[Disclosure: AgFunderNews’ parent company is AgFunder.]

Farm management and precision ag software startups led agrifoodtech funding in Q3 2025, thanks largely to a few big deals, including the $100 million raise from virtual fencing startup Halter.

New Zealand-based Halter makes “smart collars” for livestock that ranchers can use to manage herds instead of building physical fencing infrastructure. It wasn’t the only virtual fencing company to turn heads last quarter: Nofence, which has developed a similar system, closed a $35 million round shortly after Halter’s.

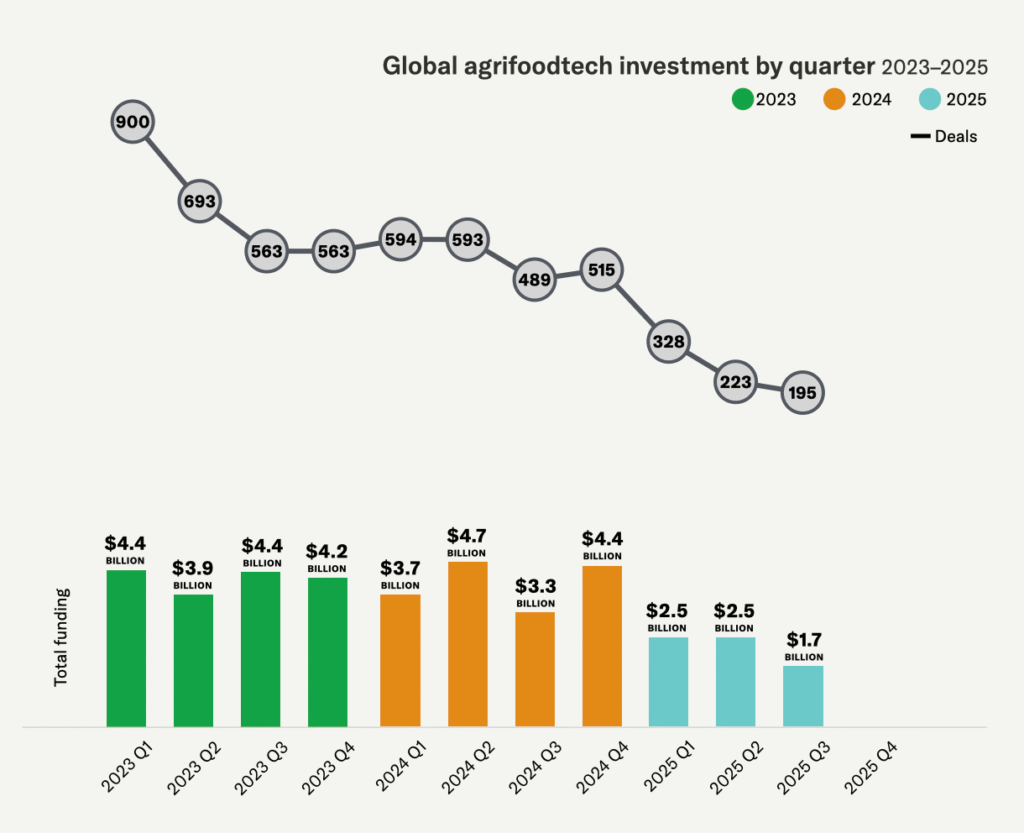

Those were two in a handful of bright glimmers against an otherwise-gloomy funding backdrop for agrifoodtech. Investment numbers across categories are still falling, dropping another 32% to $1.7 billion in the third quarter of 2025 compared to Q2 2025, according to preliminary data from AgFunder. The drop is almost a 50% decrease from the Q3 2024.

Deal count is also down, with just 195 deals so far in 2025 across all categories—nearly flat compared to the previous quarter but substantially down when stacked against previous years.

Virtual fencing, feed management lead funding

Farm Management Software, Sensing hasn’t been a leading investment category over the last few years, as Ag Biotech, Bioenergy & Biomaterials, and Innovative Food tend to outshine precision ag.

As noted above, the category’s lead is thanks to a handful of larger rounds, two of which went to virtual fencing startups.

Outside of those, feed management platform BinSentry raised $50 million from Lead Edge Capital and others, and geospatial intelligence company EarthDaily closed a $60 million round from Trinity Capital.

Absent those top four rounds, the Farm Mgmt SW, Sensing category would land much closer to the bottom of the list agrifoodtech’s best-funded areas.

Other categories saw similar boosts thanks to a few big deals. For example, Colombian food delivery giant Rappi and autonomous delivery startup Nuro each raised ~$100 million rounds in Q3, bumping the Cloud Retail Infrastructure category into second place.

Innovative Food finally getting innovative?

Innovative Food—which includes the much-maligned alt protein sector—rose to fourth place after a couple consecutive quarters low in investment.

While small compared to outlier years such as 2021 and 2022, Q3 2025 funding to the category nonetheless grew 42% from the previous quarter, clocking in at $165 million.

Top rounds for the category went to startups focused on fungi, egg replacements, and mycoprotein. Many of these companies work behind the scenes, so to speak, supplying ingredients, technologies, or both to other food companies, rather than being directly consumer facing.

The Protein Brewery, which raised $35 million in Q3, is growing fungi in fermentation tanks to supply a wide range of uses, not just meat analogs. Likewise, Revyve, which focuses on egg replacements, makes products for use across different food categories, from baked goods to alt meats and other processed ingredients; the company raised $28 million last quarter.

The Better Meat Co, which raised $31 million, now supplies its Rhiza protein to more than just alt meat applications, also dabbling in flour and dairy alternatives as potential use cases.

A scan of the remaining top-funded companies for Innovative Foods suggests a similar focus on versatile ingredients rather than plant-based nuggets and lab-made meats. Which is to say, the Innovative Foods category might actually be starting to live up to its name.

The post Agrifoodtech funding down 32% in Q3 but propped up by livestock management deals appeared first on AgFunderNews.