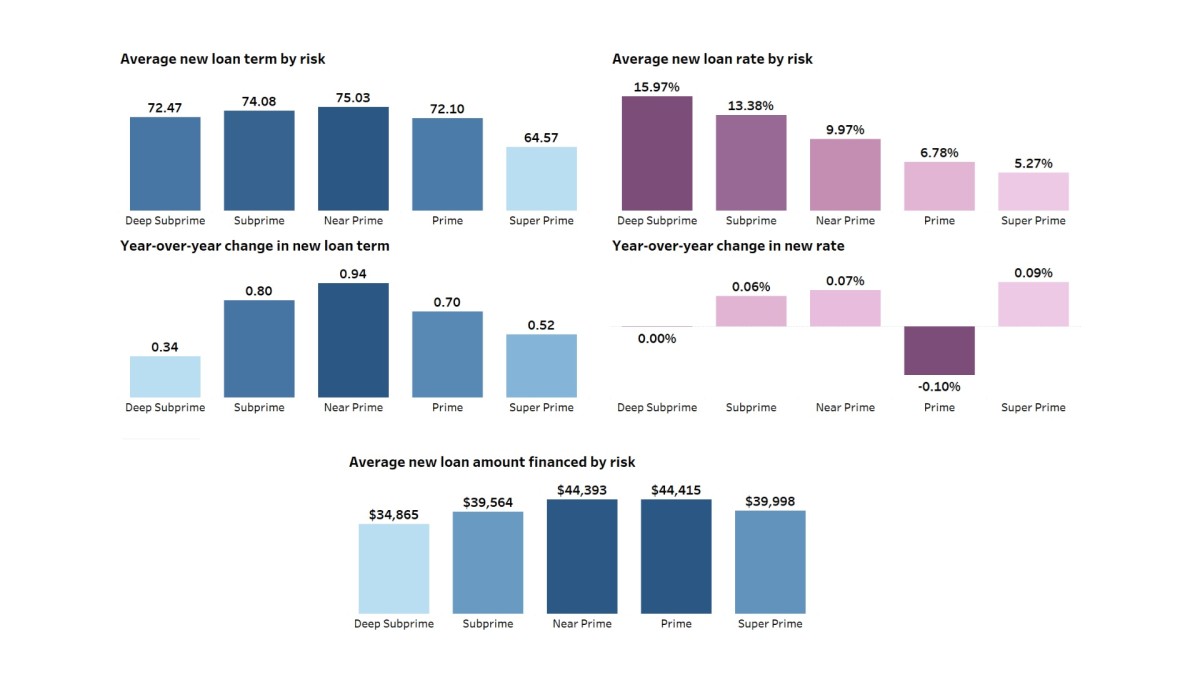

Increasing from 14.5% in Q1 2025, Q2 sees over 15% of all new car payments exceeding $1,000. While 8.96% of leases are over $1,000 per month, a whopping 17.57% of all drivers choosing to finance a car are paying $1,000 or more per month. That’s an increase of around half a percentage point from last quarter. Average lease payments also climbed by around $20 per month across all credit profiles year-over-year. Drivers choosing to finance, meanwhile, saw a much less consistent rise in payment. New payments rose by between $32 and $7, with the highest changes coming to subprime and near-prime shoppers. Total loan amounts increased year-over-year, too, with the same credit profiles seeing the biggest rise of $1,735 and $2,016, respectively. The average new loan payment was highest among near-prime shoppers, at $795 per month.

Experian

There is some mixed news regarding terms and rates, however. On the one hand, rates on average decreased year-over-year for prime customers. The average rate for a prime customer was 6.78%, which is a tenth of a percentage point lower than it was last year. Every other risk profile saw even less deviance, essentially remaining flat. However, new loan terms grew again year-over-year, with subprime, near prime, and prime groups adding nearly a full month to the average. All credit profiles saw an average loan exceeding 72 months, except super prime, which was still nearly 65 months. Importantly, averages are being driven up by growth occurring at the top end of the spectrum, specifically the 73+ month loan terms. This year has seen an increase in 73+ month loans, even surpassing a previous high set in 2023.

Interestingly, Q2 2024 actually saw a dip in lease payment relative to 2023, but Q2 2025 numbers now exceed those figures. For example, in subprime lending, the average lease payment in 2023 was $610, while in 2024 it fell to $596. As of this writing, Experian’s data shows the average subprime lease payment is now $620. The changes are relatively consistent across all risk segments, with super prime (top score) borrowers experiencing the highest increase ($588 in 2024 to $616 in 2025, a difference of $28). The average lease payment was highest among near-prime shoppers, at $621 monthly.

