In a bid to resolve its ongoing trade dispute with the United States, Japan signaled it plans to invest as much as $500 billion in the U.S., including key economic sectors such as artificial intelligence, energy, manufacturing and critical minerals.

As much as $10 billion of that figure will come from Toyota, the automaker indicated following a meeting between Pres. Donald Trump and Japan’s new Prime Minister Sanae Takaichi. That’s on top of the $50 billion the automaker has already invested in its extensive U.S. operations.

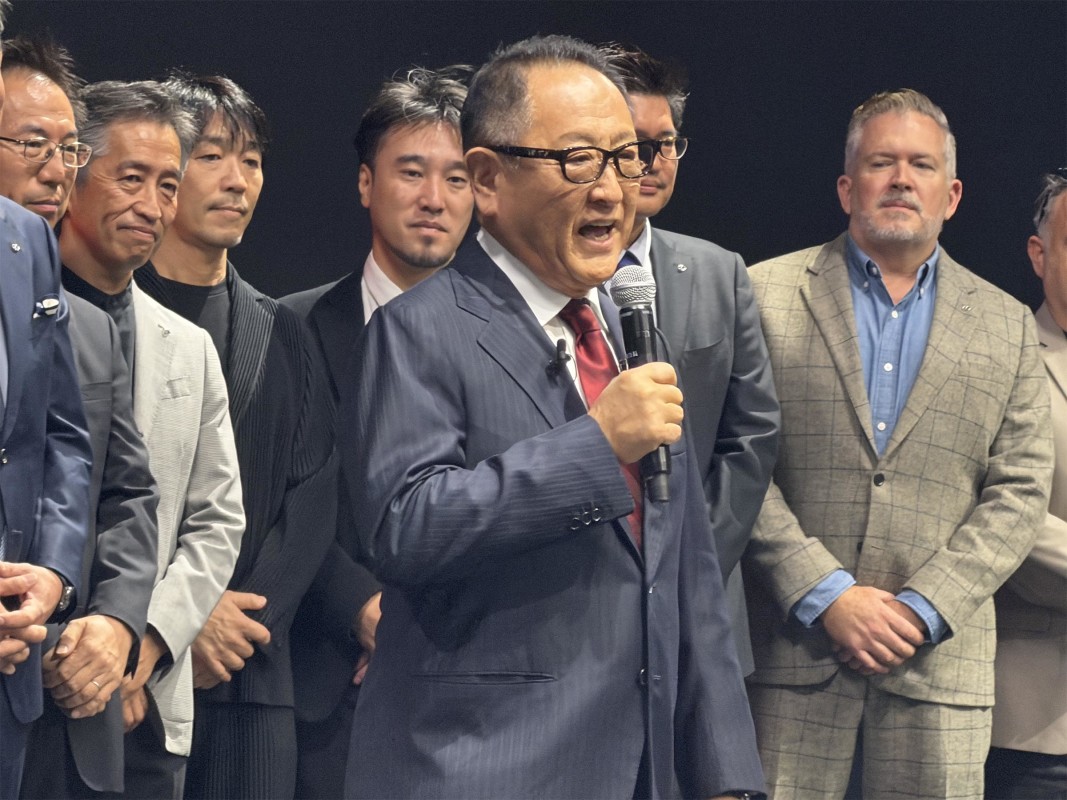

But Autoblog has learned that Toyota wants to take additional steps to ease U.S.-Japan trade frictions. CEO Akio Toyoda, sources revealed, is searching for ways to expand the market for American-made vehicles in Japan. Currently, such products account for barely 1% of the Japanese market, while manufacturers such as Toyota control a more than 37% share of the U.S. auto market.

A $10B Commitment

The Japanese finance ministry has not yet released full details on the country’s planned investment, which would be part of a finalized deal meant to ease tensions with the U.S. touched off by the Trump trade war.

While Toyota has also withheld specific details, a senior spokesman indicated “most of” the $10 billion would go into American manufacturing operations. The automaker has already invested more than $50 billion in the U.S. and now runs an extensive manufacturing network in states including Kentucky, Texas, Mississippi, Alabama, Missouri and Tennessee. The automaker most recently opened a joint venture with Mazda and is getting ready to open a North Carolina facility to produce batteries in North Carolina.

