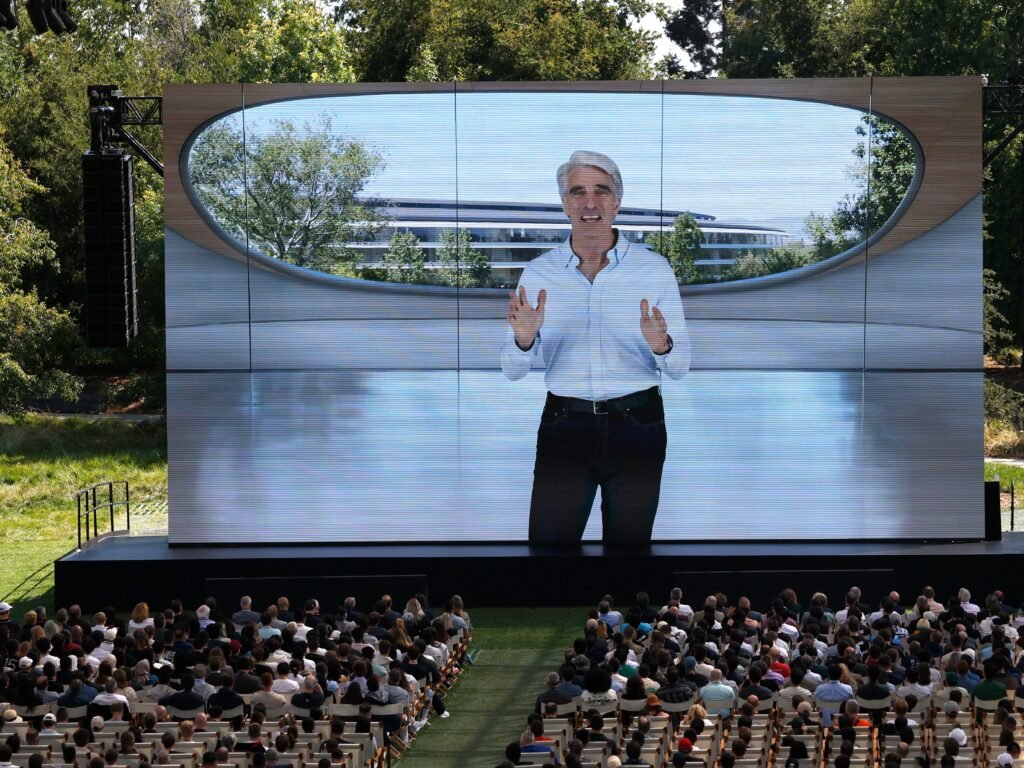

Justin Sullivan/Getty Images

- Apple’s stock dropped suddenly on Monday, shedding roughly $75 billion in market value.

- The company’s big entry into the generative AI race is still a work in progress.

- Apple’s slow AI development contrasts with competitors such as OpenAI, Google, and Microsoft.

Apple shares suddenly dropped a few minutes into its WWDC keynote on Monday. The culprit appears to be one word: Siri.

About six minutes into the presentation, Apple’s stock abruptly fell more than 2.5%, from roughly $206 to below $201. That’s the equivalent of about $75 billion in market value.

Just seconds earlier, Apple software chief Craig Federighi was on stage recapping the Apple Intelligence features the company had already rolled out in recent months, such as Genmoji, smart replies, photo cleanup tools . Then he pivoted to Siri. That’s when things got awkward.

“We’re continuing our work to deliver the features that make Siri even more personal,” Federighi said. “This work needed more time to reach our high quality bar, and we look forward to sharing more about it in the coming year.”

Translation: Apple’s long-promised AI revamp of Siri still isn’t ready. Investors probably didn’t like hearing that.

“WWDC laid out the vision for developers BUT was void of any major Apple Intelligence progress,” Dan Ives, a tech analyst at Wedbush Securities, wrote in a note to investors.

“We get the strategy but this is a big year ahead for Apple to monetize on the AI front as ultimately Cook & Co. may be forced into doing some bigger AI acquisitions to jumpstart this AI strategy,” Ives added. “We have a high level of confidence Apple can get this right but they have a tight window to figure this out.”