For many Americans, 2025 has been tough economically. Tariffs have raised the price of goods from coffee to clothing, inflation is still rising, and more than 1 million jobs have been cut since January.

Then came the longest government shutdown in U.S. history, which furloughed some 670,000 federal workers. Another roughly 730,000 had to keep working, just without pay, according to the Bipartisan Policy Center. And amid that came a pause in SNAP benefits, which left 42 million Americans without the food stamps that help them afford groceries.

SoLo Funds, a community finance platform, has seen the impact of these events firsthand. Requests for loans on the SoLo platform relating to EBT and SNAP increased 32% since October 1, compared to the year prior.

Loan requests relating to the government shutdown or furloughs—like users saying they missed their paycheck because of the shutdown or that they were waiting on furloughed pay—surged 775% as of October 1, compared to the average weekly volume of requests in the months prior.

While there wasn’t a government shutdown before October, SoLo says it did see references to those terms earlier in the year, linked to delayed paychecks, budget freezes, or agency funding pauses.

The 775% spike represents a increase from thousands of dollars in loan requests to hundreds of thousands of dollars, per the company.

And throughout 2025, SoLo funds says its continued to see spikes in loan requests for basic necessities like groceries, rent, and utilities.

How SoLo Loans work

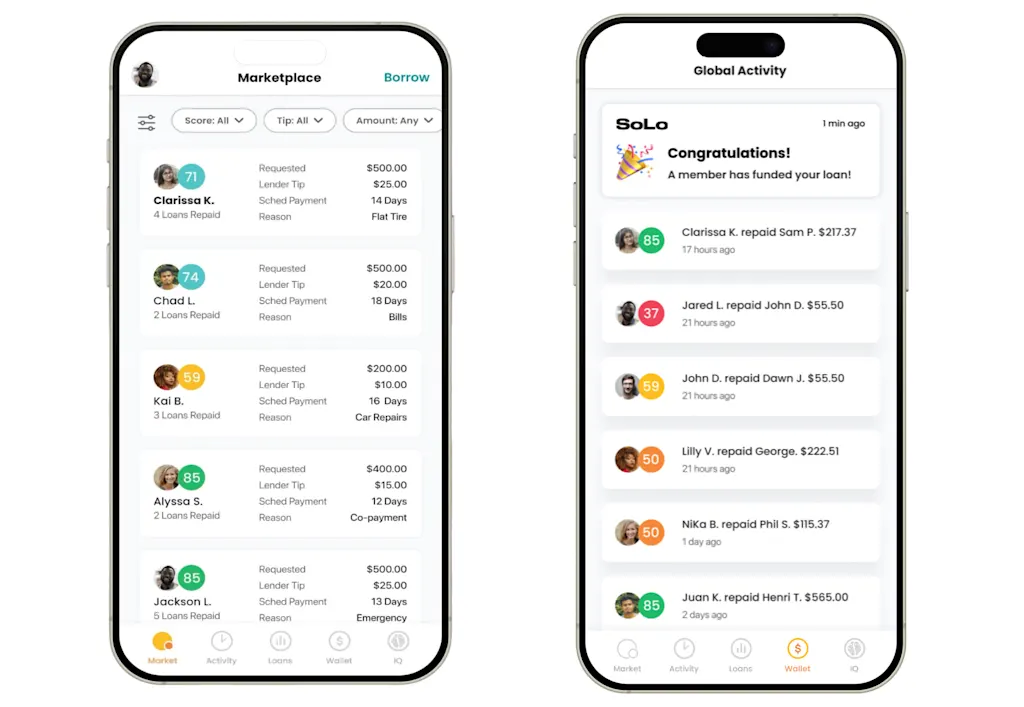

SoLo is a financial service, but it doesn’t operate like a typical bank. Members can get a checking account and a debit card, plus access to the loan marketplace.

There, they can make loan requests, citing a reason that they need the money. Other members can then scroll through the marketplace of loans and choose to fund someone’s loan directly.

Instead of a hefty interest rate—like those that come with Buy Now, Pay Later (BNPL) or payday loans—loans through SoLo come with a flat fee; interest doesn’t compound or accrue over time, and there’s no penalty for late payments.

And yet SoLo says its repayment rate is above 94%. Borrowers can also leave a tip for lenders.

“What we have been able to quantify is that working-class Americans, the heart and soul of our country, even in times of low or inconsistent income, they tend to figure it out,” says president and cofounder Rodney Williams. “With standard loan products, you can’t get a loan if you’re figuring it out. You can’t get a loan in between jobs.”

SoLo does not require proof of income for its loans, instead requiring a snapshot of cashflow; its AI underwriting process then provides a score to the user. The company first launched in 2018 and has raised $15.5 million in funding to date.

That isn’t exactly significant capital compared to top fintech companies. Stripe, Chime, and SoFi, for example, have all raised billions of dollars (and the latter two are now publicly traded). But Williams says SoLo sees 20% growth every quarter. “The people have decided they need this,” Williams says.

Community finance in action

Overall, the top five reasons people request SoLo loans are for utilities, rent, medical bills, pet bills, and then car repair. Requests for groceries have spiked recently too.

“These are measures of consumer confidence and sentiment,” Williams says. SoLo has grown to more than 2 million users who are actively on the platform “to make ends meet,” he adds.

Since its launch, users have provided $700 million in loans to other individuals.

The SoLo Funds loan request is around $250. Members can borrow up to $625, but first-time borrowers start at $100 and earn the ability to request higher amounts as they repay on time.

That loan requests specifically for furloughed workers, the government shutdown, EBT, and SNAP have increased since October highlights both how Americans continue to face financial struggles and how community support has emerged as a stopgap.

“[Those Americans] came to community finance . . . and asked for people to help. And guess what? They got funded, because people can see this person is just in between situations because of the government,” Williams says. “Like, this is a good person, I’m going to bet on that person.”

Community support has surged as people have felt abandoned by their government. Across the country, individuals have shared resources for federal workers and donated food to those in need.

SoLo considers itself another form of community support; its loans can be used for anything, in any situation—unlike Buy Now Pay Later, which requires the merchant to offer that option (someone likely can’t use BNPL to fix their flat tire, Williams notes) or even Earned Wage Access, which requires someone have a paycheck coming from which they can draw funds early. That option isn’t available to furloughed or laid off workers, for example.

Strangers helping strangers

The government shutdown is now near a possible end, but many Americans may still need financial help, especially since healthcare premiums are set to increase substantially, after the Senate failed to extend the Affordable Care Act subsidies.

“Americans were struggling before the shutdown and they’re going to be struggling after,” Williams says.

Though the stock market is strong, he notes, many Americans are underemployed, and fears of AI taking over jobs may keep those Americans from “being employed at the level they should be,” he adds.

Plus, nearly 40% of Americans don’t own any stocks and so aren’t seeing those gains.

Despite these challenges, Williams is buoyed by the empathy he sees on SoLo’s platform, of individuals connecting and helping one another in times of need.

“Everyday, thousands of people lend to and borrow from a stranger,” he says. “Everday, I see little American miracles of empathy.”