You know MillerKnoll as one of the few great American design brands. Or perhaps, a mega brand of design brands including Design Within Reach, Hay, and Muuto. But the furniture manufacturer is still shaking off a difficult few years. Its revenue dropped nearly half a billion dollars as COVID closed offices. And while margins are up since Herman Miller and Knoll joined forces in 2021, the company is still facing headwinds from global uncertainty around the economy, future of work, and tariffs.

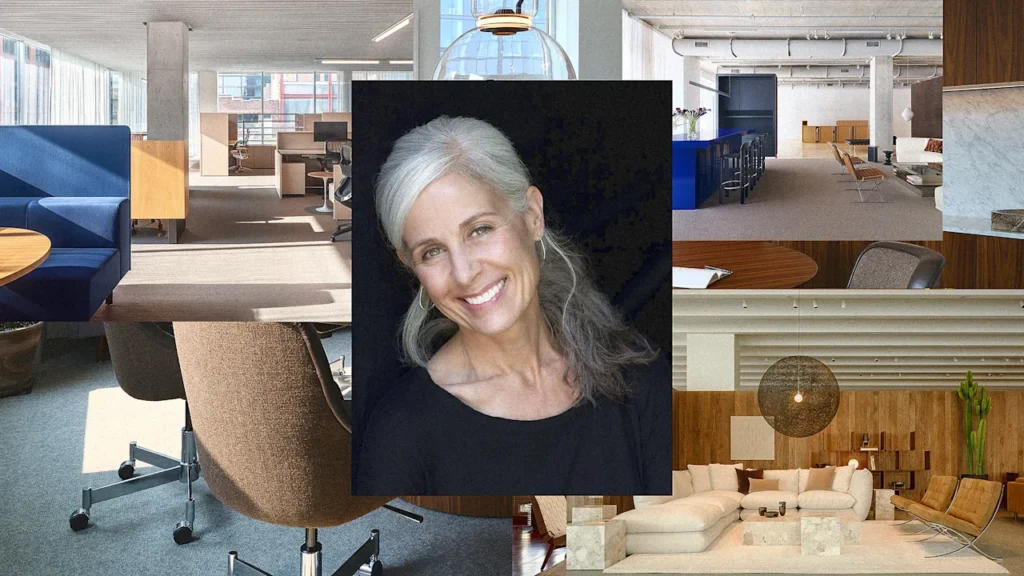

But when I spoke to CEO Andi Owen earlier this week, she was primed with energy—and dare I say, real enthusiasm. Our conversation was pegged to the appointment of MillerKnoll’s new Board Chair—John Hoke, the former chief innovation officer at Nike. But the frank, 45-minute discussion that followed touched upon every aspect of the MillerKnoll business and brand, including a spirited debate about RTO, why Herman Miller and DWR are central to her strategy to make up the $400 million in revenue lost thanks to COVID, and why she won’t try to sell you a new Eames Lounge to replace your old one.

For anyone nervous about running a business in our current climate, Owen’s POV offers a masterclass in staying grounded. This conversation has been edited for length and clarity.

So John Hoke recently left his role of Head of Innovation at Nike—one of the other few great American design brands. And he’s just taken the role of Board Chair at MillerKnoll. It feels like you want to put the pedal to the metal on innovation.

John’s been on the board for 25 years, almost, which is kind of hard to believe. He brings this incredible, enthusiastic, creative, sort of big thinking design vision to an environment which typically leans financial results oriented.

When Mike Volkema [the former board chair] retired—which is very sad, he’s an amazing human being, but I think it’s the right time for him in his life—John was just a natural choice for so many reasons. Because if I think about the journey we’ve been on in the last four or five years, MillerKnoll coming together as two companies and going through all the integration process—we’re at that stage where we can really lean in to sort of the fruits of our labor post integration, and really lean into all of our 15 brands and who they are and what they can do best.

I’m really excited about his leadership at this time. I think what he’s done in the past helps us to think differently, helps us to look outside of our industry and what we’re doing and think more expansively.

Since the Knoll acquisition in 2021, it’s been what I assume is a massive amount of work around mass consolidation of brands. You closed two major production facilities. You’ve joined offices. Obviously, there were layoffs. Do you feel like the merger is finally done?

Yeah, I would say it felt like a gorilla off my back, and I think off all of our backs. So things that you just illustrated—financially, the facilities, consolidation—all of those things, those are hard but easier decisions. They’re sometimes very black and white.

The harder things are understanding where you’re not going to encroach and what you’re not going to damage. So for us, as we went through this process, which took the better part of the last three and a half four years, it was really about, how do we keep each one of our brands, identity and creative juices intact? How do we keep the soul of each brand, while we find a way to build a culture that is all of us together?