Related: Why Mazda’s Future Depends Heavily on Toyota

Toyota is working up what it describes as a “multi-pathway” strategy aimed at offering buyers a mix of gas, hybrid, plug-in, hydrogen and all-electric powertrain options. One likely outlet for the planned investment would see an increase in production capacity for hybrid models, Autoblog was advised. A second source indicated Toyota is considering launching yet another large U.S. plant in the next several years.

Expanding Exports

Trade frictions with Japan aren’t new, and automobiles have long been a key sticking point. One of the world’s larger automotive markets, the Asian nation has traditionally seen only marginal sales of foreign-made vehicles, primarily higher-end models from European brands like Mercedes-Benz and BMW.

Only 16,707 U.S.-made autos were sold to in Japan in 2024, accounting for less than 1% of the market there. Of those, 9,633 were Jeeps, while General Motors had combined sales of about 1,000 Cadillac and Chevrolet models. By comparison, Japanese brands captured a combined 37.4% share of the U.S. market, Toyota alone holding a 15.3% share.

Obstacles Abound

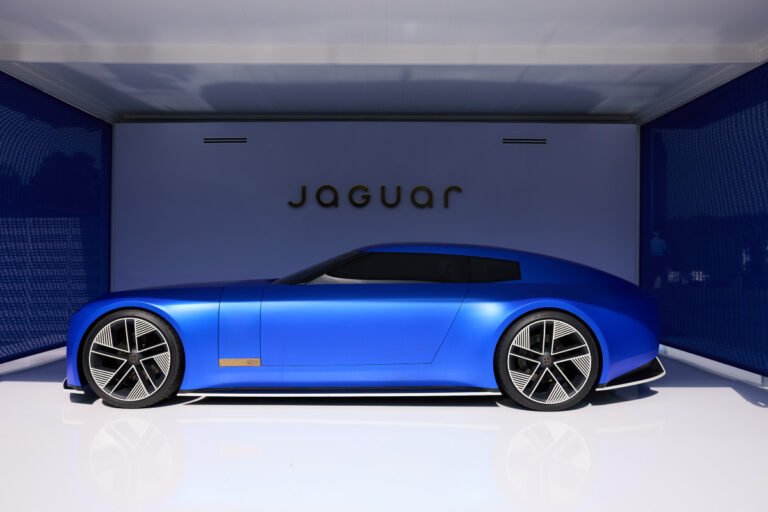

Jaguar

Japanese industry officials, as well as government representatives routinely blame American manufacturers for this problem – and there is at least some truth to that, industry analysts agree. Japan is a heavily urbanized country and, in densely populated places like Toyota, Osaka, Yokahoma and Kyoto, there’s little room for vehicles like a Ford F-150 or a Chevrolet Suburban. Even midsize American products dwarf the “Kei cars” that make up nearly 40% of Japanese sales – and which, by law, can measure no more than 11 feet in length.

But officials also acknowledge that Japanese regulations have made it costly and difficult for American products. In his role as head of the Japan Automobile Manufacturers Association, Toyota Chairman Toyoda has signaled he will press government regulators to ease some of the restrictions that keep otherwise competitive U.S. vehicles out of the market.

Related: Toyota Officially Launches New Super-Luxury Century Brand to Rival Bentley and Rolls-Royce

Welcoming the Competition

During a September meeting of U.S. dealers in Las Vegas, Toyoda signaled his desire to step into the trade dispute. He indicated his support for boosting U.S. auto exports to Japan even by brands like General Motors and Ford. Toyoda “said he welcomes the competition. It’s a healthy thing,” according to a well-placed source who was at the dealer meeting.

Exactly what else Toyoda might do remains to be seen, but that source indicated several options are under study and, among other things, the Toyota executive – and grandson of the company founder — is considering reaching out directly to American competitors to offer help boosting their exports to Japan. One possibility could involve offering U.S. vehicles through Toyota’s Japanese dealer network, though specific plans have yet to be put in place, Autoblog was advised.