The Federal Reserve cut interest rates Wednesday for the first time this year as the central bank attempts to ease pressure on the weakening U.S. job market.

The Federal Open Market Committee (FOMC) — the panel of Fed officials responsible for setting borrowing costs — cut its baseline interest rate to a range between 4 percent and 4.25 percent, a reduction of 0.25 percentage points.

Analysts and traders widely expected the Fed to cut interest rates Wednesday after several months of alarming employment data and unprecedented pressure from President Trump, who has sought to remove members of the Fed’s board.

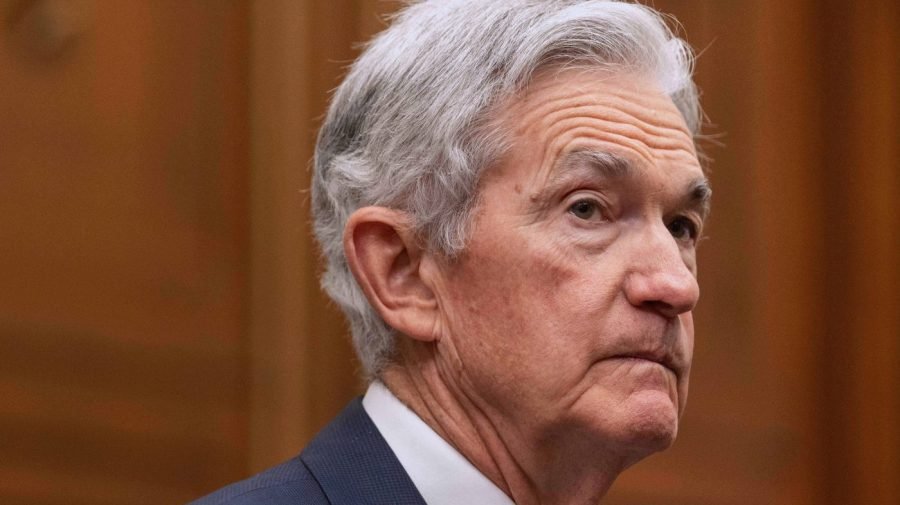

While Federal Reserve Chair Jerome Powell, the main subject of Trump’s pressure campaign, had previously said he was wary of cutting rates until the inflationary effect of Trump’s tariffs sorted out, the fading U.S. labor market pushed the Fed to risk its progress in the fight against rising prices.

“Even if inflation remains high … Powell seemed to be willing to give that the benefit of the doubt and, instead, focus on the risk that any incipient weakness in the labor market might gain momentum and prove harder to arrest over time,” economists at LHMeyer/Monetary Policy Analytics wrote in an analysis.

The unemployment rate has ticked higher throughout 2025 as the economy adds far fewer jobs each month than necessary to keep it stable. Steep revisions to previous employment reports also revealed the economy to be much weaker than it seemed heading into the year.

The Fed had held off on cutting rates for months as Trump’s tariffs shook the global economy and spurred prices higher. Consumer prices are up 2.9 percent over the past year as of August, according to the consumer price index, higher than before the election and well above the Fed’s 2 percent target for inflation.

The Fed also faced growing divisions among top officials, with some arguing the inflationary impact of tariffs had come and gone.

Fed Gov. Christopher Waller and Vice Chair of Supervision Michelle Bowman, two Trump additions to the Fed, both voted to cut interest rates in July, bucking other Fed colleagues. Their dissent marked the first time in more than 30 years that two Fed board members voted against the majority.

Trump’s growing pressure on the Fed

Trump and top administration officials have berated Powell and his colleagues for months over their unwillingness to cut interest rates.

The president frequently accused Powell — a lifelong Republican who was first appointed to his position by Trump — of waging a political battle against his trade policy. Trump also claimed the Fed should help him reduce the costs of paying down the national debt through lower interest rates, triggering alarm among fiscal experts and Fed historians.

While Trump eventually relented on his threats to fire Powell, he has sought to reshape the Fed board in his image through several other controversial means.

Trump is attempting to fire Fed Gov. Lisa Cook, whom the administration has accused of mortgage fraud based on documents filed with the Federal Housing Finance Agency.

At the center of the legal battle is whether the accusations of mortgage fraud, which have not resulted in any federal charges, are enough to overcome the Federal Reserve Act’s strict protections for Fed board members.

Trump also successfully installed Stephen Miran, his former top White House economist, on the Fed board as the FOMC meeting began Tuesday.

Victory for Trump, but at what cost?

While the Fed’s rate cut may appear to be a victory for Trump, the scale of the change to borrowing costs pales in comparison to the message of concern it sends about the economy.

The 0.25-percentage point cut is the typical size of Fed rate adjustments, but far smaller than the crisis-level cuts sought by Trump, who accused the bank of strangling an otherwise strong economy with high interest rates.

Powell, however, said earlier this year that the Fed would have been able to continue cutting rates — as it did in 2024 — if not for the disruption caused by Trump’s tariffs. Several other Fed officials said before the meeting they remain concerned that the Fed’s rate cuts could fuel higher prices caused by tariffs, even as the job market weakens.

“Several members have said they are unsure how they will vote and that they still worry about the risk the tariffs will have a lasting impact on inflation,” wrote Samuel Tombs and Oliver Allen of Pantheon Macroeconomics in a Tuesday preview of the FOMC meeting, citing recent inflation data showing price growth stalling.

Fed officials also project far weaker economic growth and higher unemployment than they did earlier this year, according to projections released Wednesday.