The good news is the heavy lift is behind us, which is why this time is so important because we feel like we can kind of lift up and look out we know who we are. ‘Smooth sailing’ is the wrong word, but I think I would be remiss if I didn’t mention, we’ve all been managing in a kind of perma-crisis mode for the last few years.

Perma-crisis seems like the perfect descriptor of our world today.

I mean, it’s sort of been one thing after another thing after another thing. COVID was kind of the crisis that never stopped. That brought on a whole series of supply chain issues, and then you have changes in the administration and all these things. And I think at a certain point, as leaders in any business integration aside, you have to move past perma-crisis and just make your bets and manage a very uncertain environment. You have to steer clear and just be steady, because you can’t continue in crisis mode forever. It’s unhealthy, it’s difficult.

What allowed you to get out from perma-crisis? Because you’re still dealing with a lot of these same problems you were a few years ago! Return-to-office not really happening. Supply chain uncertainty. Now tariffs.

I think for me personally, and I think for the team, it was really more of a mindset shift. At first, there’s the surprise and shock and awe, and it’s one thing after another thing after another thing. And it’s very easy to get in your war room and start to plan everything you’re going to do, to react. And after a time, you realize you just can’t do that anymore. You’re exhausted.

First of all, you lose sight of where you want to take the business, and you have to re-anchor on ‘these are the bets we’re making.’ We can’t control the macroeconomic or the external environment. Things are going to happen. We just have to steer clear down the path that we feel is the right path, which is around product innovation, building culture, creating human centered environments, developing a really strong retail business, staying clear on our focus and our vision, and then we’ll manage the day-to -day crisis as it comes.

It’s just too difficult to stay in reaction mode. You’re right, [the environment] hasn’t changed. But ultimately, that’s the only way I think you can really be healthy right now.

I do want to get into some of the ongoing challenges of the business. Your profit margins are up post consolidations, but your revenue is still down about $400 million since COVID. How do you buck this trend in declining revenue?

I think the downward trend in revenue can be attributed to a variety of things, right? You can say ‘macroeconomic COVID.‘

Ultimately, if you look at the industry in two buckets, there’s the commercial interior (office furniture) contract side of the business, and there’s the retail side. The contract furniture side of the business was due for consolidation. Number one, it has never really consolidated in the history of the business. And secondarily, when COVID struck, people found a new way to work. So that drop in revenue, the bulk of that came immediately, when it was like, ‘we’re all working from home and who needs to be in an office?’

I don’t think the industry has fully recovered, which I actually think is good news, because we’re starting to see that trend reverse. We’re starting to see the return to office debates become less of a debate. We’re starting to see people realize the value of human connection in a workspace and otherwise. So I think that trend is on an upward curve.

And I also think the industry has consolidated in a very healthy way. So if you start with Miller and Knoll coming together, and then you look at the latest consolidation of Steelcase and HNI—that’s good for us, that’s good for the industry, that’s good for competition, that’s good for margins, it’s good for all the things.

So I think we’ve right-sized to what demand should be in the future to how people are working today. The industry was due for a step-down. And then if you think about the residential side of the business, that’s where we see a huge amount of growth for us. Our business is very nascent. It’s smaller. We’re under-stored. We’re under-assorted. We have a huge advantage from a design perspective—an advantage in that we manufacture many of our own products. We have no real international footprint. So on the retail side of the business, opening 10 to 15 stores every year and continuing to build both of those brands—DWR and Herman Miller—we think is a top line and bottom line grower.

And then if I take everything I just said about the contract side of the business, and I say that was mostly North America. If you look at the rest of the world from a commercial interior standpoint, we have a very small market share. It’s a very profitable business for us. So there’s a lot of opportunity for us to grow internationally. Jeff Stutz, our new COO [promoted from CFO], has a really critical understanding of the contract businesses, and as we grow the international contract business…his financial expertise is going to be huge.

So I think the worst has passed, and we’re in a growth mode now, which is really nice.

I think the return to office debate is still raging.

You know, it was, though, not as much.

I mean, every year, I’m asked to moderate another panel on “will we return to office?”

Isn’t it old now? Aren’t you done with the conversation?

Oh, I’m so sick of it! Yet still, nobody exactly knows how it’s going to land. Offices have recovered a bit. The hybrid thing is here to say. I think a trend we do know now is that office footprints are shrinking. We have seen cutbacks in terms of overall square footage as companies re-invest in offices. And that doesn’t seem like it will be changing anytime soon.

And so I wonder, do you accommodate that differently? Do you design differently—like you did with the modular OE1 line? It doesn’t feel like a company of your size can just count on the office coming back to the substantial numbers people expect.

