Bitcoin is having a horrible week.

Until yesterday, the cryptocurrency had declined by roughly 2.5% over the preceding five days. But in the last 24 hours alone, the coin has taken a major hit—down more than 10%.

Worse, fear and greed indices, which measure the emotional state of investors who buy and sell Bitcoin, are near historic lows. Here’s what you need to know.

Why is Bitcoin sinking?

Bitcoin has dropped precipitously over the past 24 hours. As of the time of this writing, it’s down more than 10% to $82,185 per token. That’s a low the coin has not seen since April.

But why has Bitcoin been falling so much over the past 24 hours? There are two major factors at play.

The first has to do with what happened in the stock market yesterday. When markets opened, AI-related stocks were flying high due to the previous day’s news that Nvidia Corporation (Nasdaq: NVDA) had exceeded expectations for its Q3 2026 earnings.

This good news, momentarily, gave investors a confidence boost. Nvidia’s results were a sign, many argued, that the AI bubble people have been talking about for months was perhaps overstated.

But as the day continued, those bubble fears resurfaced, and investors sold Nvidia heavily, along with other AI stocks and other tech stocks. This selloff contributed to a steep decline in the markets, which ended down for the day.

Unfortunately for cryptocurrencies, many people who invest in volatile AI stocks also invest in crypto. And when one of those assets declines, they tend to sell off the other asset to lock in any accumulated profits and buffer against losses elsewhere in their portfolio.

However, you can’t blame Nvidia and the tech stock slide yesterday for all of Bitcoin’s woes.

A second factor likely influencing Bitcoin’s massive 24-hour drop is that, as CNBC notes, America’s job numbers for September were released, and they showed stronger-than-expected job growth data (119,000 new jobs versus the roughly 50,000 analysts expected).

Why would good job numbers send Bitcoin’s price down?

Because those better-than-expected jobs numbers sent the probability of a December rate cut by the Federal Reserve down from 50% to about 40%. Rate cuts are generally seen as good news for the prices of assets like Bitcoin because the cuts boost liquidity in the markets.

At the beginning of November, many analysts expected there was a 90% chance of Fed rate cuts in December. By mid-November, that chance had been slashed to 50%. Now it’s down to 40%. This increasing likelihood that the Fed will not cut rates is likely weighing heavily on Bitcoin’s price today.

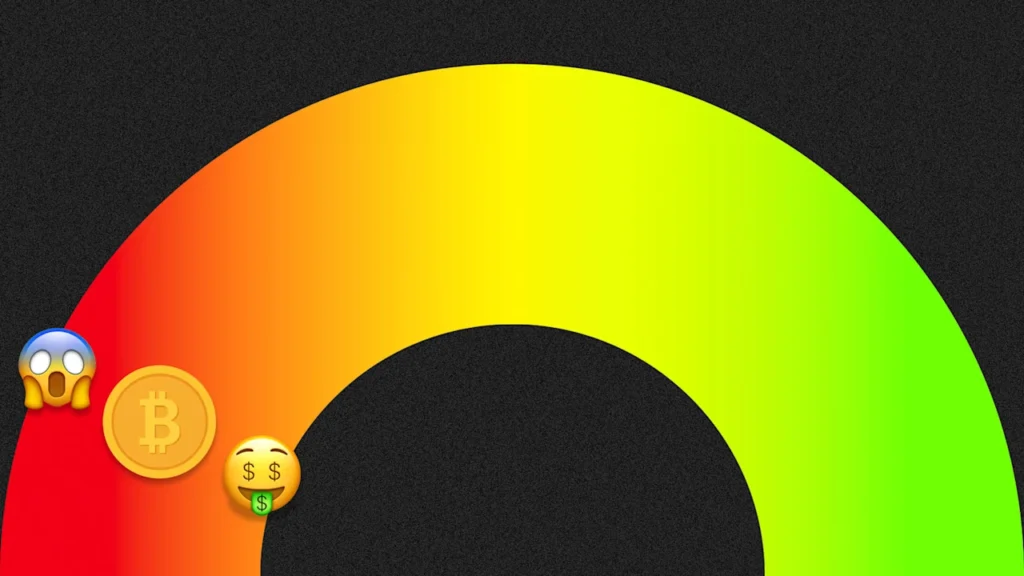

Crypto fear and greed indices near historic lows

A fear and greed index measures the emotional state of investors in a particular asset. Several crypto-focused platforms maintain their own Fear and Greed Indexes, including CoinMarketCap and Binance.

As CoinMarketCap notes, its fear and greed index “measures the prevailing sentiment in the cryptocurrency market” on a scale of 0 (extreme fear) to 100 (extreme greed).

This index “helps investors understand the emotional state of the market, which can influence buying and selling behaviors.”

Currently, CoinMarketCap’s Crypto Fear and Greed Index is at an 11. That’s the lowest level it’s recorded since June 2023, the farthest back the index goes.

At 11, the index is currently lower than the 15 it was at on March 11, 2025, when crypto markets were also tumbling. This suggests that the emotional state of cryptocurrency investors right now is extremely fearful.

Similarly, Binance’s Crypto Fear & Greed Index is also at an 11 (it ranges from 0 to 100). That’s four points lower than where it was yesterday, and 50% lower than where it was last week.

While seeing the historic lows of the “fear” range of the index might further alarm Bitcoin investors, it should be noted that these indices can help track periods of over-selling (fear side of the spectrum) or when the token may be over-bought (greed side of the spectrum).

However, these indices can’t predict whether any token will continue to be sold off or if its price will rebound.

Other cryptocurrencies are seeing a large selloff, too

As the crypto Fear and Greed indices suggest, it’s not just Bitcoin that is seeing major selloffs as of late. Other cryptocurrencies are also down significantly across the board.

This includes Ethereum (down 12% to $2,650), XRP (down 12.25% to $1.85), BNB (down 11.4% to $797), Solana (down 13.45% to $122.73), and Dogecoin (down 14.7% to $0.134).