A group of five House Republicans says it will vote against the GOP’s “big, beautiful bill” over provisions in the Senate version that would mandate the sale of land owned by the federal government.

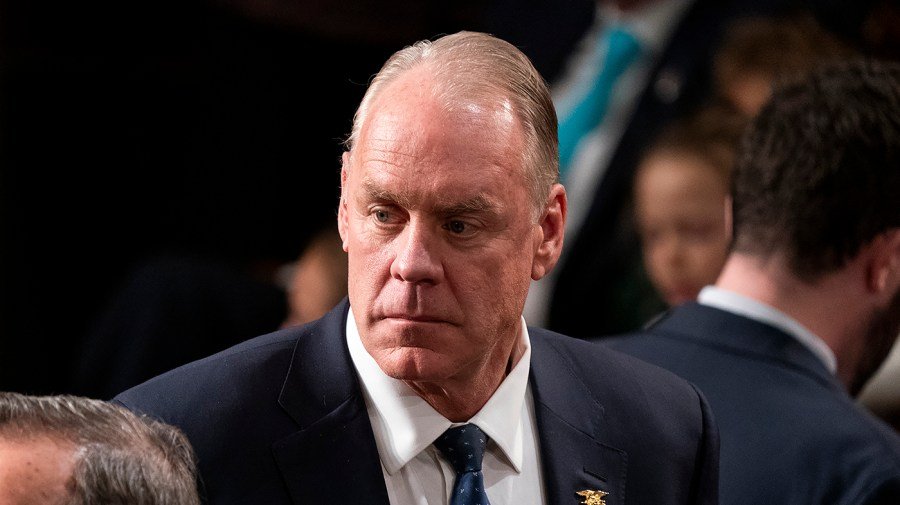

“We support the OB3 passed by the House and generally accept changes to the bill that may be made by the Senate. However, we cannot accept the sale of federal lands that Senator [Mike] Lee seeks,” wrote GOP Reps. Ryan Zinke (Mont.), Mike Simpson (Idaho), Dan Newhouse (Wash.), Cliff Bentz (Ore.) and David Valadao (Calif.).

“If a provision to sell public lands is in the bill that reaches the House floor, we will be forced to vote no,” they added.

Zinke has publicly said he would not support the bill if it mandates the sale of public lands, but a group of five would be enough to actually prevent the bill from passing, since Republicans can only afford to lose three House votes if every Democrat remains opposed as expected.

“It is our hope that the Senate Parliamentarian strips any language from the bill regarding public lands sales, but we hope we can count on you once again to hear our concerns and work with Senate Leadership to remove the provision that will tank the entire Republican agenda,” the quintet said in their letter, which was addressed to Speaker Mike Johnson (R-La.).

Republicans are seeking to pass their bill through a process known as budget reconciliation, which allows some measures to pass through the Senate with a simple majority, evading the filibuster.

The parliamentarian, who acts as the Senate’s referee on what can pass through reconciliation, has already rejected a proposal from Lee to sell off public lands. However, Lee has said he would try again to pass a narrower set of public land sales.

Text obtained by The Hill indicates that the revised plan would still sell of 1.2 million acres.

While controversial, the public land sales is far from the only intra-party fight facing the legislation. Members are also feuding over provisions related to the extent of cuts to Medicaid and climate friendly tax credits, as well as federal tax deductions for people who live in areas with high state and local taxes.