I think what you’re saying, Mark, is absolutely right on. I don’t think anybody in this industry is banking on the days when there were rows and rows of cubicles and tons and tons of office space, because we don’t live that way anymore. When I think about what’s cool about our company is that whether you’re downsizing, whether you’re moving, whether you have less people in the office, those are all opportunities to think differently about your space. And what’s interesting is that people are looking at smaller spaces now—not everyone, but many companies are looking at smaller spaces that are actually more enticing and more geared towards what they do. There are very few people that are sort of stamping out the same desk in the same chair for everybody.

So that opportunity to really uniquely think about space, to innovate around products that might suit an engineer versus a marketer versus a CEO, those are things we do really well. We think about the entire space. That’s all business opportunity. Less space is not necessarily a bad thing.

We’re not sitting here banking on the days of yore in the ’80s, when it was Action Office everywhere. What we’re banking on is that people will understand that a premium space that’s geared to your employees—a place where people actually want to come, whether they’re coming for two days or three days—like, I don’t care. Whatever your tenets are around being together, people want that space to be compelling.

I’m just so bored by the conversation. But [back to office] mandates don’t work. Like whatever, you can try to do a mandate if you want to, but what works is people wanting to see each other and wanting to work in a space that’s compelling.

It’s like psychological theory, right? Positive reinforcement works better than negative.

Treat people like adults. Give them a space they want to come to, create a culture they want to be in, and the problem is solved. That’s not easy to do, but space plays into that, and that’s really good for us.

When you talk about expanding your office contract business internationally, what does that involve? Does that really just involve stepping up the amount of people who are doing direct sales to these companies? Overseas manufacturing?

We try, and mostly do, manufacture in the locations where we sell our products. So we manufacture in Asia for Asia. We manufacture in Europe for Europe. So it’s a matter of manufacturing facilities. It’s a matter of building up internal teams, and it’s also a matter of building up our external dealer partners. So what countries do we have enough dealers? What countries do we need to add dealers? You know, the Middle East right now is on fire. How do we support growth in those areas? Then additionally, what are the products we need that we have to develop for these countries? Because it’s not the same everywhere. You can probably take 80% of your product portfolio unchanged everywhere, but that other 20% you really do have to be uniquely developed for that country in some cases.

It seems like tariffs have made a minimal impact on your business thus far. Will that change?

Now, I would say tariff planning has had maximal impact! I mean, it’s a lot of money for everyone, but I think we’re in the place of sort of waiting to see how this all comes out. We have our worst case scenario and our best case scenario, and we’re sort of taking it a day at a time. I don’t think we have seen every tariff fully enacted going through the supply chain. There will be an impact, and we’ll try to be as efficient and effective as we can to offset costs, because the last thing we want to do is keep [increasing] prices to cover these costs. So right now, we’re in a wait-and-see mode. I will say it has been impactful, but we have not gotten to our worst case scenario yet.

You also talk about the domestic sector being this big area of growth for you. Does that include the home office sales that you had that incredible spike during COVID? Or is it really like me getting that Eames Lounger for my living room?

I think that it’s both. When I came to the company, we said Herman Miller is one of those brands that’s able to live in five or six or seven different places with equal authority. So it can be in a doctor’s office, a healthcare institution, it can be in an office, it can be your home. It can be gaming. And it has relevance everywhere.

With Herman Miller retail stores, we said what if we took that thing that we do really well, which is ergonomic task seating, and expanded that part of the brand and the lifestyle piece. It’s been an amazing retail concept for a variety of reasons. Part of it is we attract that small business owner that doesn’t really want to work with an office furniture dealer, but wants five, ten, twenty setups for a startup or whatever that might be. Plus for the residential buyer, we’re on a street that they can easily access. They can come and get fitted for a chair.

DWR is more of our marketplace of modern design, and we have 38 stores now. We’re opening them so quickly. I lose count of how many we have. But if you compare that to other folks in the residential home furnishings business, it’s dramatically under where we [we should be]. We have a great digital storefront. But what we find is that people want to have both.

In places where we have both the brick and mortar and the digital it’s a really magic formula. So again, it’s kind of both. We experienced a massive bump during COVID with home office because we had a path to market that many folks didn’t have in office furniture. We’re still growing it, because we have the opportunity to get market share in places where we’re not. And I think that opportunity will exist for the next five to seven years, because we just are so under-stored.

You bring up brick and mortar retail. I know that you’re aiming to double it over the coming years. Could you speak more specifically on why it is such an opportunity for you. Because while I know we’re both sick of talking about if the office is coming back, we could say the same thing about ‘is physical retail coming back?’

Having been in retail for so much of my career, there have been limitless debates over the years. ‘Stores are down!’ ‘Stores are not dead!’ ‘No one will ever shop online!’ Name the debate.

I think what works really well for us is that the people that staff our stores tend to be architects and designers. So you’re not necessarily just buying a piece of furniture. We can help you with a variety of things. So we can help you design your space if you want that. I think our secret sauce is the people that work in our stores. That’s number one.

