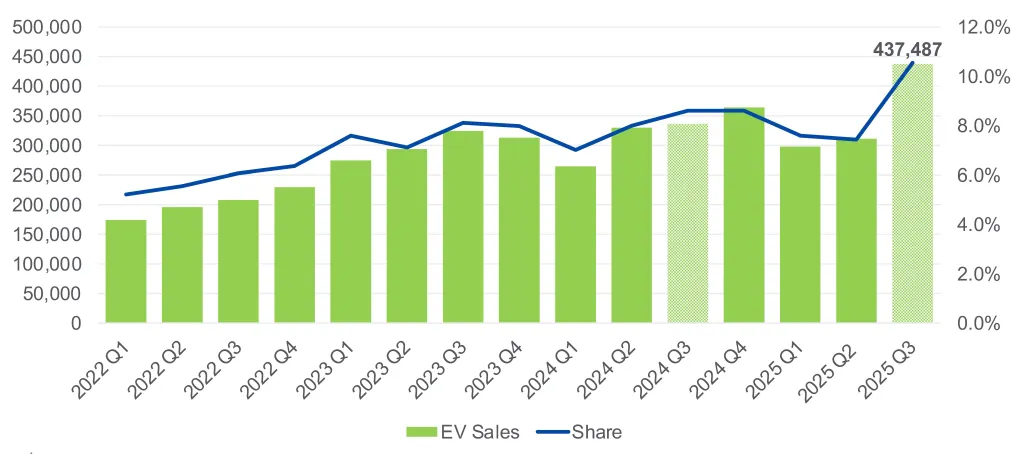

- A total of 437,487 EVs were sold in the US during Q3 2025.

- Topping the charts were the Tesla Model Y and Model 3.

- Other strong sellers included the Ioniq 5 and the Prologue.

Final sales results for the third quarter are now in, closing one of the most closely watched reporting periods the electric vehicle market has seen in recent years. No doubt, the Trump administration’s move to scrap the federal EV tax credit sparked a final buying spree that sent sales figures sharply upward.

Unsurprisingly, two familiar Tesla models held a commanding lead, but several other notable models experienced significant demand spikes.

How Big Was the Jump?

According to Kelley Blue Book data, U.S. EV sales hit an all-time quarterly high of 438,487 units, up 40.7 percent from Q2 and 29.6 percent higher year over year, surpassing the previous record from Q4 2024 by nearly 20 percent.

Electric vehicles also claimed a record 10.5 percent share of total vehicle sales, up from 8.6 percent in the same period last year.

Read: Federal Deadline Turns EV Into One Of VW’s Hottest Sellers

The Tesla Model Y was still comfortably the most popular EV in the United States, as 114,897 were sold during the period, a 29 percent increase from 89,077 delivered last year. Even so, Tesla’s overall market share slipped to 41 percent from 49 percent a year ago.

In second place was another Tesla, the Model 3, at 53,857 units. That result was actually down 7.8 percent year over year, suggesting some buyers may have shifted their attention toward the updated Model Y.

Top 10 Best-Selling EVs In Q3 2025

SWIPE

What About Non-Tesla Models?

The first non-Tesla entrant on the best-sellers list was the Chevrolet Equinox EV. A total of 25,085 were sold, a huge 156.7 percent rise from 9,772.

Positioned not far behind it were the Hyundai Ioniq 5 with 21,999 sales, the Honda Prologue with 20,236 sales, and the Ford Mustang Mach-E with 20,177 sales. The VW ID.4 was also a strong performer for the quarter, with 12,470 units, a 176 percent increase from Q3 2024.

A surprise inclusion among the best-sellers was the Audi Q6 e-tron. A total of 10,299 SUVs were sold during the quarter, an impressive result considering that model’s premium positioning that allowed it to outsell the Ford F-150 Lightning (10,005 units).

Other strong performers included the Rivian R1S with 8,184 sales, the Chevrolet Blazer EV (8,089), the Kia EV9 (7,510), and the Cadillac Lyriq, of which 7,309 found new homes.

Still, fewer than 10 models managed to exceed 10,000 sales in Q3 2025, underscoring how top-heavy the market remains. For most automakers, EV volume remains well below the levels needed for profitability.

The Best Sellers YTD

Year-to-date figures show total U.S. EV sales surpassed 1.04 million units, up 11.7 percent from about 935,000 a year earlier.

Tesla continued to lead with 451,160 units, down 4.3 percent year over year but still holding a 41 percent market share. Chevrolet followed in second place with 87,137 units, a 113 percent jump, while Ford ranked third with 69,600 (+2.8%) and Hyundai came in fourth at 57,167 (+31.1%).

Among individual models, the Tesla Model Y led the way with 265,085 units, down 8 percent year over year, followed by the Model 3 at 155,180, up 18 percent. Chevrolet’s Equinox EV climbed into third place with 52,834 sales, a massive 390 percent surge.

Ford’s Mustang Mach-E posted 41,962, the Hyundai Ioniq 5 reached 41,091, and the Honda Prologue recorded 36,553. Tesla’s Cybertruck ranked seventh at 25,973, edging out the Ford F-150 Lightning’s 23,034 and Volkswagen’s ID.4 at 22,125. The Chevrolet Blazer EV closed the top ten with 20,825 units.

What Happens Next

With federal incentives now expired, analysts expect a cooldown. “The training wheels are coming off,” said Cox Automotive’s Director of Industry Insights, Stephanie Valdez Streaty. “The federal tax credit was a key catalyst for EV adoption, and its expiration marks a pivotal moment.”

Cox Automotive projects a temporary dip in EV sales through late 2025 and early 2026 before growth steadies again over the long term.

John Halas contributed to this story.

BEST SELLING EVs JAN-SEP 2025

SWIPE

EV BRAND SALES USA 2025

EV MODEL SALES USA 2025

Cox Automotive