Beyond the Brushstroke: Art as the Ultimate Alternative Investment

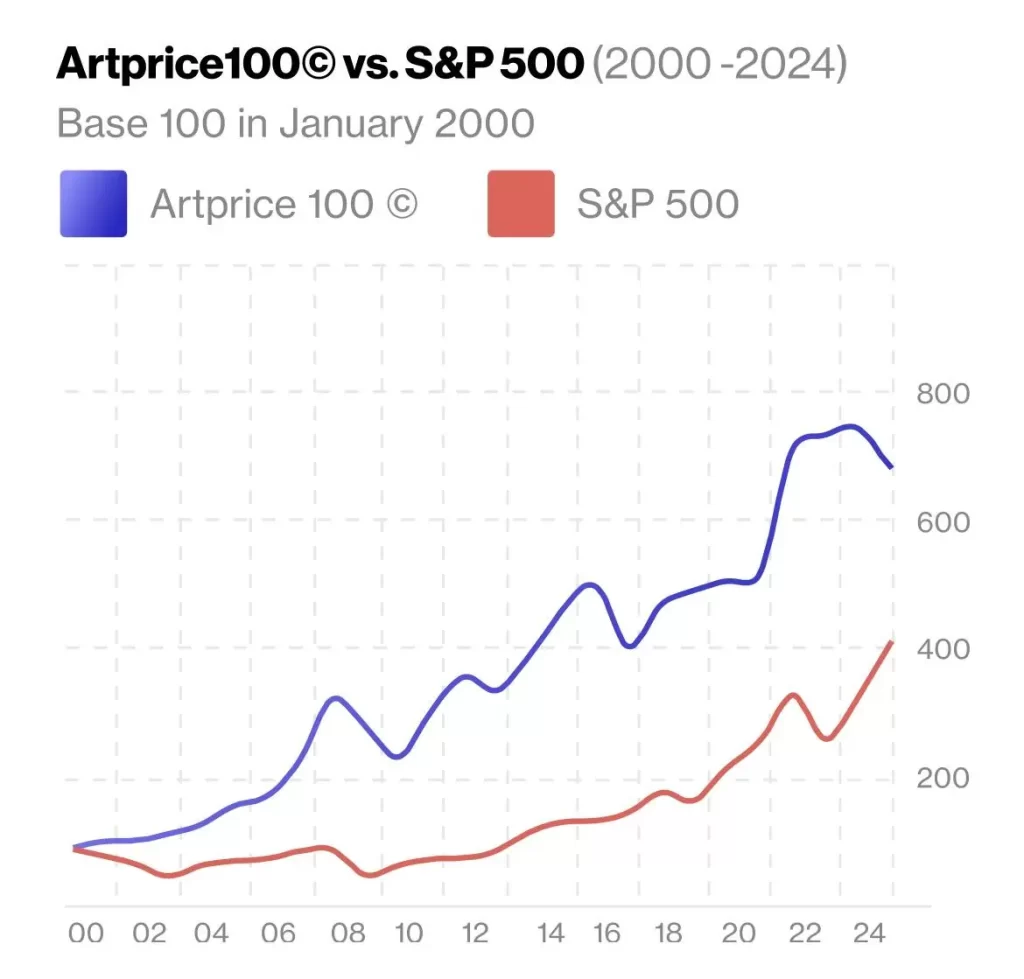

Art does not only have value as a decorative element on a wall. It is also a valuable investment tool, unlike the volatile stock market, which fluctuates wildly. The art market has generally remained consistent in terms of its long-term growth. The disconnection between both makes it a great investment choice for investors who want to diversify their portfolios when the stock market is having difficulties. When the stock market experiences a downturn, usually the value of artworks does not drop as sharply, and therefore, the price of artworks can be used to provide a cushion in an investor’s portfolio while everything else feels uncertain.