Used vehicles don’t seem to cost much less these days

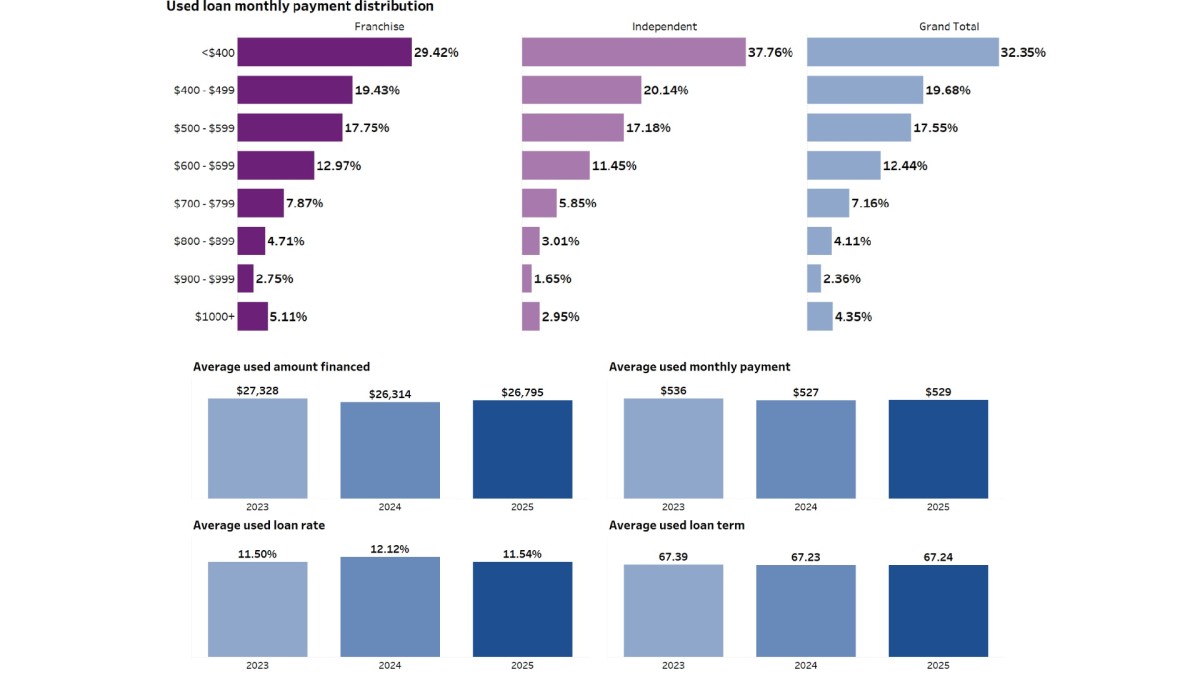

Turned off by pricey new cars and mostly unattractive finance offerings? Your first alternative will likely be the used market. While rates on the whole fell slightly, Experian’s data still claims the average used car loan is financed at a dismal 11.54%, with the average amount financed being $26,795. Both numbers are lower than those in 2023, but higher than last year. The average used vehicle’s loan term is 67 months — the same as it’s been since at least 2023 — and the average payment is $529 per month. However, in total, 4.35% of all used car loans reported monthly payments of $1,000 or more, with just 32.35% being under $400. Prime lending saw the only decrease year-over-year in average monthly payment, with a modest $2 drop. Nearly 70% of used car loans are longer than 61 months.

Experian

Actually paying for the car? That’s a different story

If you’re finding some of these figures a little eye-popping, well, you’re not alone. Refinancing volume has essentially skyrocketed; Experian reports an 11% volume increase from Q1 and a 29% increase from this time five years ago. The $3.6 billion in refinancing customers opted for in Q2 2025 inches closer to the numbers we saw throughout 2021 and 2022, when rates were at record lows. Credit profiles in the prime risk category account for over half of all refinancing. While the average refinancing term remains mostly static at around 65 months, it brings the effective term to over 90 months. Delinquencies — the number of loans and leases past due — remain high, increasing to 2.32% up from 2.28% in Q4 2024.

Final thoughts

It’s a lot of data to take in, but there’s a pretty clear message to extrapolate here: cars are more expensive than ever. Super prime customers can, by and large, afford it, while the growing delinquencies and increasing loan terms paint a picture that pretty much everyone else is struggling but doing it anyway. Just like zero to 60 mph used to be a significantly more meaningful metric than it is today, so too is the $1,000 monthly payment. It’s also important to note that $1,000 payments are still clearly a minority — thankfully. But for how much longer remains to be seen.