At the center of Audi’s plan is Edge Cloud 4 Production, a factory computing approach that links shop-floor automation with cloud flexibility. Audi says it is moving worker guidance and other production systems into the cloud, reducing the need for on-site industrial PCs and simplifying updates, maintenance, and cybersecurity.

In high-volume body shop operations, Audi says cloud-controlled systems can run robots and production cells with millisecond-level coordination, replacing localized hardware controllers with virtual versions that can be updated more quickly.

Where Audi Is Using AI Right Now

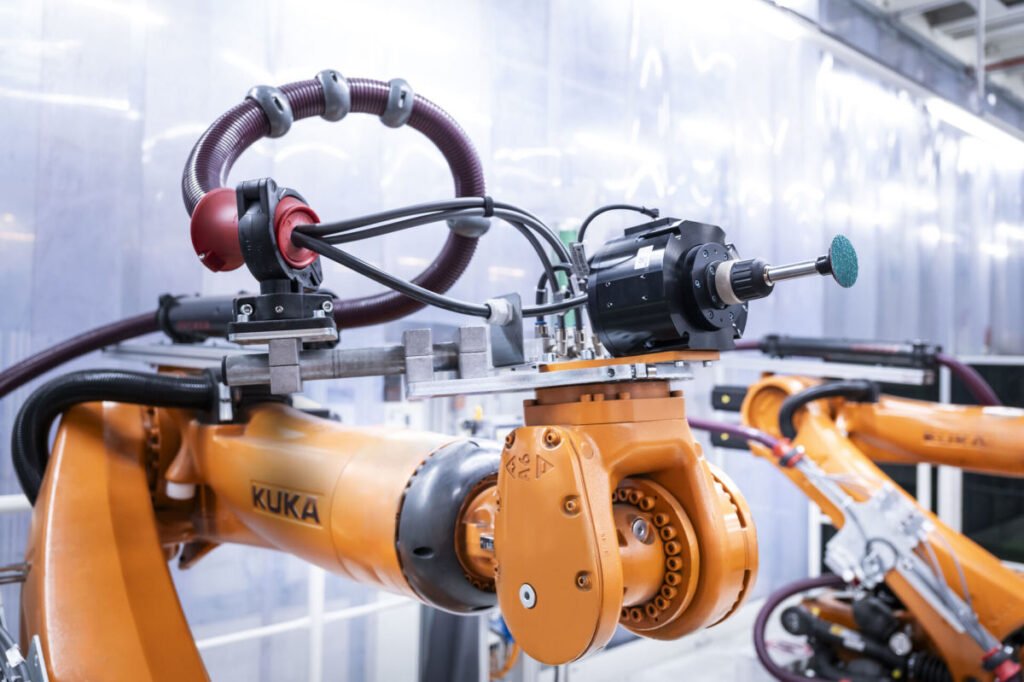

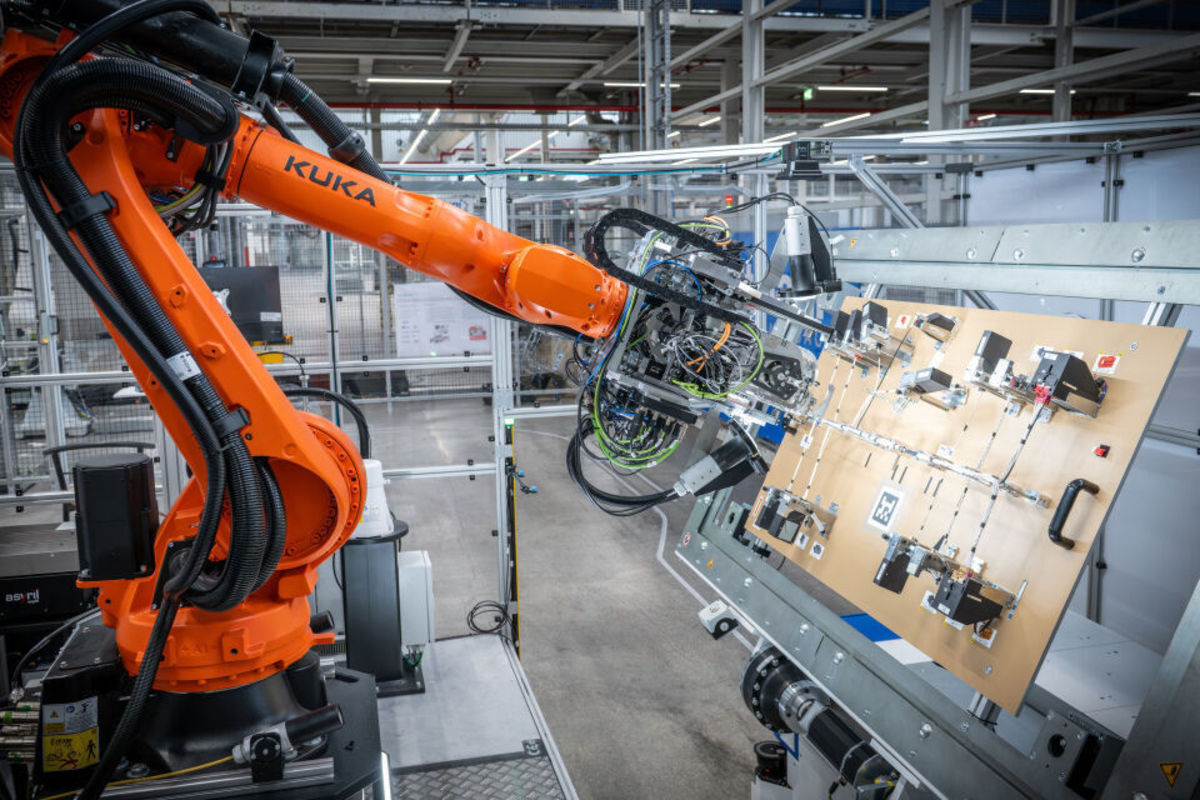

Audi highlighted several AI applications that are either already in use or nearing series rollout. One is weld splatter detection, which identifies weld residue on underbodies and marks it for removal, with a robot now taking over the grinding work after a system upgrade. Audi says this approach is being expanded as part of a broader Volkswagen Group rollout and is planned for series production at multiple locations.

Another is ProcessGuardAIn, a modular monitoring system that uses plant and process data to detect anomalies early and alert experts before defects propagate. Audi says it is testing the system in paint shop processes such as pretreatment dosing and cathodic dip coating, and that series introduction is planned for the second quarter of 2026. The company also describes AI-supported dryer control in the paint shop as an energy-focused use case, with testing continuing into the summer, and it points to wiring harness automation work intended to shorten changeover times and improve repeatability in a part of the industry that is still largely manual.

Why This Matters For Audi’s Business

Manufacturing efficiency is becoming a competitive lever as automakers face slower demand in some markets and tighter margins in electrification transition years. Audi’s production AI push lands while the brand is also navigating sales pressure. Faster quality detection and lower rework rates are not glamorous, but they can protect profit per vehicle and reduce warranty exposure, especially as vehicles become more software-defined and production complexity increases.

On the product side, the brand is still debating how much technology is too much. In the factory, though, Audi is leaning in hard on software and data, treating AI as infrastructure rather than a customer-facing feature. The global production network angle matters too. Audi builds across multiple countries and relies heavily on overseas plants to supply key markets, including the United States, which shapes cost and logistics realities in a way that connects to questions like why they still don’t have a U.S. factory.

![1,110-HP Genesis X Skorpio Concept Is A V8-Powered Off-Road Coupe That Should Take On Dakar, And Genesis Will Sell You One [Update]](https://usatimes247.com/wp-content/uploads/2026/01/l-intro-1769634616-pUCzCK-768x432.jpg)