Secondarily, I think that what works well for us is that people do want to understand touch and feel. Our products tend to not be inexpensive products! They’re an investment for many people.

I’ll give you a perfect example: When I joined the company, I was lucky enough to buy an Eames lounge and ottoman. My husband and I looked at it online forever, and I thought we were going to get the tall because my husband is taller than me. We went into a store. Sitting in both was what made the difference for us (and we didn’t get the tall). Had we just done it online, we probably would have ended up with a very different decision.

Unfortunately, I do have to bring up return-to-office one more time. Where we’re seeing investment in enterprise buildouts right now is actually in data centers. Every architecture firm we’re talking to is now designing data centers as their cash cow. How much is the data center an explorable market for you?

You know, I would be lying if I said we weren’t thinking about how we play in this market, because it’s growing. I’m not sure yet how we can play in that. There’s probably a way, but not one I’m comfortable sharing at this point. It’s interesting, though.

I’ve followed MillerKnoll’s efforts around incorporating recycled plastics, but I also just feel like what you do best is longevity—if you just can convince people to stick with the products you built for a long time and for businesses not to throw them away.

That’s what we hope. Where was I? I think I was in the La Jolla store, and a woman came in, and she brought the ottoman of her Eames Lounge that her father had. And she was an older woman, probably my age, and she’s like: ‘I want it just like this, but I want a new one.’ And I was like, ‘No, you don’t.’ I said, ‘First of all, this is rosewood. You can’t get it anymore, and there was such a patina to the leathers.’ I said, ‘Listen, keep this one. We can refurbish it. We’ll restuff it. We’ll do whatever you want, but hang on to this one.’

So anyway, I lost the sale, but on the other hand, that’s what we want. We want you to have something that’s an heirloom that you can keep for a very long time, that we can fix and repair. And if we can’t fix and repair it, let’s give it to another user, or recycle it. Something we really don’t want our products ending up in a landfill in any way, shape, or form.

Old leather hits different. You bring up the Eames Lounge. So much of your brand storytelling is around archive pieces, archive releases, archive collaborations. How important is the archive—that sort of deeper mid century-plus archive—to your business versus the newer designs?

It’s hard to look at brands like Herman Miller and Knoll and not acknowledge that a big part of what we do is making sure that we honor that legacy, right? So I think if you look at everything from Eames Lounge and Ottoman to building our archives in West Michigan, to Hay’s latest collab with Emma Coleman—like we have both, right? And we just hired a new creative director for Herman Miller, Carlos Martinez. Because in my opinion, that’s amazing history. But we’re also at a point in time where we have to evolve into the future.

So I think that’s one of the things that Carlos, who just joined us this week, will be really focused on. I think you make a good point—it’s hard when you have such an amazing history to make sure you’re moving quickly and effectively into the future. And I think with Knoll we’ve done a really nice job of that in the last three or four years. We’ve definitely done that with some of our newer brands, whether that’s Mutto, Hay, NaughtOne, CBS. With Herman Miller, we’re going to turn the corner.

That’s interesting, because aesthetically, I don’t know how I would define Herman Miller today. I’m a little historical storied out, and I feel like, well, what’s the future? Because I’m seeing the future everywhere else, and it’s depressing.

We have to be the ones to make the future not depressing, right? And I think you’re right. I think the vision for Herman Miller is something we are in the process of evolving and unleashing. With all the things that are going on in the world, we have such an opportunity to be a force for good. Part of our goal [is]…how we do bring that human connection even in the darkest of times?

An insider told me a while back that that your initial push into gaming—the Embody gaming chair—was actually a big disappointment: it had flopped and the sales had done poorly.

No, actually, just just the opposite! I think our initial gaming chair was a huge success. Actually, it continues to be a huge success. So much so that we’ve invested pretty dramatically in this business…all the way to working with Esports teams and launching our second gaming chair. I would say our second gaming chair, which was really our attempt to do a lower cost chair, has been successful, but didn’t have all the bells and whistles that we really wanted for the either professional gamer as well as just the casual gamer.

So we have two [new gaming chairs] in the works right now, and they take a long time to put together. But no, we believe in the business. We have not been disappointed by the business at all. I think if we’re disappointed in anything, it’s about the speed—the speed with which you can develop something like this, which, it takes time.

Looking five years ahead as a customer or someone studying the company, what’s going to surprise me most?

Oh, gosh, I think you’re going to be surprised most by how the brands have evolved and how much Herman Miller and DWR have grown. I think you’re going to be surprised by bottom line growth, too. Integration and all of that costs so much money and so much investment, and I think the years that we have ahead will be super profitable.

You’re going to be surprised by how much noise we’re going to make and how many things we’re going to change in the world. I really do. I’m excited about it. I think our sustainability efforts will make a huge difference. And I think some of the people that we’ve brought on board have such unique and innovative perspectives that we’re thrilled where we’ll be in five years.