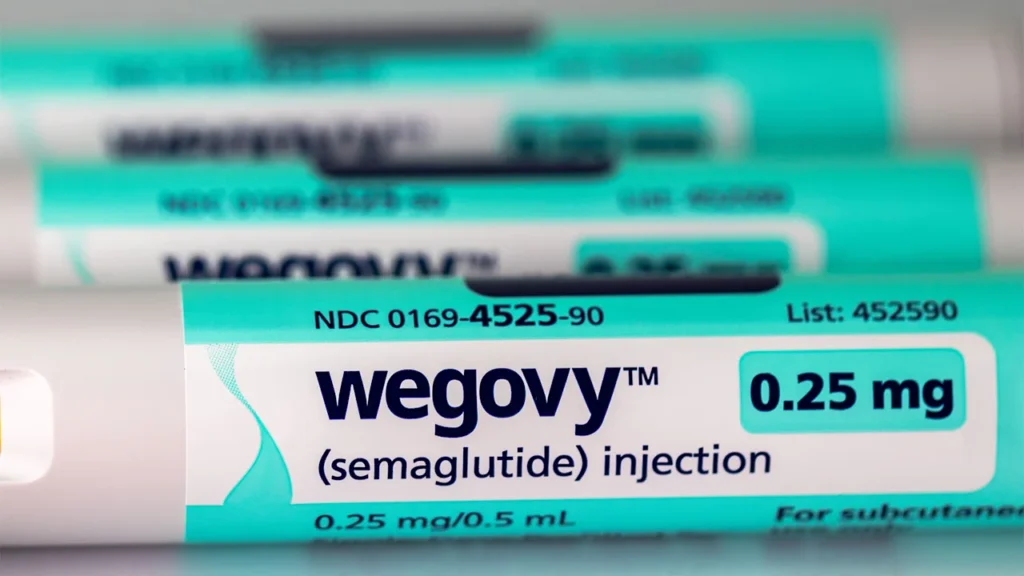

In Novo Nordisk’s legal fight against dozens of U.S. pharmacies and companies selling cheaper copies of its weight-loss drug Wegovy, one name remains conspicuously absent: Hims & Hers. The high-profile telehealth company continues to sell compounded versions of Wegovy at lower prices, testing the limits of federal restrictions on such copies and contributing to weaker sales growth for Novo.

In June, Novo accused Hims of violating its intellectual property and endangering patients, scrapping a brief arrangement enabling them to sell Wegovy directly to consumers and raising expectations of litigation.

A Novo spokesperson said the Danish drugmaker was not ruling out further legal action after announcing new lawsuits against 14 small pharmacies, telehealth providers and weight-loss clinics this week, but declined to comment on Hims. The drugmaker has filed more than 130 cases in 40 U.S. states.

A spokesperson for Hims defended personalization of medicines as the future of healthcare, saying patients and providers use their platform to make clinical decisions.

“Investors are happy to see Novo getting more aggressive on the litigation front, but remain puzzled as to why they haven’t confirmed that they are filing or have filed litigation against Hims yet,” said Barclays analyst Emily Field.

Legal experts say Novo’s expanding litigation against smaller telehealth players could add pressure on a company like Hims to negotiate a settlement or help the drugmaker test out strategies.

At the same time, the fact that Novo and Hims had a prior collaboration may complicate legal action. “Business happens in the shadow of the law,” said Robin Feldman, a professor at UC Law San Francisco who has written books on the pharmaceutical industry and its intellectual property battles. “Sometimes companies file against smaller players as a shot across the bow, a way to rattle the larger players.”

The U.S. Food and Drug Administration set a May 22 deadline for compounding pharmacies to cease mass-producing copies of Wegovy, a practice allowed only when a drug is in shortage.

Hims says it still offers personalized versions of Wegovy, in doses not manufactured by Novo, that better suit individual patient needs. The telehealth provider argues that individualized dosing remains legal under compounding rules.

Compounding laws “are just vague enough to allow for different interpretations, and the interpretation that matters — that of the courts — has not been provided to our knowledge,” said TD Cowen analyst Michael Nedelcovych.

Novo’s cases against smaller compounders could shape how courts interpret those boundaries, said Gaston Kroub, a partner at patent litigation firm Kroub, Silbersher & Kolmykov.

“This is an untested set of affairs,” said Kroub. “If you want to train for a heavyweight championship fight, you start sparring with lighter opponents.”

In addition to trademark infringement, Novo has accused pharmacies of steering people toward compounded Wegovy by interfering with the relationship between clinicians and patients.

Josh Gerben, an intellectual property attorney, said the fact that Hims and Novo had a prior business relationship will complicate any claim Novo could bring.

—Maggie Fick and Diana Novak Jones, Reuters