If you can relate to an individual in your life who remains unencumbered by all that is happening around them and consistently brings something positive, then consider the art world as a similar opportunity for your portfolio.

Pleasure and Investment

Art also behaves differently than stocks and bonds, in the sense that no regular monthly or quarterly income can be generated, nor is there going to be any frequent “noise” that will reflect that it is being traded frequently. However, art can help to reduce the overall portfolio risk. Investors tend to overlook the utility of asset classes simply on their ability to provide a different return; the value will simply be seen as potentially benefiting the investor as an asset that has less daily volatility, or, in this case, through “art,” it has some aesthetic enjoyment. Once the art begins to gain appreciation, the investor obtains the aesthetic enjoyment of the art as they hold it. No investment fund has yet been able to accomplish that!

In the art business, what drives returns is often the uncertainty. However, after all the ups and downs in the art market, over time, it appears that, on average, art investments have outperformed both gold and bonds as safe havens.

Long-term credibility

Although not as good a performer as equities, the long-term success of art relative to other haven investments and all of the studies on collectible investments, such as classic cars and fine wine, indicate substantial long-term appreciation for these asset classes. Art is still in good company as a collectible asset class, as some analytic models indicate that art significantly contributes to portfolio diversification and stability when combined with other assets.

Additionally, various models show that including even a small percentage of collectibles, including art, in an investment portfolio can significantly decrease risk for the entire portfolio. Because of these characteristics, a combination of investment in a collectible asset, such as art, along with investment in traditional asset classes, is often an attractive investment opportunity for an investor who enjoys both passion and prudence.

Current market scenario

It is very thrilling to see how drastically investing in artwork has changed; you do not have to own a mansion, a private gallery, or even a trust fund to buy into the art market. With the arrival of modern art funds, fractional ownership platforms, and tokenised art, more and more people have easy access to buying art. You can now purchase a small piece of a high-value painting without needing to be extremely wealthy.

The operation of these funds closely resembles pooled investment vehicles, where managers strategically make purchases and hold for an extended time frame before they ultimately sell the art assets; additionally, fractional ownership platforms allow everyday people to buy small stakes in very valuable works of art previously confined to vaults and museums.

There has been an influx of innovation that brings new life and excitement to the art marketplace by creating new opportunities for both purchase and ownership of extremely valuable pieces that would have otherwise remained inaccessible.

Returns and culture

The performance of art investment platforms can differ greatly. There are some that are producing strong annualised returns for certain collections, while others highlight the early-stage nature of the entire space. Liquidity continues to improve, transparency is increasing, and the regulatory environment is beginning to catch up to the industry as well. However, the industry is still going through a significant maturing process. Most investors who have entered these platforms are aware that this will take time and commitment to see a potential return on their investment.

Another aspect of art investing that numbers don’t really express as well is that some collectors and/or artists have created a legacy through their collections. Many collectors and/or artists use the power of their portfolios in the form of foundations, grants, and community programmes. Others donate their pieces to museums or lend their works to exhibitions and education programmes. A painting that was purchased 20 years ago could end up funding scholarships, helping shape collections of museums, or inspiring future generations. As such, art has become much more than an alternative form of investment; it is also a cultural legacy.

Conclusion

The combination of art’s financial value, emotional satisfaction, and contribution to society is a very attractive investment for many investors, as it can give them the opportunity to earn much greater returns than they could otherwise earn on their equity portfolios. Although art, historically, will not meet or exceed an investor’s real investment return in terms of dollar size, it will provide many other benefits for an investor. An additional value of art is that it can bring joy, meaning, and legacy to life all over again through an investor’s Dividend Income (DI) from the sale of their art.

Art has become a very important investment category, especially as it allows both investment profit and enjoyment for an investor and can enable an investor to build a much more complete legacy for themselves.

Written by – Deshna Doshi

Edited by – Anjali Khimasiya

The post Beyond the Brushstroke: Art as the Ultimate Alternative Investment appeared first on The Economic Transcript.