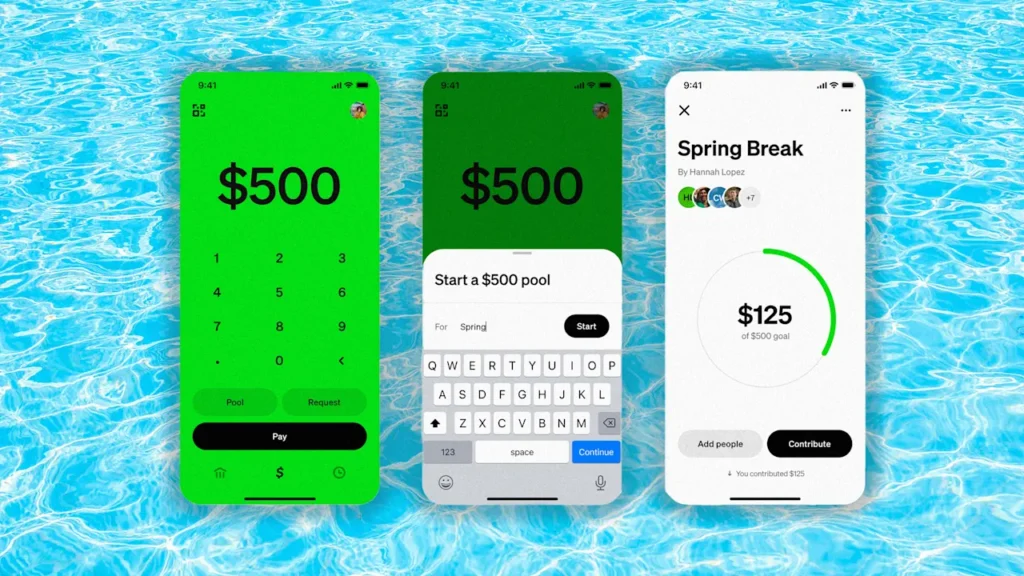

Cash App wants you to take a dip into its newest feature: Pools.

The company announced the launch of a new “pools” feature Tuesday, which allows users to—you guessed it—pool their money and make group payments. For instance, it can be used to pay for a dinner with friends, a vacation, or even to collect money for a birthday or wedding gift.

Owen Jennings, Business Lead at Block, Cash App’s parent company, says that implementing pools was something of a no-brainer, since they were able to simply look at how their users were utilizing the app, and create a new feature to facilitate the behavior the Cash App team was seeing.

“It’s really, really common behavior, we see more than half of our customers engaging in pooling behavior,” he says of Cash App users sending money to each other to pay for a single, larger expense. “To some extent, we’ve just built something that’s custom for this specific use-case.”

Jennings adds that what he’s particularly excited about, in terms of pools, is that “for the first time, we’re allowing out-of-network contributions,” which means some users don’t even need to have Cash App in order to participate. In those cases, their friends can send them a link to a Cash App pool, and the out-of-network participants can use Apple Pay or Google Pay to contribute.

While pools is an active feature for a subset of Cash App users currently, there is a wider rollout planned for the coming months.

Jennings also mentions that launching new features and products, such as pools, is the primary way that Cash App, and Block at large, have grown its customer base and deepened engagement with current customers. “Folks typically come in because of our peer-to-peer features,” he says, “and increasingly attach to additional features.” In that sense, the company is seeing a payoff.

Block—which was founded by CEO Jack Dorsey (perhaps most well-known for founding Twitter) in 2009 and is also the parent company of Square, Afterpay, TIDAL, Proto, and Bitkey—has grown enough to become the latest entrant into the S&P 500. Investors evidently liked that news, too, because the company’s stock has popped recently—shares are up nearly 24% over the past month, as of writing.