Elon Musk’s epic feud with President Trump intensified recently with Musk’s announcement of a new political party focused on reducing the national debt. Speculation on Musk’s motivations have ranged from his alleged loss of green subsidies to administration personnel clashes to genuine concern over America’s astronomical spending.

But taking Musk’s concerns at face value, his solution is wildly off-base. The only way to tame government fiscal avarice is to return to hard money.

Fortunately, the crypto revolution now makes this possible from the bottom up.

Government activity, like all human activity, is dictated through incentives. Democrats, guided by a Modern Monetary Theory that abjures any limits on money printing to pay back debt, will never constrain spending, because spending buys votes.

Republicans, though more ideologically inclined against accumulation of debt, constantly face the hard realities of electoral politics. Sometimes, facing flippant accusations that they want to starve children and push grannies off cliffs, laundered through a compliant media, they bow down to the same debt god. Other times, they simply find their own preferred occasions to overspend.

Most Americans have never known an era in which government faced any real limits on its money-printing prerogatives. In 1971, Richard Nixon followed the rest of the world and took the U.S. off the gold standard. A decade of oil shocks, stagflation, and economic malaise immediately followed.

The destructive consequences of Nixon’s intensified in the half-century since. As Saifedean Ammous describes in The Fiat Standard, fiat money’s degrading effects stretch well beyond our constant battle with inflation. It shortens our time horizons, makes us discount the future, and transitions us from hopeful savers to instant-gratification debt-ridden spenders. We are forced to become investment experts just to maintain the value of what we earn.

Fiat money also puts a cadre of Ivy League intellectuals in the unenviable and impossible task of finding some “just right” formula to balance discordant factors such as inflation, unemployment and the cost of capital.

The unnoticed effects are equally deleterious. Fiat money affects our food supply, the materials and design of our buildings, the priorities of scientific research and the frequency of geopolitical conflicts, among innumerable other issues.

This situation will not resolve from the top-down. But for the first time, it doesn’t have to.

There is a way for people, acting independently, to force government discipline. They can refuse to transact in money that constantly loses value.

Bitcoin — with its fixed supply, rock-solid and thermodynamically guaranteed network security, and brand recognition — is the most obvious candidate. But that is only one option. Other “layer-one” blockchains could emerge, either “forked” from Bitcoin or built from scratch.

Monetary policy is hard-coded into these cryptocurrencies, free from political meddling — if they are designed correctly. Or people could choose to return to the gold standard, through gold-backed stablecoins. This would eliminate the original gold standard’s greatest drawback — the cost of transport and salability over space.

This is already happening in countries where Modern Monetary Theory is having its toxic effects, devaluing national currencies at scale. Dollar-backed stablecoins have proven popular in Brazil, India, Nigeria, Turkey, and Indonesia. One article dubbed Venezuela the “stablecoin capital of the world.” In 2024, total stablecoin transfer volume hit $27.6 trillion, exceeding Visa and Mastercard transactions combined.

The dollar will only maintain its world’s reserve currency status if the U.S. government imposes enough fiscal discipline to fend off harder competitor currencies — something it will not do voluntarily. Nor will a new political party bring this about.

Whatever his motivations, if he is serious about reining in the national debt, Musk should abandon his fanciful America Party and focus instead on hardening America’s monetary future. The harder the money, the brighter that future will be.

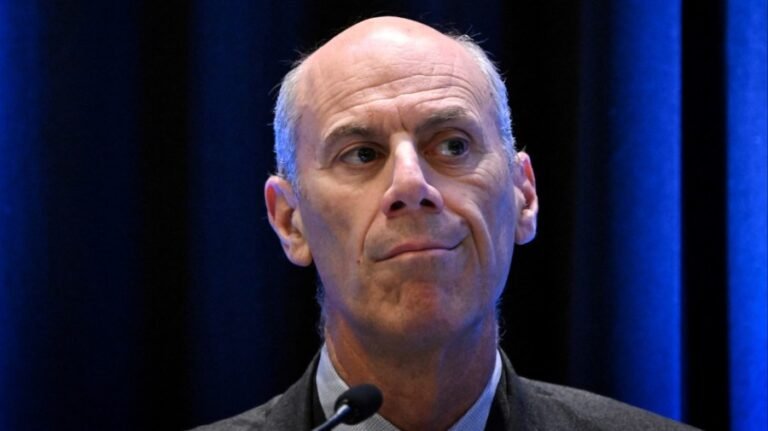

Paul H. Jossey is a lawyer and author of an upcoming book on restoring America’s masculine culture through technological advances.