The global tablet market just had its best month since the pandemic boom in 2020. According to the most recent data from Omdia, manufacturers shipped 162 million tablets in 2025, which is a solid 10% increase from the year before. North America saw a small drop, but areas like Central Europe and Asia Pacific kept things going, showing that the world isn’t ready to give up on the middle child of the tech family just yet.

This surge didn’t happen by accident. A perfect storm of aggressive holiday discounts, the arrival of high-performance chips like Apple’s M5, and a rush to stock up before expected component price hikes drove the numbers up. However, analysts suggest we are currently standing at a crossroads. As we move into 2026, the industry expects a significant slowdown, forcing brands to pivot from chasing volume to perfecting the user experience.

Omdia report: Global tablet market surges 10% as AI takes center stage

Companies are changing the way they market these devices in a big way. Tablets are not just “big phones” or “small laptops” anymore. Instead, they are becoming the main hubs of complex digital ecosystems. To achieve this, they must ensure that the AI and the different operating systems work together smoothly.

A standout example is Lenovo’s new Qira system, which aims to bridge the gap between Windows and Android. This type of cross-OS functionality reduces the friction of moving tasks from a PC to a tablet, making the device feel like a natural extension of your workspace rather than a standalone gadget. Even more significant is the collaborative leap between Apple and Google. We already know that Gemini will help power future Apple Intelligence (especially Siri) features. The project will help Apple to finally catch up in the mobile AI segment.

Winners and challenges in a changing market

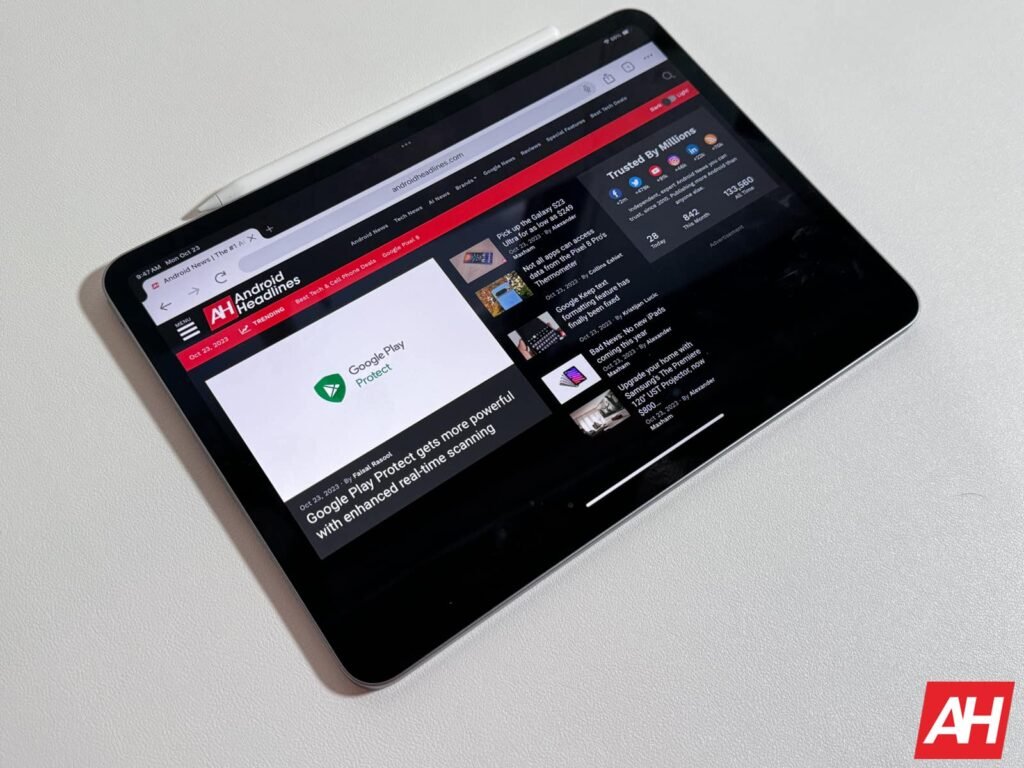

Apple is still the leader in tablets, shipping almost 20 million iPads in the last three months of 2025. They got ahead because there was a lot of demand for the 11th-generation iPad and the M5 Pro models for professionals. Lenovo, on the other hand, saw a huge 36% increase in growth. Brands like Huawei and Xiaomi maintained their grip on the top five rankings through consistent full-year gains.

Despite these wins, 2026 presents a tougher environment. Rising costs for memory and supply chain disruptions will likely force vendors to choose between competitive pricing and their own profit margins. For consumers, this means future growth will focus on “selective” opportunities—primarily high-end flagship replacements and government-backed education initiatives in emerging markets.

The post Tablet Shipments Hit Five-Year High in 2025 Before Predicted 2026 Slump appeared first on Android Headlines.