The latest investigation from the Organized Crime and Corruption Reporting Project landed like a quiet indictment of Washington’s complacency.

Reporters traced over $100 million in U.S. real estate to the sons of Iraqi-Kurdish leader Masoud Barzani. The properties were held through shell companies named after Pirates of the Caribbean characters, financed by offshore accounts and serviced by a Delaware lawyer who paid household bills and luxury purchases through “administrative” accounts.

No one has been charged with a crime — and that is the point. Because every element of the scheme — lawyers forming entities, trusts masking ownership, cash real-estate deals with no financing — largely falls outside U.S. anti-money-laundering law.

The U.S. still exempts lawyers, accountants and real-estate professionals from the Bank Secrecy Act. They are not required to identify clients, monitor transactions or file suspicious-activity reports. They can move millions through limited-liability companies, administer offshore trusts or close cash real-estate deals, all while remaining invisible to regulators.

This isn’t an oversight. It’s deliberate. Every Financial Action Task Force evaluation since 2006 has flagged this as a major deficiency. Nothing has changed.

So while the world’s largest economy lectures others on transparency, it still allows foreign political elites to buy U.S. property anonymously, with lawyers and title agents acting as intermediaries who bear no substantial anti-money laundering obligations. That’s exactly how the Barzani purchases happened. The U.S. didn’t miss them — it just never required anyone to look.

Across the Pacific, regulators are moving the opposite direction. In a recent conversation, Australian Transaction Reports and Analysis Center CEO Brendan Thomas told me, “Strengthening oversight of professional service sectors — including lawyers, accountants and real estate professionals — is a major priority for Australia. These sectors are being actively exploited by organized crime, particularly in the real estate market. Without regulatory control, the risks only grow.”

Australia’s tranche 2 reforms will finally bring lawyers, accountants and real-estate agents under anti-money laundering supervision. It took years of debate, but the rationale is simple: These are the gatekeepers, the professionals who open access to the financial system. When they’re unregulated, organized crime and foreign kleptocrats exploit them.

The irony is that Australia is closing the very loopholes the U.S. continues to defend. Even worse, Washington isn’t just standing still: It’s going backward. In the span of months, three pillars of America’s financial-crime architecture were either suspended, delayed or gutted.

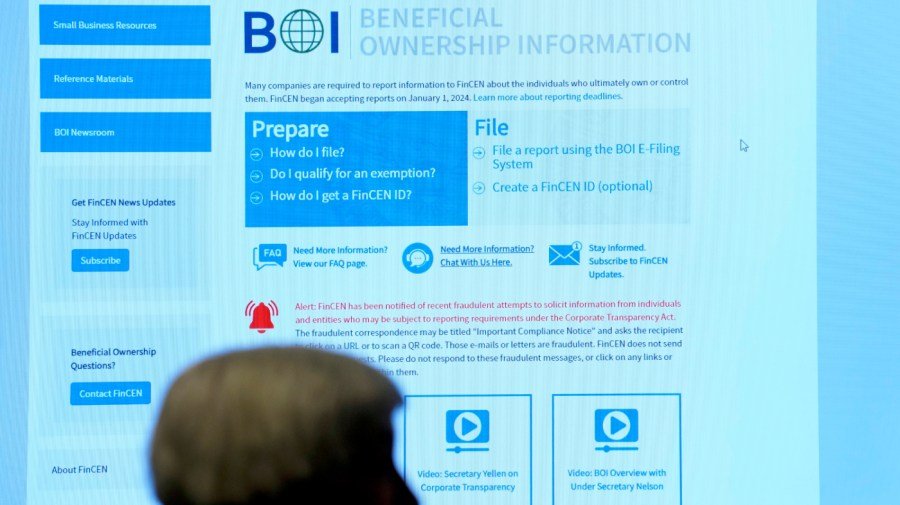

The Corporate Transparency Act, intended to expose shell-company owners, was hollowed out by exemptions that removed most domestic firms from reporting. The Investment Adviser AML Rule, which would have covered hedge funds and private-equity managers overseeing trillions in assets, was postponed until 2028. The Foreign Corrupt Practices Act, long the backbone of global anti-bribery enforcement, was effectively curtailed after the Justice Department narrowed eligibility for prosecution.

Each rollback reopened channels that criminal networks and politically exposed persons have used for decades. Together, they signaled a retreat from the post-9/11 consensus that financial integrity is national security. And yet Washington continues to insist that other nations “do more.”

When you pair deregulation with impunity, you get exactly what the Organized Crime and Corruption Reporting Project uncovered: opaque wealth moving freely through law firms, corporate service providers and real-estate markets with no questions asked.

This isn’t theoretical. Every dollar entering those channels is a compliance blind spot. Lawyers can act as escrow agents. Title companies can finalize transactions for anonymous LLCs. Accountants can layer funds through trust accounts. None have a legal duty to file a suspicious-activity report.

For a foreign official or organized-crime figure, the U.S. remains the one of the easiest high-end laundering destinations on Earth, as one of the last major jurisdictions where professional gatekeepers operate in the dark. And it’s getting easier.

That’s not leadership. It’s exposure. And it undermines every sanction, asset-seizure and corruption initiative Washington claims to champion. You can’t preach transparency to Moscow, Beijing or Dubai while leaving Delaware, Florida and California wide open.

The Barzani case is not an anomaly. It’s the case study of a system built to look the other way. If $100 million can move through U.S. lawyers and title companies for politically connected foreign families, then the framework itself is broken.

Australia’s reforms show what accountability looks like: Regulate the gatekeepers, close the real-estate loopholes and make professional facilitators subject to the same anti-money laundering standards as banks.

The next Financial Action Task Force evaluation of the United States is scheduled for 2026. And when that happens, it won’t just be a reputational embarrassment. It will be an invitation for criminals, sanctioned actors and corrupt officials to keep using America’s blind spots as their vault.

Australia is closing the loopholes. The U.S. is reopening them. And every time we weaken the guardrails meant to protect the financial system, we don’t just invite corruption — we authorize it.

Brett Erickson is the managing principal at Obsidian Risk Advisors and an advisory board member of the Seton Hall School of Diplomacy and International Relations, DePaul University Driehaus College of Business and Loyola University Chicago School of Law Center for Compliance Studies.